Summary

- Asset Management has also been impacted due to Covid-19 but is on a gradual recovery path

- Euromoney Institutional Investor Plc’s revenue was impacted due to events cancelled due to novel coronavirus

- Intermediate Capital Group Plc reported a strong 22% rise in AUM for FY20

- Impax Asset Management Group Plc reported £1.8 billion of net inflows in six months endings 31st March 2020

This pandemic of coronavirus and the lockdown due to it has impacted the whole world and is going to have a far-reaching impact not only on the society and people but on the businesses as well. Almost all the industries, while the most affected sectors have been Aviation, Retail, Hospitality in the last couple of months, the Asset Management industry which has been instrumental in turning savings into investments for clients, has been going through rough weather. The industry has already adopted a flexible working and has been connecting in a different way than the usual. Investors perspective has also changed, and ESG agenda, which was already in flow has come at the forefront of investment thinking. Though things are slowly coming back to normal and there is increased movement in the equity and bond markets, which remained open despite all odds and have been offering opportunities to those who have clear plans and a strategy despite the current problems.

Here we are going to discuss four London Stock Exchange companies, who have declared the financial highlights. These companies are Euromoney Institutional Investor Plc, Helical Plc, Intermediate Capital Group Plc and Impax Asset Management Group Plc. We are going to discuss their Financial Highlights and share price performance.

Overview of Euromoney Institutional Investor Plc

Euromoney Institutional Investor Plc (LON:ERM) is an international, multi-brand information services provider, which delivers important Business to Business information to professional as well as international markets. The company provides market intelligence, price discovery, and events through its different segments. It is quoted on the London Stock Exchange and trades under the FTSE 250 share index.

ERM – Financial Highlights

On 04th June 2020, the company declared half-yearly results for the period ended 31st March 2020.

- Group’s revenue increased by 1 per cent, it was weighed down by a five percentage points decline from events cancelled due to novel coronavirus, while the underlying revenue remained flat.

- Adjusted profit before tax declined by 15 per cent during the six-month ending 31st March 2020, mainly impacted by events cancelled due to novel coronavirus and drop in Asset Management.

- As at 31st March 2020, the net cash was reported at £8.1 million, and bank facilities were of £188 million extended to December 2022.

- As at 31st March 2020, the company’s Acquisition commitments increased to £2,092K as compared to £986K as at 31st March 2019.

- As at 31st March 2020, the company’s Contract liabilities increased to £132.5 million as compared to £87.2 million as at 31st March 2019.

- As at 31st March 2020, the company’s property, plant and equipment increased to £74.2 million as compared to £15.3 million as at 31st March 2019.

- For the financial year 2020, the board will not announce any interim dividend payment, resulting in a cash saving of around £12 million.

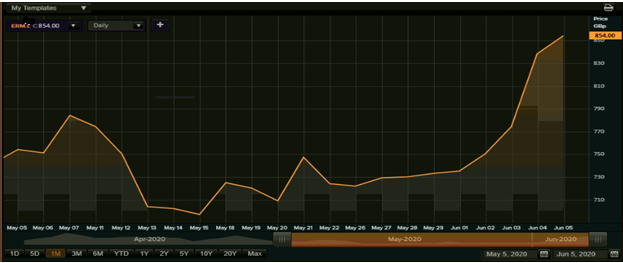

ERM – Share Price Performance

(Source: Thomson Reuters)

On 05th June 2020 as at 01:36 PM GMT, the stock price of Euromoney Institutional Investor Plc is trading at GBX 854.0, higher by 1.91 per cent, as compared to the previous closing price of GBX 838.0. The shares outstanding of the company have been reported to be at 109.29 million.

Overview of Helical Plc

Helical Plc (LON:HLCL) is a property investment and advancement company focusing on Manchester and London. The company’s objective is to provide market-leading returns by promising client-focused and design-led properties.

HLCL – Financial Highlights

On 04th June 2020, the company declared annual results for the year ended 31st March 2020.

- Net asset value (NAV) increased by 5.5 per cent to £598.7 million as at 31st March 2020 (31st March 2019: £567.4 million).

- During the FY2020, final dividend proposed decreased by 20 per cent to 6.00 pence per share (2019: 7.50 pence share) to reduce expenditures and safeguard cash resources in the present uncertain environment.

