Microsaic Systems Plc

Microsaic Systems Plc (LON:MSYS) is a Woking, United Kingdom based Electrical and Electronic Equipment company that mainly indulges in the business of research, development, as well as selling of specific scientific instruments. The companyâs flagship technology is the Chip-based miniaturised mass spectrometry technology which basically allows point of need detection at any phase in a client's work process. Intended for the pharmaceutical and biopharmaceutical businesses, the companyâs incredible, smaller MS frameworks and programming deliver processing as well as production readiness and enhances business profitability. The company also manufactures products in Small Molecule Applications, Biopharma Applications, as well as Integrated software.

MSYS Financial Performance

On 23rd September 2019, Microsaic Systems Plc posted its half year results for a period of six months ended on 30th June 2019. The results mainly highlighted a year on year increase of 30 per cent in the revenues to £0.33 million during the reporting period H1 2019, as opposed to £0.25 million in H1 2018. The company also reported that the cash balance as on 30th June 2019 was £4.1 million, as against £5.4 million as on 31st December 2018.

MSYS Share Price Performance

On 6th December 2019, at 08:40 A.M Greenwich Mean Time, at the time of writing, Microsaic Systems Plcâs share price was reported to be trading at GBX 0.874 per share on the London Stock Exchange Market, a marginal decline of 0.11 per cent or GBX 0.001 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 0.875 per share.

The beta of the companyâs stock has stood at a value of 3.8094. This enables us to analyse that the degree of movement in the share price of the company, is higher, when compared to the movement of the benchmark market index.

Nanoco Group Plc

Nanoco Group Plc (LON:NANO) is a Manchester, United Kingdom domiciled Technology Hardware and Equipment company that is indulged in the business of designing, developing and manufacturing of quantum dots and other semiconductor nanomaterials in commercial quantities for use in displays, lighting, solar energy and bio-imaging that are incorporated into the final product. The research and development activities are based at Manchester, while the manufacturing activities are based in nearby Runcorn.

NANO Financial Performance

On 16th October 2019, the company produced its preliminary results for the year ended on 31st July 2019. The companyâs main highlighting point was a significant 115 per cent year on year growth in the turnover from £3.3 million in FY 2018 to £7.1 million in FY 2019. The company also highlighted a reduction of 27 per cent in the net loss for the period as well as a 31 per cent decline in the Loss per share to GBX 1.52 per share in FY 2019.

NANO Share Price Performance

On 6th December 2019, at 08:45 A.M Greenwich Mean Time, at the time of writing, Nanoco Group Plcâs share price was reported to be trading at GBX 13.10 per share on the London Stock Exchange Market, an increase of 2.75 per cent or GBX 0.35 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 12.75 per share.

The beta of the companyâs share has stood at a value of -0.2058. This enables us to analyse that the degree of movement in the share price of the company, is lower and inverse, when compared to the movement of the benchmark market index.

Advanced Oncotherapy Plc

Advanced Oncotherapy Plc (LON:AVO) is a London, United Kingdom based Healthcare equipment and services providing organisation that is involved in giving radiotherapy frameworks to disease treatment using a proton therapy innovation. The company is occupied with advancement and afterward working of the Linac Image Guided Hadron Technology (LIGHT) proton pillar malignant growth treatment gadget. The company's portions incorporate Development of Proton Therapy-UK; Development of Proton Therapy-Switzerland; Development of Proton Therapy-USA, and Healthcare-related properties-UK. Its LIGHT framework incorporates a progression of secluded straight quickening agents. This component offers emergency clinics and focuses to alter treatment plans dependent on a scope of energies. The company's Research and advancement/ADAM S.A. (Research and development/ADAM) office is situated on the grounds of European Council for Nuclear Research (CERN), Geneva and Switzerland. The ompany's confirmation and approval site is situated in Daresbury, United Kingdom.

AVO Financial Performance

On 30th September 2019, the company made a press release to report its six-month results for the half year that started on 1st January 2019 and ended on 30th June 2019. The company had not reported any revenue as the products of the company are still in the initiation and testing phase but will be in contention for commercialisation soon. The operating loss for the period was reported to be around £11.005 million, mainly headlined by the administrative expenses as reported by the company.

AVO Share Price Performance

On 6th December 2019, at 08:50 A.M Greenwich Mean Time, at the time of writing, Advanced Oncotherapy Plcâs share price was reported to be trading at GBX 38.00 per share on the London Stock Exchange Market, no change in the price of the share, as compared to the previous dayâs closing price, which was also reported to be at GBX 38.00 per share.

