US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 14.14 points or 0.32 per cent higher at 4,405.50, Dow Jones Industrial Average Index surged by 112.93 points or 0.33 per cent higher at 34,859.18, and the technology benchmark index Nasdaq Composite traded higher at 14,643.60, up by 64.10 points or 0.44 per cent against the previous day close (at the time of writing – 11:45 AM ET).

US Market News: The major indices of Wall Street traded in a green zone after a surge in oil price amid global supply chain squeeze. Among the gaining stocks, Merck (MRK) shares grew by around 0.81% after the Company requested emergency use authorization for its antiviral Covid-19 pill. Exxon Mobil Corp (XOM) shares rose by around 0.63%, driven by a rise in crude oil price. Among the declining stocks, Southwest Airlines (LUV) shares dropped by about 1.80% after the airlines cancelled more than 1,000 flights on Sunday. Hasbro (HAS) shares went down by approximately 0.91% after announcing that the CEO Brian Goldner would take medical leave, with immediate effect.

UK Market News: The London markets traded on a mixed note, with FTSE 100 pushed higher by the energy and mining stocks. Moreover, the Bank of England (BoE) policymaker Michael Saunders had hinted of a sooner-than-expected interest rate hike to tackle rising inflation.

Can the US market bounce back?

ASOS shares plunged by about 13.41% after the ongoing supply chain disruptions and higher logistics costs had caused the Company to anticipate a drop in the adjusted profit before tax of approximately 40% during FY22. Moreover, the CEO, Nick Beighton, decided to step down.

Britvic shares dropped by around 6.18% after RBC Capital Markets had downgraded the Company to “sector perform” from “outperform”.

AstraZeneca’s antibody cocktail had proven to significantly reduce the severe COVID-19 or death. Furthermore, the shares grew by around 1.17%.

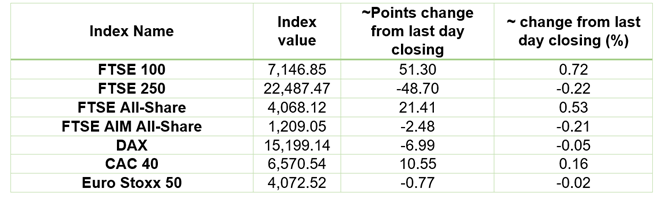

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as of 11 October 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 sectors traded in green*: Basic Materials (3.10%), Energy (1.56%), Financials (0.96%).

Top 3 sectors traded in red*: Real Estate (-1.63%), Consumer Cyclicals (-0.97%), Technology (-0.59%).

Top 3 gainers on FTSE All-Share index*: Anglo American PLC (5.41%), Ferrexpo PLC (5.36%), Superdry PLC (4.95%).

Top 3 losers on FTSE All-Share index*: TUI AG (-6.82%), Drax Group PLC (-6.78%), Britvic PLC (-6.76%).

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $83.61/barrel and $80.47/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,755.15 per ounce, down by 0.13% against the prior day closing.

Currency Rates*: GBP to USD: 1.3607; EUR to USD: 1.1557.

Bond Yields*: US 10-Year Treasury yield: 1.612%; UK 10-Year Government Bond yield: 1.1945%.

*At the time of writing