Global Markets*: Stocks in the United States were hovering in red amid increased uncertainty over crude oil prices and escalating tension between US and Iran, with the S&P 500 index was trading 6.9 points or 0.22% lower at 3,000.50, Dow Jones Industrial Average Index fell off 108.05 points or 0.40% and quoting at 27,111.74 and the technology benchmark index Nasdaq Composite was trading lower at 8,160.87 and down by 15.84 points or 0.19% against its previous day close, at the time of writing.

Global News: On Saturday, two facilities owned by Saudi Aramco were attacked using drones in an attack which was claimed by Houthi rebels from Yemen, an Iran-supported outfit. The attack cut more than half of the production of Saudi Arabia and shut 5 per cent of global crude output, as the biggest crude oil processing plant in the world was damaged. The oil production from the facilities is anticipated to be well below the maximum capacity for an extended period and could take months to return to full capacity. This led to the biggest percentage spike in almost three decades as oil prices rose as much as 20 per cent to above $71 a barrel, before easing after President Donald Trump said he would release US emergency supplies. Concerns about political implications of the attack and impact on global growth due to higher energy prices led to stocks opening lower on Monday, while Treasury yields fell, as demand for safe-haven US debt rose.

European Markets: Broader equity benchmark index FTSE 100 (UK) closed at 46.05 points or 0.62 per cent lower at 7,321.41, the FTSE 250 index decreased by 135.45 points or 0.67% lower at 20,060.30, and the FTSE All-Share Index contracted by 24.52 points or 0.60% lower at 4,028.79. Another European equity benchmark index STOXX 600 ended at 389.53, down by 2.26 points or 0.58 per cent.

European News: After a meeting between European Commission chief Jean-Claude Juncker and Prime Minister Boris Johnson on Monday, Johnson reiterated its commitment to leave the European Union on 31 October while the EU said that British authorities had still not proposed an alternative to the Irish backstop. The British government is yet to reach an agreement with the EU with less than seven weeks until Britain is due to leave, though he is hoping an agreement can be reached at a summit of EU leader on 17-18 October. After recovering from a three-year low below $1.20 reached earlier this month, the sterling declined half a per cent on Monday as both the EU and Britain suggests their positions remain far apart, raising concerns about a hard-Brexit.

London Stock Exchange

Top Players*: PREMIER OIL PLC (PMO), WOOD GROUP (JOHN) PLC (WG.) and ENQUEST PLC (ENQ) are top performers and increased by 10.48%, 9.98% and 8.48% respectively.

Worst Performers*: ALFA FINANCIAL SOFTWARE HOLDINGS PL (ALFA), THOMAS COOK GROUP PLC (TCG) and SIRIUS MINERALS PLC (SXX) are the top three laggards and decreased by 16.58%, 10.34% and 9.31% respectively.

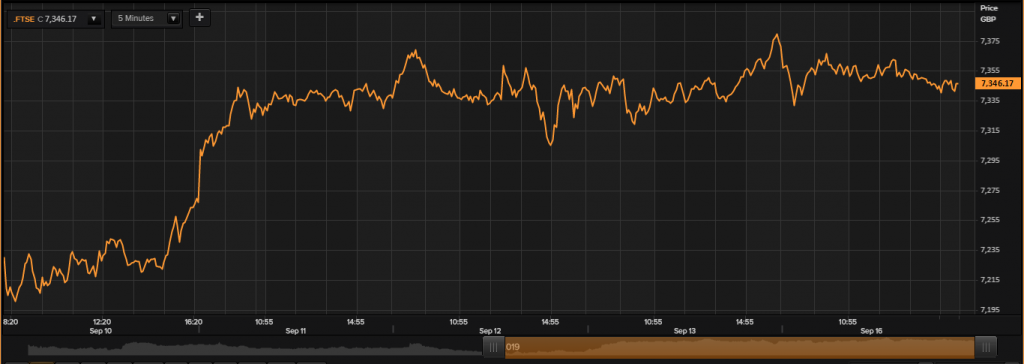

FTSE 100 Index

Five days Price Performance (September-16-2019), before the market closed; Source: Thomson Reuters

Top Gainers*: BP PLC (BP.), ROYAL DUTCH SHELL PLC 'A' (RDSA) and ROYAL DUTCH SHELL PLC 'B' (RDSB) top gainers at the FTSE 100 index and climbed by 4.22%, 2.63% and 2.54% respectively.

Top Laggards*: EVRAZ PLC (EVR), PRUDENTIAL PLC (PRU), and AUTO TRADER GROUP PLC (AUTO) are top three laggards in todayâs session and reduced by 3.85%, 3.10% and 2.99% respectively.

Volume Leaders*: (LLOY) LLOYDS BANKING GROUP PLC; (VOD) VODAFONE GROUP PLC; (BP.) BP PLC.

Top Performing Sectors*: Energy (up 2.58%) and Utilities (up 0.79%).

Worst Performing Sectors*: Financials (down 1.36%), Basic Materials (down 1.31%), and Technology (down 1.09%).

Currency Exchange Rates*: GBP: USD and EUR: GBP were quoting at 1.2423 and 0.8857.

US and UK 10-Year Bond Yields*: The US 10-year and the UK 10-year Bond yields were quoting at 1.847% and 0.690% respectively.

Â

*At the time of writing