Centamin Plc

Centamin Plc (CEY) is a Jersey-based upstream exploration and development company that is involved in mining, exploration and production of precious metals, especially gold. The companyâs operations and biggest assets are located in the African Nations of Burkina Faso and Côte DâIvoire (Ivory Coast).

CEY Q3 Update

On 23rd October 2019, Centamin Plc announced a quarterly report for the quarter ended 30th September 2019. The company reported Gold production of 98,045 oz. from the Sukari Gold Mine in the third quarter, taking total production for the nine months in 2019 (Year to Date Production) at 332,141 oz. The company reported a Gross revenue at US $160.8 million from 108,826 oz in sales of gold, at an average gold price of US$ 1,478 per oz. during the quarter. As far as the outlook for the fourth quarter of the year is concerned, October production has been in line with expectations and on its way to be the best monthly performance for the year. The lower spectrum of the final production guidance for the year at 490,000 oz., stays as the target, while the cost guidance for the fourth quarter has not changed and is expected to stay between US $675 and US $725 per oz. produced.

CEY Share Performance

On 23rd October 2019, at 09:30 AM GMT, while writing, Centamin Plcâs stock traded at GBX 111.20 per share, an increase of 3.88 per cent or GBX 4.15 per share in comparison with the previous dayâs closing price which was reported at GBX 107.50 per share. At the time of writing, the companyâs stock traded 40.51 per cent higher from its 52-week low price of GBX 79.14 per share, set on April 18, 2019. The companyâs Market Capitalisation was around GBP 1.237 billion.

By the time of writing, 2.74 million stocks of the company had been traded for the day. The average volume of trading per day for last one year has been 5.47 million. The stock has gained 5.90 per cent in the last one year from the price of GBX 105.00 per share.

Â

Quilter Plc

Quilter Plc (QLT) is a London, the United Kingdom based financial services company that was previously known as Old Mutual Wealth Management Limited. The company is engaged in the business of providing investment advisory and wealth management services. The company provides investment advice, asset management and investment management, as well as retirement solution through its various brands which are Quilter Financial Planning, Quilter Private Client Advisers, Quilter Investors, Quilter Cheviot Investment Management, Old Mutual Wealth and Old Mutual International. The company also has international operations in some select countries.

QLT Trading Update

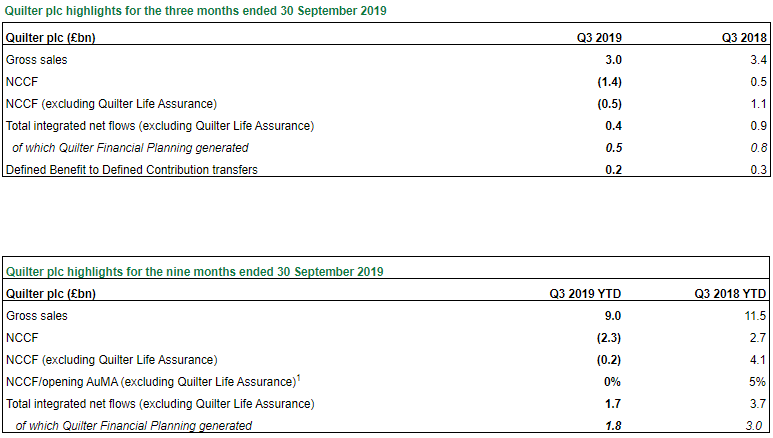

On 23rd October, the company announced a trading update for the third quarter ended 30th September 2019. The company announced that the Assets under Management and Administration were reported to be at of £118.7 billion as on 30th September 2019 an increase of 9 per cent from the previous year- end on 31st December 2018. The company reported gross sales of £3.0 billion in Q3 2019 as compared to £3.4 billion in Q3 2018. The company reported a Net Client Cash Outflow of £1.4 billion during the reporting period as compared to a Net Client Cash Inflow of £500 million in Q3 2018.

