InterContinental Hotels Group PLC

InterContinental Hotels Group PLC (IHG) is into hotel operations. The company owns, franchise, manage and lease hotel. The company has its operations worldwide, currently having 5,723 hotels and 855,915 rooms under its brand name. InterContinental Hotels Group PLC is headquartered in Denham, the United Kingdom.

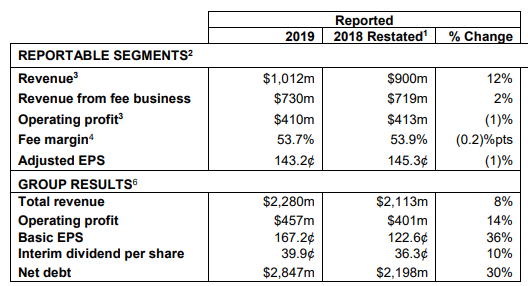

Financial Highlights (H1 FY2019, US$ million)

(Source: Interim Reports, Company Website)

In H1 FY19, the companyâs revenue from reportable segments surged by 12 per cent to $1,012 million, while underlying revenue surged by 13 per cent as compared with the corresponding period of the last year. Revenue from fee business rose by 2 per cent to $730 million against $719 million in H1 FY18. Operating Profit from reportable segments declined by 1 per cent to $410 million as compared to $413 million in H1 FY18, while underlying operating profit surged by 2 per cent. Fee margin from reportable segments declined to 53.7 per cent against the same period in 2018. Adjusted EPS from reportable segments reduced by 1 per cent to 143.2 cents as compared to 145.3 cents in H1 FY18.

In H1 FY19, the groupâs total revenue surged by 8 per cent to $2,280 million and operating profit rose by 14 per cent to $457 million against the corresponding period of the last year, driven by the System Fund moving from a $12 million in-year deficit to a $47 million in-year surplus and a decrease of $38 million in exceptional costs. Basic earnings per share stood at 167.2 cents, an increase of 36 per cent against the $122.6 cents in H1 FY18. Interim dividend per share increased by 10 per cent to 39.9 cents as compared to 36.3 cents in H1 FY18. Net Debt stood at $2,847 million, up by 30 per cent against the $2,198 million in H1 FY18.

Although the companyâs revenue rose in the half-year of 2019, the profitability margins remained stagnant or slightly declined. There had been a significant increase in the operating costs of the company in the current period, which had impacted the profitability of the company. Due to geopolitical uncertainties, most people preferred to stay at home, negatively impacting both the tourism and hospitality industry.

Share Price Performance

1-year Price Performance (as on 7th August 2019), before the market closed (Source: Thomson Reuters)

On 7th August 2019, at the time of writing (before the market close, GMT 8:20 AM), InterContinental Hotels Group PLC shares were at GBX 5,181 and increased by 1.43 per cent versus the previous day closing price. Stock's 52 weeks High is GBX 5,770, and 52-weeks Low is GBX 3,861.31. The groupâs stock beta stood at 1.38, reflecting higher volatility as compared to the benchmark index.

IWG Plc

Switzerland based International Workplace Group (IWG) Plc is a co-work and workspace company. The company helps more than 2.5 million people and their occupation to work more productively. The group is owned majorly by the institutional investors. Toscafund Asset Management LLP, M & G Investment Management Ltd. and Aberdeen Standard Investments (Edinburgh) are among the top institutional investors in the revolutionary workspace company.

Recent News

On 6th August 2019, the company announced its purpose to commence a £100 million share buy-back programme. With Investec Bank PLC, the company come in into an irrevocable arrangement to repurchase on its behalf and within certain pre-set parameters, ordinary shares in the group for the treasury.