The beta of the companyâs share has stood at a value of 1.6841. This enables us to analyse that the degree of movement in the share price of the company, is higher, when compared to the movement of the benchmark market index.

Falanx Group Limited

Falanx Group Limited (LON:FLX) is a London, United Kingdom domiciled innovation organization giving digital security and insight services to its customers. The vertical's help thing types consolidate The Assynt report, introduced and gave inspectors, essential understanding services and business information services. The vertical's services are offered to worldwide clients, including overall non-business components, oil and gas organizations, fiscal affiliations, protection offices, utility providers, hindrance establishments, bearers' associations and advancement business components. The organization has its business spread more than six topographical locales, to be specific the United Kingdom, Europe, Australasia, the United States of America and in the Middle East.

FLX Financial Performance

On 3rd December 2019, the organisation posted its interim results for the half year ended on 30th September 2019. The company highlighted that the group revenues were on the up by 21 per cent year on year from £2.18 million in the same period during the previous year to £2.64 million. This was significantly because of the increase in the intelligence business unit sales for the period.

FLX Share Price Performance

On 6th December 2019, at 08:55 A.M Greenwich Mean Time, at the time of writing, Falanx Group Limitedâs share price was reported to be trading at GBX 1.52 per share on the London Stock Exchange Market, no change in the price of the share, as compared to the previous dayâs closing price, which was also reported to be at GBX 1.52 per share.

The beta of the companyâs share has stood at a value of 3.2584. This enables us to analyse that the degree of movement in the share price of the company, is higher, when compared to the movement of the benchmark market index.

Primary Health Properties Plc

Primary Health Properties Plc (LON:PHP) is a United Kingdom domiciled organization occupied with the Real estate Investment trust (REIT) business. The principle business of this Real Estate Investment trust (REIT) is to put resources into the responsibility for social insurance offices inside the United Kingdom and in the Ireland Republic. It is particularly interested in the ownership of freehold or long-term leasehold assets in purpose-built primary healthcare facilities, that are leased out to medical professionals, government medical facilities and other associated medical and healthcare entities. Its arrangement of advantages comprises of about 306 such essential social insurance properties. Among the organization's offices incorporate Appleby Primary Care Center, Wrexham; Allesley Park Medical Center, Amesbury; Carnoustie Medical Group, Birkenhead; Hope Family Medical Center, Carnoustie; Dinays Powys Medical Center, St Catherine's Health Center, Dinas Powys; Appleby-in-Westmorland, Coventry; Barcroft Medical Center and Cedars Surgery.

PHP Financial Performance

Primary Health Properties declared results for the six months ended 30th June 2019 on 25th July 2019. The reported year on year increase in the Net Rental income was 43.9 per cent to £53.8 million in the first half of 2019, as compared to £37.4 million in H1 2018. The Adjusted EPRA Earnings per share was reported at GBX 2.8 per share. The dividend was declared at an increase of 3.7 per cent to GBX 2.8 per share.

PHP Share Price Performance

On 6th December 2019, at 09:00 A.M Greenwich Mean Time, at the time of writing, Primary Health Properties Plcâs share price was reported to be trading at GBX 148.60 per share on the London Stock Exchange Market, an increase of 0.41 per cent or GBX 0.60 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 148.00 per share.

The beta of the companyâs share has stood at a value of 0.2042. This enables us to analyse that the degree of movement in the share price of the company, is higher, when compared to the movement of the benchmark market index.

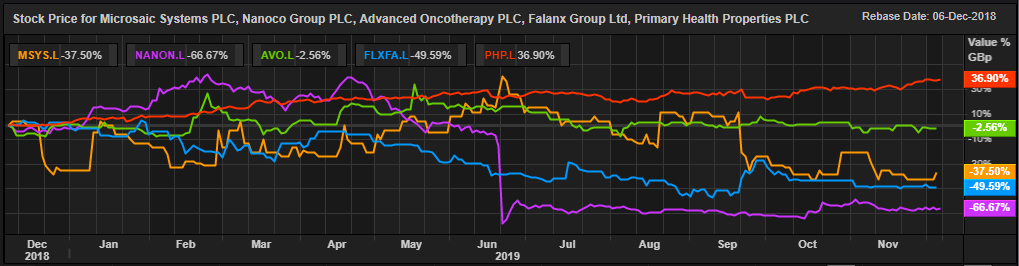

Comparative Share Price Chart of MSYS, NANO, AVO, FLX and PHP

(Source: Thomson Reuters) Daily Chart as on 06-December-19, prior to the close of the market