Source: Company Website

QLT Share Performance

On 23rd October 2019, at 09:50 AM GMT, while writing, Quilter Plcâs stock traded at GBX 141.55 per share, a decrease of 1.74 per cent or GBX 2.50 per share in comparison with the previous dayâs closing price which was reported at GBX 144.05 per share. The companyâs stock hovered 29.50 per cent above its 52-week low price of GBX 109.30 per share (at the time of writing), set on December 06, 2018. At the current market price, the companyâs stock was trading 9.78 per cent below its 52-week high price of GBX 156.9 per share, which the companyâs stock hit on April 18, 2018. The companyâs Market Capitalisation was around GBP 2.740 billion.

By the time of writing, 555,130 stocks of the company had been traded for the day. The average volume of trading per day for last one year has been 3.96 million. The stock has gained 23.07 per cent in the last one year from the price of GBX 115.020 per share.

Metal Tiger Plc

Metal Tiger Plc (MTR) is a company is into making direct equity investments in resource companies on the UKâs AIM (Alternative Investment Market) platform. The company has made some tactical investments in companies like Thor Mining Plc and MOD Resources Limited, in which the company hold around 19.9 per cent interest. In terms of On Market Portfolio, the companyâs important investment includes Arkle Resources plc and Greatland Gold Plc. The company considers the following conditions before making any type of an investment in a particular project: Favourability of the price outlook of the commodity, Managementâs performance and its proven track record, capability of the companyâs management to add to the value in terms of corporate governance as well professionalism and expertise in Financial as well as Technical context, the capability of the company of substantially growing the worth of the mining asset leveraging its experience and expertise in exploration and development operations, risks involved in the projects such as location, geographical jurisdictions and political climate and most importantly by understand the potential to exit.

Â

MTR Financial Performance (results for six months ended 30th June 2019)

The company released its results for the six months ended 30 June 2019 on 25 September 2019. The company highlighted that it had made an agreement to sell its current interest of 30 per cent in its joint venture with MOD Resources Limited, one of its Direct Equity strategic investment and to support the offer of acquisition made by Sandfire Resources NL for MOD, contingent to the approval of the shareholders of MOD Resources Limited.

The company reported a robust performance of some of its key performance indicators such as Net Asset Value (NAV) which was reported at £26.68 million 30th June 2019, a massive year on year increase of 133.01 per cent as compared to the NAV on 30th June 2018 at £11.45 million. This translated into a year on year increase of 76.28 per cent of the NAV â fully diluted per share at GBX 1.71 per share as on 30th June 2019, as compared to the fully diluted per share NAV on 30th June 2018 at GBX 0.97 per share. This resulted into an operating profit for the company at £4.36 million in H1 2019 as against an operating loss £5.11 million in H1 2018. For the reported period Profit was reported to be at £4.52 million in H1 2019 as against a loss of £4.49 million in first half of 2018. The cash and cash equivalents of the company stood at £2.57 million as at the end of the reported period. This was a year on year increase of approximately 248.43 per cent as compared to the cash and cash equivalents balance as on 30th June 2018 at £737,000. The company reported a net cash outflow from operating activities during the period ended 30th June 2019 at £1.203 million, a reduction of 38.11 per cent year on year in net cash outflow as compared to the net cash outflow for the six months ended 30th June 2018 at £1.944 million.

Â

MTR Share Performance

On 23rd October 2019, at 09:01 AM GMT, while writing, Metal Tiger Plcâs stock traded at GBX 1.35 per share, an increase of 1.89 per cent or GBX 0.025 per share in comparison with the previous dayâs closing price which was reported at GBX 1.32 per share. At the time of writing, the companyâs stock was 34.87 per cent higher from its 52-week low price of GBX 1.00 per share, set on January 04, 2019. At the current market price, the companyâs stock was trading 35.71 per cent below its 52-week high price of GBX 2.1 per share, which the companyâs stock hit on October 24, 2018. The companyâs Market Capitalisation was around GBP 20.66 million.

By the time of writing, 518,140 stocks of the company had been traded for the day. The average volume of trading per day for last one year has been 2.12 million. The stock has lost 30.77 per cent in the last one year from the price of GBX 1.9330 per share.

The Beta of the stock has been reported to be at 1.0439, from which it can be inferred that the stockâs price movement, is more volatile as compared to the movement of the comparative benchmark index.