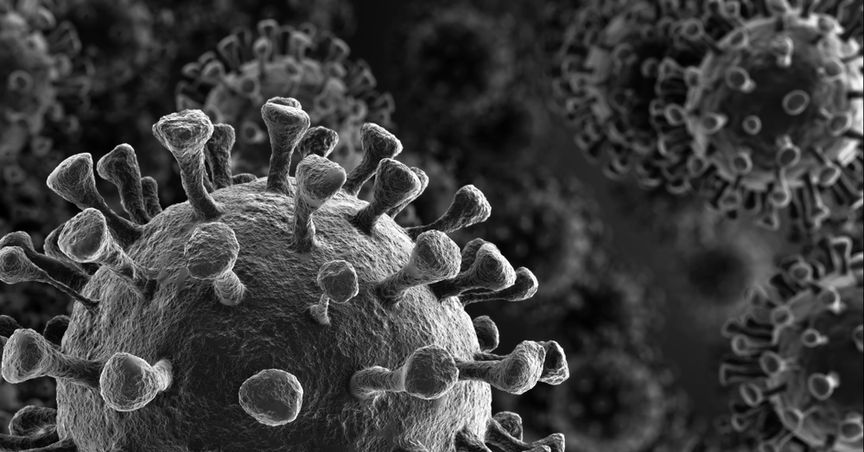

Hammerson Plc while updating about the impact of the Covid-19 on the business stated that, as at the end of 27 March (Q+2 day), it has received overall 37 per cent of UK rent billed for the second quarter. Further, the company announced that it has received 57 per cent of rent due, adjusted for rent deferred, switched to monthly payment, and a nominal proportion waived. The company is hopeful that both the figures will increase going further as temporary agreements are implemented and further cash is collected. After this news, the company’s stock price surged by 16.12 per cent and closed at GBX 77.38 on 31st March 2020.

The company stated that due to this outbreak, the management’s priority is to taking care of health and wellbeing of the staff, partner, and consumers while safeguarding the long term value of the business. It also believes that it should help tenants, mainly the independent and smaller brands which are not much keen to shut their space in its centres. However, the company had received many requests for waver, monthly payments and rent deferrals. The company further said that it is looking into them individually while inspecting risk profile and business model of the occupier, combined with the relief made accessible by the related government.

The company informed that they would keep following the government instruction and the Group is taking all the adequate steps to reduce the impact of Novel Coronavirus outbreak and is ready to help its staff and their family in this situation of crisis.

Updates on Liquidity and other financials

The company has also informed about its balance sheet and liquidity. It reported that the Group had withdrawn an extra £100 million for an additional cash reserve on 25th March 2020. The company was already having £1.2 billion of undrawn committed facilities and cash as at 31 December 2019. As per the company information on 21st February 2020, the liquidity will be further increased by the net proceeds of £395 million with regards to the outright sale of seven retail parks portfolio, which is scheduled to get complete on 23rd April 2020. Till now, the tightest Group gearing covenant is 150 per cent in comparison with 65 per cent as at 31st December 2019 and 55 per cent on a pro forma basis. Additionally, the unencumbered asset ratio was reported at 1.89x versus 1.50x covenant on the private placement senior notes. Interest cover was reported at 3.3x as compared to the 1.25x covenant.

During the announcement of the financial year 2019 result, the company had guided £140 million of capital expenditure for the FY2020, which included 63 million with regards to on-site developments at Cergy, Les 3 Fontaines and Italik, Paris. However, these projects have been postponed due to unavailability of staffs to work on sites. Further, material efficiencies and deferrals has also been recognised in projected capital expenditure, and no new spending will be utilised in the near term. The company has chalked out ways to save cost through identified administrative, property and service charge all across territories with a drop of 40 per cent on average expected service charges of the second quarter in the United Kingdom & Ireland to support brands.

As per the company, Value Retail and VIA Outlets, altogether 17 in numbers out of the 20 premium outlets held by its interests, have been closed after the government announced a shut down in the relevant regions. The company has emphasised that “it is important to highlight that businesses like Value Retails, which have a greater degree of variable, higher marketing spend, are going to see cut in the near-term.” As per the company, it is not possible to access the impact of Coronavirus on these independently and externally managed financed vehicles.

Talking about the final dividend of the year 2019, “the company stated that though the Board is very much positive about the strong financial performance of the company, the Novel Coronavirus outbreak will have a material impact on the Group during the year 2020. During the substantial uncertainty of Novel Coronavirus spread, the Board has decided that it is not apt to go for a dividend for the financial year ended 31st December 2019 of 14.8 pence per share, recommended earlier.

Overview of the Hammerson Plc, its recent news and share price performance

- Overview of Hammerson Plc

Hammerson Plc(LON:HMSO) is a real estate investment trust (REIT). The company’s portfolio concentrates on premium outlets and best quality flagship destinations in the finest cities of Europe and the United Kingdom. The company owns nine retail parks, twenty premium outlets and twenty-one flagship destinations. The company has its operations spread across fourteen countries.

Company’s Portfolio

(Sources: Company Website)

- HMSO – News Updates

- On 25th March 2020, the company while informing that it was plans to hold its AGM on 28th April 2020 electronically due to impact of Novel Coronavirus, announced two changes with regards to implementation of the Proposed Remuneration Policy in the year 2020, i.e. the Non-Executive and Executive Directors wanted the rise in fee and remuneration growths be cancelled. Secondly, at the AGM, the company is looking for investors consent to announce the Restricted Share Scheme and has indicated that the first grant would be over shares value, during the time of grant, 75 per cent of salary.

- On 12th March 2020, the company announced the appointment of General Counsel and Company Secretary. As per the company information, Sarah Booth would retire from the post of General Counsel and Company Secretary on 27th March 2020. She will be replaced by Alice Darwall on the same date. She would also be included in the company’s Group Executive Committee.

- HMSO – Share Price Performance

On 01st April 2020, at around 09:59 AM (GMT), Hammerson Plc’s stock was trading at a price of GBX 74.0 per share on the London Stock Exchange, a decline in the value of about GBX 3.38 or 4.37 per cent, against the closing price of the previous day, which has been reported to be at GBX 77.38 per share.

The one year high of the company’s stock price was recorded on 12th April 2019 at GBX 351.90, whereas its one-year low stock price was recorded at GBX 65.24 on 30th March 2020. The current share price was down by 78.97 per cent from the one-year high price, while the same was up by 13.42 per cent from the one-year low price.

As on 1st April 2020, the market capitalisation of HMSO has been reported at GBP 592.96 million with respects to the stock’s current market price. Hammerson Plc’s free float and outstanding shares have been reported at 731.08 million and 766.29 million, respectively. At the time of writing, the stock’s yearly dividend yield was reported to be at 38.87 per cent, whereas the yearly dividend was reported at GBX 25.90 per share.

The beta of the stock has been pegged at 1.95, which indicates that the share price movement is notably more volatile in respect to the movement with the comparative benchmark index.