Simplistic calculations are used to show that, if lithium carbonate stays cheap, sodium-ion batteries have no hope. Nonsense. The different manufacturers are optimising different features to serve different markets and they include the following. Potentially, cost can be lower than lithium-ion whether expressed as up-front cost, levelised cost of storage or in other ways. This is only partly because the raw materials are low cost. Being at the beginning of its experience curve, other elements of cost can be expected to come down rapidly without the diminishing returns suffered by mature lithium-ion.

Multiple benefits

The following benefits provide cost and other commercially-impactful benefits. They can be fully discharged, have faster charging and even higher watts per watt-hour. They can be optimised for higher energy density at a given high power density than current lithium-ion. Better low temperature performance is on offer and, at the system level, there are many improvements to safety, deployment, energy density and cost over what is simplistically reported at cell level.

Potentially, they need less cooling, less battery management system, less fire-prevention, fire-fighting infrastructure and recycling cost. Large ones may become safely stackable not needing the large footprint of nervously well-separated lithium-ion stationary storage. Sometimes, all those aspects can offset any energy density deficit at cell level. Finally, expect long cycle life and probably other measures of life benefitting total cost of ownership and applicability.

Multiple business cases

Little wonder then that Natron, optimising parameters such as cycle life, can chase vehicle chargers, short term grid and beyond-grid storage and counterweighted industrial electric vehicles whereas other sodium-ion proponents optimise parameters such as energy density for electric cars, for example. Contrary to popular reporting, no one will sell them on cost alone. Indeed, in industry, our alarm bells ring when someone says they only have a cost advantage.

Lithium-ion sales will peak

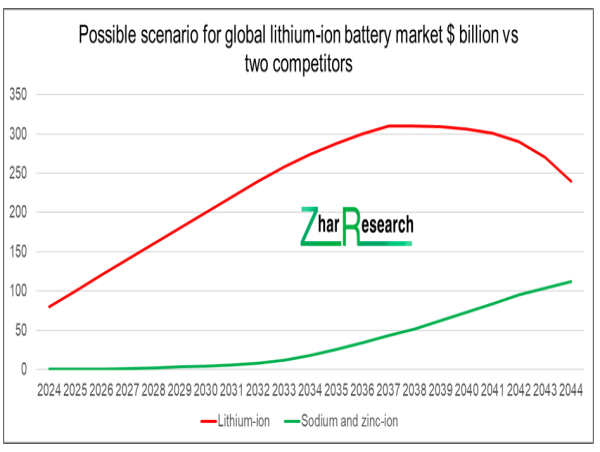

Lithium-ion battery value sales will peak no later than 2037 then drop steeply. One reason will be base metal-ion batteries, with sodium-ion batteries in the lead, together taking at least a $40 billion bite out of its markets at that time, when a mix-and-match of about 20 advantages may apply, given the current research pipeline.

Multiple impacts on lithium-ion

Lithium-ion will also be severely impacted by peak electric car and its commoditisation and the largest energy storage market becoming stationary storage, particularly Long Duration Energy Storage. Primarily, that LDES market will be for grids with 50-100% wind and solar, mostly implying duration of subsequent discharge of days up to one month. Here the necessarily massive up-to-10GWh levels of storage are best done by battery-free solutions such as liquid or solid gravity storage and underground compressed air. There will also be a large market for smaller LDES sizes serving beyond-grid such as 100MW data centres and desalinators where footprint matters and redox flow batteries RFB are strong candidates, all ion-batteries still finding it tough to compete. However, they can serve grids and beyond-grid locations with less wind and solar contribution. See them in your solar house, where there is inadequate space for LDES, at least for now.

Chasing sodium-ion

What will be close on the heels of sodium-ion? Researchers bet on zinc-ion with potentially similar benefits. By far the most research on followers is on these. Some advantages over sodium-ion may emerge. However, as-yet, near-zero self-leakage and economy of size sufficient for mainstream LDES is not in prospect for any ion-battery.

Possible scenario

The image shows a possible scenario. Of course the actual results for 2024 will be different and measured in different ways but it is surely time to debate the big picture. All contributions welcome.

New reports

See reports on zinc in energy storage, on LDES overall , LDES beyond grid, RFB and other useful analysis at www.zharresearch.com and www.giiresearch.com.

Distributed by https://pressat.co.uk/