- Total dividend of the company decreased by 13.9 per cent for the FY2020 of 8.70 pence (2019: 10.10 pence).

- IFRS Profit before tax decreased slightly to £43.0 million for FY2020 (2019: £43.5 million).

- EPRA earnings per share dropped to 7.6 pence during FY2020 (2019: loss of 8.4 pence).

- As at 31st March 2020, the Group's cash and undrawn bank facilities was reported at £279 million (31st March 2019: £382 million).

HLCL – Share Price Performance

(Source: Thomson Reuters)

On 05th June 2020 as at 01:08 PM GMT, the stock price of Helical Plc is trading at GBX 361.50, higher by 0.42 per cent, as compared to the previous closing price of GBX 360.0. The shares outstanding of the company have been reported to be at 119.98 million.

Overview of Intermediate Capital Group Plc

Intermediate Capital Group Plc (LON:ICP) aims at providing financial support to companies to grow through public and private markets. The company believes in developing long-standing associations with its business associates to provide value for investors, customers, and staffs.

ICP – Financial Highlights

On 04th June 2020, the company declared final results for the financial year ended 31st March 2020.

- Asset Under Management (AUM) of the company increased by 22 per cent to €45.3 billion during the FY2020, which includes the new money raised of €10.2 billion.

- The profits from the fund management company increased by 27 per cent to £183.1 million during the FY2020 (2019: £143.8 million).

- As of 31st March 2020, the company had €11.4 billion of available capital to grab the opportunities available in the market and support the portfolio companies.

- As at 31st March 2019, the Net current assets increased to £762.3 million up from £328.1 million of last year.

- Final ordinary dividend increased by 2 per cent to 35.8 pence per share during the FY2020 and total regular dividends increased by 13 per cent to 50.8 pence per share.

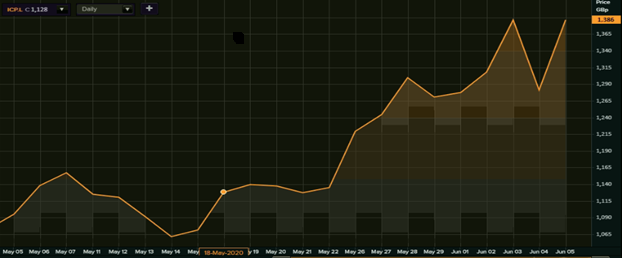

ICP – Share Price Performance

(Source: Thomson Reuters)

On 05th June 2020 as at 01:39 PM GMT, the stock price of Intermediate Capital Group Plc is trading at GBX 1,386.0, higher by 8.20 per cent, as compared to the previous closing price of GBX 1,281.0. The shares outstanding of the company have been reported to be at 283.28 million.

Overview of Impax Asset Management Group Plc

Impax Asset Management Group Plc (LON:IPX) provides a varied range of fixed income, listed equities real asset, and smart beta strategies. The company was established in the year 1998.

IPX – Financial Highlights

On 04th June 2020, the company declared an interim result for the six months endings 31st March 2020.

- The company reported £1.8 billion of net inflows in six months endings 31st March 2020, the highest level on record.

- Revenue of the company increased to £41.2 million in H1 FY2020 (H1 2019: £33.8 million) and Adjusted operating profit improved to £10.5 million in H1 FY2020 (H1 2019: £7.7 million).

- The cash reserves were reported at £19.9 million in H1 FY2020 (H1 2019: £14.9 million).

- The company reported a total of 5.0 million options outstanding as at 31st March 2020, out of which 2.5 million were exercisable.

- The company’s adjusted earnings per share increased to 6.3 pence in the first half-year of 2020 (H1 2019: 4.4 pence).

- The company's shareholder's equity improved to £63.2 million in the first half of 2020 (H1 2019 £54.6 million).

- As at 31st March 2020, Asset Under Management (AUM) were reported at £14.4 billion, and as at 30th April 2020, the Asset Under Management was reported at £15.8 billion.

- The Interim dividend of the company improved to 1.8 pence during the H1 2020 (H1 2019: 1.5 pence per share).

IPX – Share Price Performance

(Source: Thomson Reuters)

On 05th June 2020 as at 01:20 PM GMT, the stock price of Impax Asset Management Group Plc is trading at GBX 384.0, higher by 3.78 per cent, as compared to the previous closing price of GBX 370.0. The shares outstanding of the company have been reported to be at 130.42 million.