US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 39.62 points or 1.11 per cent higher at 3,624.77, Dow Jones Industrial Average Index expanded by 399.72 points or 1.36 per cent higher at 29,879.53, and the technology benchmark index Nasdaq Composite traded higher at 11,936.56, up by 107.27 points or 0.91 per cent against the previous day close (at the time of writing, before the US market close at 11:15 AM ET).

US Market News: The key indices of the Wall Street traded in the green on Monday as Moderna reports high effectiveness of its covid-19 vaccine. The treasury yield increases as the investors sell bonds after positive vaccine news. Among the gaining stocks, Moderna gained around 7.2% after it announced reports about the covid-19 vaccine. Palo Alto Networks was up by about 4.2% it raised the full-year earnings estimate. KKR rose by approximately 1.9% after it is likely to buy Seiyu. Among the decliners, shares of Casper Sleep plunged by nearly 19.2% after the company reported a quarterly loss of 40 USD cents per share. JD.com was down by about 6.9%, although it reported earnings above estimates.

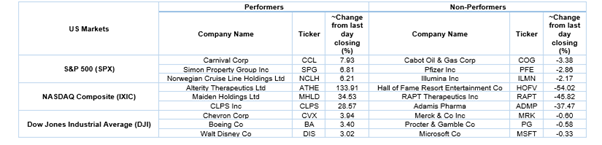

US Stocks Performance*

European News: The London and European markets traded in the green. The number of shoppers in the UK's retail destination plunged by around 57.7% year on year for the week ended 14 November 2020 following the second lockdown in the UK. Among the gaining stocks, Vodafone gained about 6.2% after the company reported a resilient performance in H1 FY21. Smiths Group was up by nearly 4.8% after it reported a strong cash generation in Q1 FY21. Antofagasta moved up by about 2.7% after it announced that Centinela and Zaldívar are the company's first operations to commit to the Copper Mark. Among the decliners, shares of Tricorn Group plummeted by 27.1% after it announced a balance sheet related risk of £3.6 million. Ocado was down by around 4.2% on the FTSE-100 index.

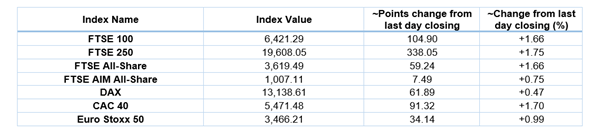

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 16 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); International Consolidated Airlines Group SA (IAG).

Top 3 Sectors traded in green*: Energy (+5.77%), Financials (+2.34%) and Healthcare (+2.21%).

Top 2 Sectors traded in red*: Utilities (-0.20%) and Healthcare (0.03%).

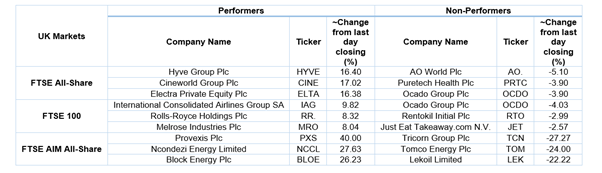

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $43.88/barrel and $41.27/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,887.75 per ounce, up by 0.09% against the prior day closing.

Currency Rates*: GBP to USD: 1.3192; EUR to GBP: 0.8974.

Bond Yields*: US 10-Year Treasury yield: 0.898%; UK 10-Year Government Bond yield: 0.348%.

*At the time of writing