Atalaya Mining Plc

Atalaya Mining Plc (LON:ATYM) is the London alternative investment market and, Toronto Stock Exchange-listed mining and development company which creates silver and copper concentrates from Proyecto Riotinto site in southwest Spain. The company has entered equity participation exercise with an option to acquire 80 per cent of copper producer Proyecto Touro.

Financial Highlights

On 21st November 2019, the company announced its third-quarter as well as nine-month financial report for the period ended 30th September 2019 through a press release.

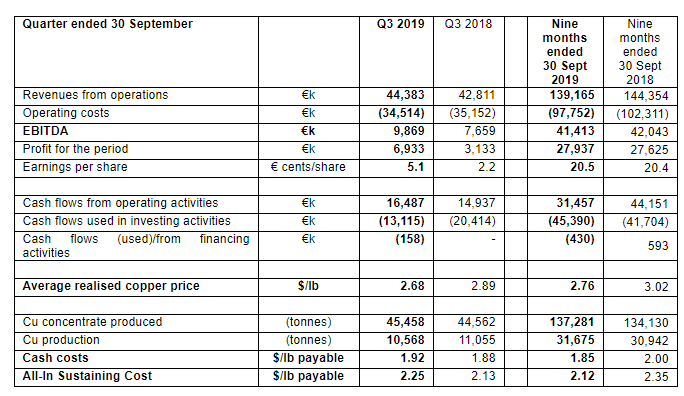

The companyâs revenue from operation decreased by 3.6% to â¬139.2 million in the nine months of FY2019 as compared to â¬144.4 million in nine months of FY2018. However, the companyâs revenue from operation increased by 3.7% to â¬44.4 million in the third quarter of FY2019 as compared to â¬42.8 million in the third quarter of FY2018.

The companyâs EBITDA decreased by 1.42% to â¬41.4 million in the nine months of FY2019 as compared to â¬42.0 million in nine months of FY2018. The companyâs EBITDA improved by 28.8% to â¬9.87 million in the Q3 of FY2019 in contrast to â¬7.66 million in the Q3 of FY2018.

The companyâs profit for the period increased to â¬27.9 million in the nine months of FY2019 as compared to â¬27.6 million in nine months of FY2018. The profit strengthened to â¬6.9 million in the Q3 of FY2019 as against â¬3.1 million in the Q3 of FY2018.

The companyâs earnings per share increased to 20.5 ⬠cents in nine months of FY2019 as compared to 20.4 ⬠cents in nine months of FY2018. The earnings per share rose to 5.1 ⬠cents in the Q3 of FY2019 in contrast to 2.2 ⬠cents in the Q3 of FY2018.

(Sources: LSE)Â

Share Price Performance

On 16th December 2019, at 08:31 AM GMT, while writing, ATYM share price was reported to be trading at GBX 190.0 per share on the LSE, a decrease of 0.52 per cent or GBX 1.00 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 191.00 per share.

On 19th February 2019, the shares of ATYM were at GBX 245.00, which was highest, and they reached to GBX 182.00 on 12th December 2019 which was lowest in the last 52 weeks. The present share price was down by 22.4 per cent from the 52-week high price, whereas it was up by 4.4 per cent from the 52-week low price.

The companyâs market capitalisation was reportedly valued to be at GBP 258.9 million as per the shareâs current market price. The stock outstanding of the ATYM share has been reported to be at 137.34 million, and the free float has been at 37.24 million.

The beta of the ATYM share was reported to be at -0.1402. It means that the companyâs share price movement is inversely correlated in its trend, as compared to the benchmark market indexâs movement.

AB Dynamics Plc

AB Dynamics Plc (LON:ABDP) is a holding company which provides integrated test systems for the international locomotive industry. Founded in 1982, presently the most significant 25 vehicle producers in the world believe in its test equipment, and it is their trusted suppliers of the test system for automotive. In UK facility, the company designs and manufacture specialised systems for chassis, steering system development and suspension; expansion of the new generation of the improved safety system in the vehicles; Noise, Vibration & Harshness testing of powertrain assemblies and driverless car technology, etc.

News Update

On 11th December 2019, the company announced about the exercise of options was held by employees in respect of a total of 31,970 new shares of 1pence each.

On 5th December 2019, the company announced that it granted options for more than 60,000 new ordinary shares of 1pence each to Sarah Matthews-DeMers who joined as a chief financial officer on 4th November 2019. Additionally, 60,000 options of new ordinary shares of 1pence each were granted to Matthew Hubbard, who is Chief Technology Officer.

Financial Highlights

On 27th November 2019, the company announced its final financial results for the period ended 31st August 2019.

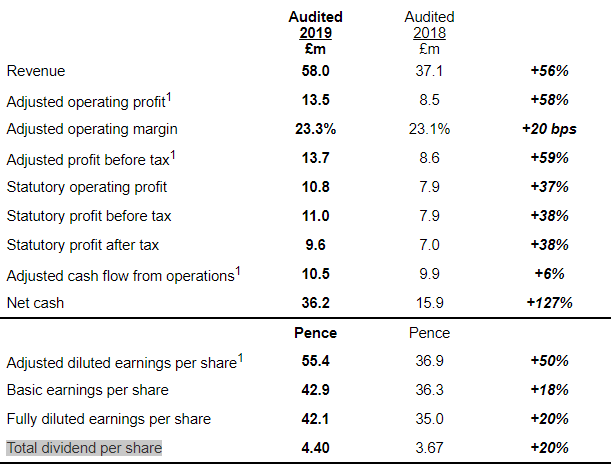

The companyâs revenue increased by 56.3% to £58.0 million in FY2019 as compared to £37.1 million in FY2018.

