As the British prime minister prepares to chalk-out a new infrastructure plan and fears over rising cases of coronavirus concerning the investors, the FTSE-100 index was trading at 6,202.17 up by 0.70 per cent (as on 29th June 2020, before the market close at 1.21 PM GMT+1).

The other important points to watch out were:

- As per the data released by the Bank of England, the mortgage approval to purchase houses fell to 9,273 in May from 15,851 in April.

- The British prime minister, Boris Johnson, on Tuesday will state the plan for infrastructure projects such as hospitals, schools, rail and road.

Given the above market conditions, we will discuss two stocks - ASA International Group PLC (LON:ASAI) and International Personal Finance PLC (LON:IPF). As on 29th June 2020, (before the market close at 12.18 PM GMT+1), ASAI decreased by approximately 1.11 per cent, while IPF’s stock price dipped by around 0.72 per cent, against the previous day closing. Let’s walk through their operational and financial updates.

ASA International Group PLC (LON:ASAI) – Growing Loan Portfolio and Client Base

ASA International is a leading international microfinance institution, which aims to enhance financial inclusion among low-income populations throughout Asia and Africa. ASA International has 2.5 million low-income, female micro-entrepreneurs, as well as small business owners, with 1,895 branches and more than 12,480 workers. The Company is operational in 13 markets in Asia and Africa.

FY2019 Annual Result (year ended 31st December 2019) as Reported on 3rd June 2020

Comparison of FY19 Performance Against FY18

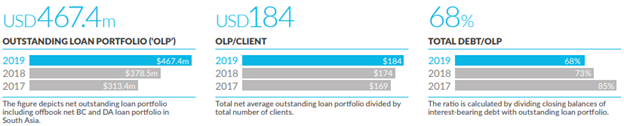

The outstanding loan portfolio (OLP) grew by 28 per cent on a constant currency to USD 467.4 million. The Company clients increased by 17 per cent to 2.5 million customers, which translated to an average OLP per client of USD 184. The normalized net profit was up by 12 per cent on a constant currency to USD 34.5 million. The Company segregates the business into four geographies, South Asia, South East Asia, West Africa and East Africa.

In South-East Asia client base grew by 11 per cent to 0.49 million, and net profit was up by 38 per cent. The clients in West Africa and East Africa increased by 5 per cent and 11 per cent to 0.46 million and 0.35 million, respectively. The net profit in West Africa was down by 6 per cent due to subdued growth in Nigeria and devaluation of Ghanaian currency. The net profit in East Africa grew by 69 per cent driven by growth in both Rwanda and Uganda. Due to COVID-19 impact, the Company expects the writeoff to be in the range of 2-3 per cent on the outstanding loan portfolio of USD 450 million.

KPIs for FY2019

(Source: Company Website)

Business Update as Reported on 29th June 2020

As on 26th June 2020, the Company had a cash balance of USD 110 million. Since the start of COVID-19, the Company secured a loan of USD 45 million from international and local lending institutions also, total funding of USD 200 million is in the pipeline. There has been a slight improvement in the collection activity post-lockdown in all the operating countries. Given the current distressing economic situation due to the pandemic, the Company has suspended the dividend for FY2019.

Share Price Performance

1-Year Chart as at June-29-2020, before the market close (Source: Refinitiv, Thomson Reuters)

ASA International Group PLC’s shares were down by 1.11 per cent to trade at GBX 134.00 (as on 29th June 2020, before the market close at 12.18 PM GMT+1). Stock 52 week High and Low were GBX 395.00 and GBX 46.30, respectively. The Company had a market capitalization of GBP 136.39 million.

Business Outlook

The Company targets a collection efficiency of above 98 per cent to maintain a stable portfolio quality. The Company believes that the loan collection will be effected in the countries where the government has provided a moratorium on the loan repayment, and lock-down is imposed. By the end of June 2020, real-time ASA Microfinance Banking System is expected to be launched, which will allow digital connection of all entities. The Company believes there are 372 million potential customers in the existing market, which is the future target clientele.

International Personal Finance PLC (LON:IPF): Focuses on Quality Lending than Growth

International Personal Finance Plc is into home credit and fintech business. IPF is a digital platform, which focuses on end to end lending. IPF has close to 2.1 million customers across 11 markets. The Company operates in European and Mexican market.

Q1 FY 2020 Trading Update (three months period ended 31st March 2020) as Reported on 30th April 2020

The lending declined by 15 per cent year on year. The credit issue on the IPF lending platform was decreased by 21 per cent year on year. The payment collection was 95 per cent in the quarter, which was 87 per cent in March. The business in the first ten-weeks in the quarter performed as per the Company expectation driven by the European home credit business, digital business and improved payment collection in Mexico. However, the business performance changed since mid-March when the free movement was restricted. The collection of the European home credit business was impacted. The Company reassessed the lending criteria to cater to clients with more strong credit profiles. On 1st April IPC reduced the cap on non-credit cost for new lending, which will resume to normal from 8th March 2021.

Markets

The government imposed temporary price caps on new lending in Europe and also introduced a moratorium on loan repayment. The government in Hungary and Romania has imposed a moratorium on loan until the end of 2020 whereas a temporary loan moratorium has been put in place in the Czech Republic. However, in all the countries where a moratorium is imposed, customers have the option to opt-out and continue repayment. Amid the distressing times, the Company introduced short-term products with capped rates for secure credit quality customers in Hungary and Poland. In Mexico, the Company is focusing on better quality home credit lending than growth.

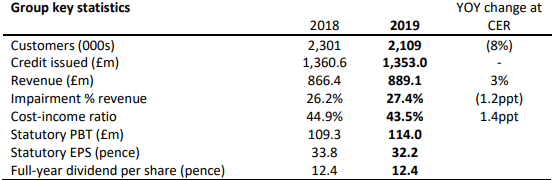

FY2019 Performance

(Source: Company Website)

Trading Update as Reported on 10th June 2020

The Company has issued only 30 per cent of the original target amount in April and May to protect the credit quality with the payment collection of 80 per cent of the pre-COVID levels in May and 76 per cent in April. Better payment options were provided to the customers that led to increased collection. The Company generated net cash of GBP 43 million in May. As on 31st May 2020, the Company had liquidity headroom of GBP 223 million including the cash and undrawn loan facility. The Company repaid GBP 44 million bonds at 6.125 per cent due for maturity in May 2020 and GBP 40 million in June. The Company is looking for options to refinance EUR 406 million bonds due to mature in April 2021.

Share Price Performance

1-Year Chart as at June-29-2020, before the market close (Source: Refinitiv, Thomson Reuters)

International Personal Finance PLC’s shares were down by 0.36 per cent to trade at GBX 56.30 (as on 29th June 2020, before the market close at 10:00 AM GMT+1). Stock 52 week High and Low were GBX 179.80 and GBX 32.55, respectively. The Company had a market capitalization of GBP 126.39 million.

Business Outlook

The demand for credit will be stable in a short time. The Company believes that the lower payment collections are temporary due to government moratorium and restricted movement of the public. The lending and collection are expected to improve as the lock-down eases in the operating markets. The Company will lend to the customers with stable credit quality. The Company believes that given the strength of the balance sheet and the funding position IPF will sail through the current uncertain times.