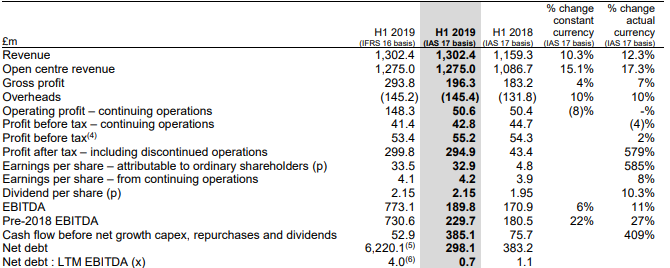

Financial Highlights (H1 FY2019, £ million)

(Source: Interim Reports, Company Website)

On a constant currency basis, the companyâs revenue increased by 10.3 per cent to £1,302.4 million as compared to £1,159.3 million, due to increased revenue in the Americas and EMEA. Gross profit on IAS 17 basis surged by 4 per cent to £196.3 million as compared with the corresponding period of the last year. Operating profit from continuing operations on IAS 17 basis declined by 8 per cent to £50.6 million against the £50.4 million in H1 FY18. EBITDA on IAS 17 basis surged by 6 per cent to £189.8 million against the £170.9 million in H1 FY18. Pre-2018 EBITDA on IAS 17 basis rose by 22 per cent to £229.7 million as compared with the same period in 2018. Overall, occupancy for the pre-2018 business increased by 3.4ppts year-on-year to 75.2 per cent.

On an actual currency basis, the revenue increased by 12.3 per cent, gross profit on IAS 17 basis surged by 7 per cent, and profit before tax on IAS 17 basis from continuing operations declined by 4 per cent. Earnings per share from continuing operations on IAS 17 basis stood at 4.2 pence, reporting an increase of 8 per cent against the 3.9 pence in H1 FY18. Interim dividend per share increased by 10.3 per cent to 2.15 pence against the 1.95 pence in H1 FY18. Cash flow before net growth capex, repurchases and dividends on IAS 17 basis surged by 409 per cent to £385.1 million against the £75.7 million in H1 FY18. Net Debt to LTM EBITDA on IAS 17 basis was 0.7x.

The addition of new centres indicates the companyâs strong focus on prudent capital allocation, and this has allowed them to maintain a robust financial position.

Share Price Performance

1-year Price Performance (as on 7th August 2019), before the market closed (Source: Thomson Reuters)

On 7th August 2019, at the time of writing (before the market close, GMT 8:22 AM), IWG Plc shares were hovering around GBX 375 and increased by 1.35 per cent versus the previous day closing price. Stock's 52 weeks High is GBX 383.10, and 52-weeks Low is GBX 199. The groupâs stock beta stood at 1.61, reflecting higher volatility as compared to the benchmark index.

SDL PLC

SDL Plc (SDL) is a Software & Computer Services company providing content management solutions. The company is working with Donnelley Language Solutions to provide innovation in language. The companyâs expertise in language translation and digital content management is trusted by many top companies and is presently working with 90 out of the top 100 global brands.

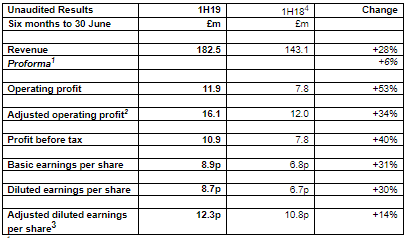

Financial Highlights (H1 FY2019, £ million)

(Source: Interim Report, Company Website)

For the first half of the financial year 2019, the companyâs revenue increased by 28 per cent to £182.5 million from £143.1 million in the first half of the financial year 2018. The companyâs revenue surged by 6 per cent on a proforma basis. The increase in the revenue was driven by benefit due to the exchange rate between the US Dollar and Pound Sterling.

The companyâs operating profit was up by 53 per cent to £11.9 million in H1 FY2019 from £7.8 million in H1 FY2018. The adjusted operating profit stood at £16.1 million in H1 FY2019 versus £12 million in H1 FY2018, reflecting an increase of 34 per cent. The companyâs PBT (profit before tax) surged by 40 per cent to £10.9 million in H1 FY2019 from £7.8 million in H1 FY2018.

The basic earnings per share was 8.9 pence in H1 FY2019 versus 6.8 pence in H1 FY2018, up by 31 per cent. The companyâs diluted earnings per share surged by 30 per cent to 8.7 pence in H1 FY2019 from 6.7 pence in H1 FY2018. The companyâs adjusted diluted earnings per share surged by 14 per cent to 12.3 pence in H1 FY2019 from 10.8 pence in H1 FY2018.