The companyâs adjusted operating profit increased by 58.8% to £13.5 million in FY2019 as compared to £8.5 million in FY2018. The statutory operating profit increased by 36.7% to £10.8 million in FY2019 as compared to £7.9 million in FY2018. The adjusted operating profit margin increased by 20 bps to 23.3% in FY2019 as compared to 23.1% in FY2018.

The companyâs adjusted profit before tax increased by 59.3% to £13.7 million in FY2019 as compared to £8.6 million in FY2018. The statutory profit before tax increased by 39.2% to £11.0 million in FY2019 as compared to £7.9 million in FY2018.

The companyâs earnings per share increased to 42.9 pence in FY2019 as compared to 36.3 pence in FY2018. The adjusted diluted earnings per share increased to 55.4 pence in FY2019 as compared to 36.9 pence in FY2018. The total dividend per share increased to 4.40 per share in FY2019 as compared to 3.67 per share in FY2018.

(Sources: LSE)

Share Price Performance

On 16th December 2019, at 08:31 AM GMT, while writing, ABDP share price was reported to be trading at GBX 2,290.00 per share on the LSE, an increase of 1.78 per cent or GBX 40.00 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 2250.0 per share.

On 26th November 2019, the shares of ABDP were at GBX 2850.00, which was the highest and it reached to GBX 1378.0 on 28th December 2018 which was the lowest in the last 52 weeks range. The present share price was down by 19.64 per cent from the 52-week highest price, whereas it was up by 66.18 per cent from the 52-week lowest price.

The companyâs market capitalisation was reportedly valued to be at GBP 504.44 million as per the shareâs current market price. The stock outstanding of the ABDP share has been reported to be at 22.42 million, and the free float has been said to be at 13.53 million.

The beta of the ABDP share was reported to be at 0.88. It means that the companyâs share price movement is less volatile in its trend, as compared to the benchmark market indexâs movement.

Vp Plc

Vp Plc (LON: VP.) is a professional rental business which was founded in 1954. The company aims to provide profit maximisation to stockholders by delivering facilities and products to a various spectrum of end markets including housebuilding, construction infrastructure, and oil & gas in the UK as well as overseas.

Financial Highlights

On 04th December 2019, the company announced its interim financial report for the six months period ended 30th September 2019 through a press release.

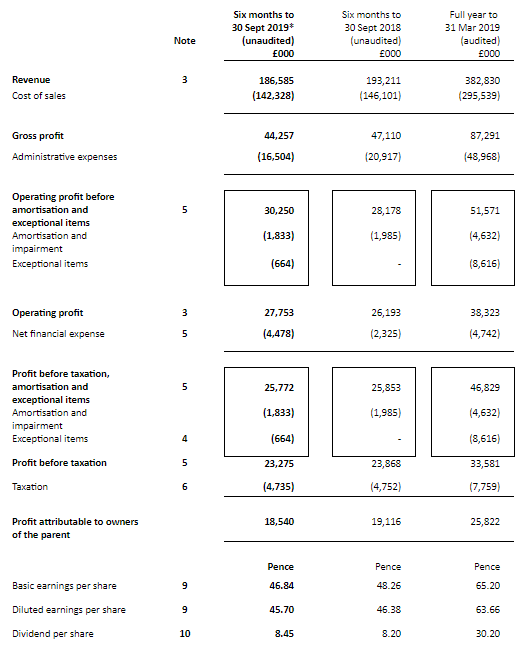

The companyâs revenue decreased by 3.4% to £186.6 million in H1 FY2020 as compared to £193.2 million in H1 FY2019.

The companyâs gross profit decreased by 5.9% to £44.3 million in H1 FY2020 as compared to £47.1 million in H1 FY2019. The operating profit increased by 6.1% to £27.8 million in H1 FY2020 as compared to £26.2 million in H1 FY2019.

The companyâs earnings per share decreased to 46.8 pence in H1 FY2020 as compared to 48.3 pence in H1 FY2019. In contrast, the diluted earnings per share dropped to 45.7 pence in H1 FY2020 as compared to 46.38 pence in H1 FY2019. The total dividend per share increased to 8.45 per share in H1 FY2020 as compared to 8.20 per share in H1 FY2019.

(Source: LSE)

Share Price Performance

On 16th December 2019, at 08:18 GMT, while writing, VP share price was reported to be trading at GBX 975.00 per share on the LSE, an increase of 7.14 per cent or GBX 65.0 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 910.0 per share.

On 03rd April 2019, the shares of VP were at GBX 1060.00, which was the highest and it reached to GBX 679.81 on 08th May 2019, which was the lowest in the last 52 weeks range. The present share price was down by 8.01 per cent from the 52-week highest price, whereas it was up by 43.42 per cent from the 52-week lowest price.

The companyâs market capitalisation was reportedly valued to be at GBP 365.40 million as per the shareâs current market price. The stock outstanding of the VP share has been reported to be at 40.15 million, and the free float has been said to be at 17.35 million.

The beta of the VP share was reported to be at 0.24. It means that the companyâs share price movement is less volatile in its trend, as compared to the benchmark market indexâs movement.