The company had successfully acquired and merged DLS (Donnelley Language Solutions), which will improve and accelerate innovation in the language. The company expects the second half to be a stronger period with decent sales momentum and increased sales pipeline. However, being an IT company, the SDL needs to invest heavily in innovation and system maintenance any failure to do so will impact the brand royalty and may affect the companyâs financial performance.

Share Price Performance

1-year Price Performance (as on 7th August 2019), before the market closed (Source: Thomson Reuters)

On 7th August 2019, at the time of writing (before the market close, GMT 8:20 AM), SDL Plc shares were at GBX 494 and increased by 1.23 per cent versus the previous day closing price. Stock's 52 weeks High is GBX 600.79, and 52-weeks Low is GBX 430. The groupâs stock beta stood at 0.65, reflecting lower volatility from the benchmark index.

Meggitt PLC

Meggitt PLC (MGGT) is a United Kingdom-headquartered engineering company that offers advanced technologies, products and services. The company operates in 16 countries and focuses on three core sectors, namely aerospace, defence and energy. The differentiated technology and products of the company are underpinned by deep intellectual property, across a wide range of applications. The groupâs operations are segregated in five operating segments: Meggitt Equipment Group, Meggitt Sensing Systems, Meggitt Polymers & Composites, Meggitt Control Systems, and Meggitt Aircraft Braking Systems.

Recent News

On 6th August 2019, the company announced that Executive Director, Philip Green decided to retire from the Board at the end of December 2019.

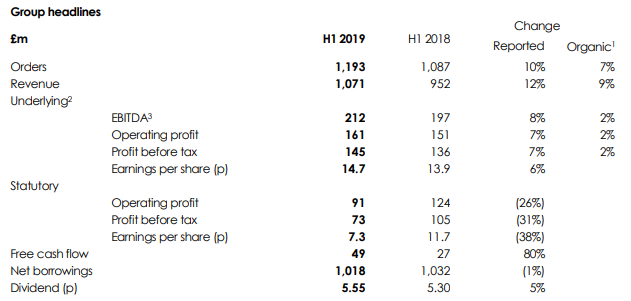

Financial Highlights (H1 FY2019, £ million)

(Source: Interim Reports, Company Website)

In H1 FY19, the reported orders increased by 10 per cent to £1,193 million as compared with the corresponding period of the last year, while organic orders surged by 7 per cent. Organic revenue rose by 9 per cent, due to strong trading performance in defence and civil OE. Reported revenues climbed by 12 per cent to £1,071 million against the £952 million in H1 FY18, driven by the currency and organic growth, partially offset by non-core divestments.

Underlying operating profit surged by 7 per cent to £161 million. Underlying operating margin decreased to 15 per cent, due to the growth in the installed base and additional investment in Engine Composites. Statutory operating profit reduced by 26 per cent to £91 million against the £124 million in H1 FY18, mainly as a result of lower gains from the disposal of businesses as compared to the previous period. Underlying earnings per share increased by 6 per cent to 14.7 pence as compared with the corresponding period of last year, while statutory EPS was 7.3 pence.

Free cash flow surged by 80 per cent to £49 million, inclusive of the sale of buildings and land associated with the companyâs move to the Ansty Park site. Interim dividend per share increased by 5 per cent to 5.55 pence, due to the continued confidence in the vision of the company.

While the company has considered the uneven nature of the demand for defence products and the moderating potential for air traffic growth, it continues to expect strong revenue growth in 2019. For FY 2019, it expects to deliver civil OE organic revenue in the range of 5% and 7% and targets 4% to 6% organic growth in group revenue, underpinned by strong shipset content. In FY19, strong order intake with organic book to bill of 1.13x, the company aims at driving sustainable improvements in operational performance and is well-positioned to deliver targets for an inventory turns of 4.0x by 2021.

Share Price Performance

1-year Price Performance (as on 7th August 2019), before the market closed (Source: Thomson Reuters)

On 7th August 2019, at the time of writing (before the market close, GMT 8:20 AM), Meggitt PLC shares were at GBX 590 and increased by 0.31 per cent versus the previous day closing price. Stock's 52 weeks High is GBX 606.98, and 52-weeks Low is GBX 410.01. The groupâs stock beta stood at 0.88, reflecting lower volatility as compared to the benchmark index.