Highlights

- Ether or ETH is the token of Ethereum’s ecosystem, where blockchain developers can build new decentralised solutions

- Australia’s central bank has confirmed the use of Ethereum’s private chain in the country’s pilot CBDC project

- ETH tokens are also used for speculative trading, and they are listed on cryptocurrency exchanges like Binance

What is it that almost always keeps cryptocurrency enthusiasts on edge? It is the debate around the real-world utility of any asset, be it the biggest cryptocurrency, Bitcoin (BTC), or major altcoins like Ether (ETH) and Dogecoin (DOGE). Even though the term 'cryptocurrency' suggests use of these assets as currency or money, things are not favourable at the moment. This is also why regulators like the Australian Taxation Office (ATO) prefer the term cryptoasset, not cryptocurrency.

Bitcoin -- launched in 2009 alongside a supporting white paper by Satoshi Nakamoto -- was presented as ‘electronic cash’. The idea and expectation were to have a currency without any role of central banks. Ether, which is linked to blockchain service provider Ethereum, was not launched with identical expectations. Is Ether a Bitcoin competitor? How does their utility differ? Let us explore.

What is Ether used for?

Ether can be seen as the perfect example of a ‘native token’, a token confined to a particular ecosystem where it is used as a medium of exchange. Such a medium of exchange, however, should not be confused with money issued by a sovereign authority. The latter has wide use, just as the Australian dollar is Australia’s most readily accepted form of payment. One can say that even a specific country can be termed an ecosystem with millions of merchants and customers. By this measure, Ether can be understood as ‘money’ within Ethereum’s ecosystem.

However, the purchasing power of Ether is limited only to the services that Ethereum provides. For example, when a developer uses its blockchain network to build a decentralised app, a new ERC-20 token, or record a non-fungible token (NFT) transaction, Ether tokens are used to pay the network fee. This means Ether is Ethereum’s money, but not in a way the US dollar or the Australian dollar is.

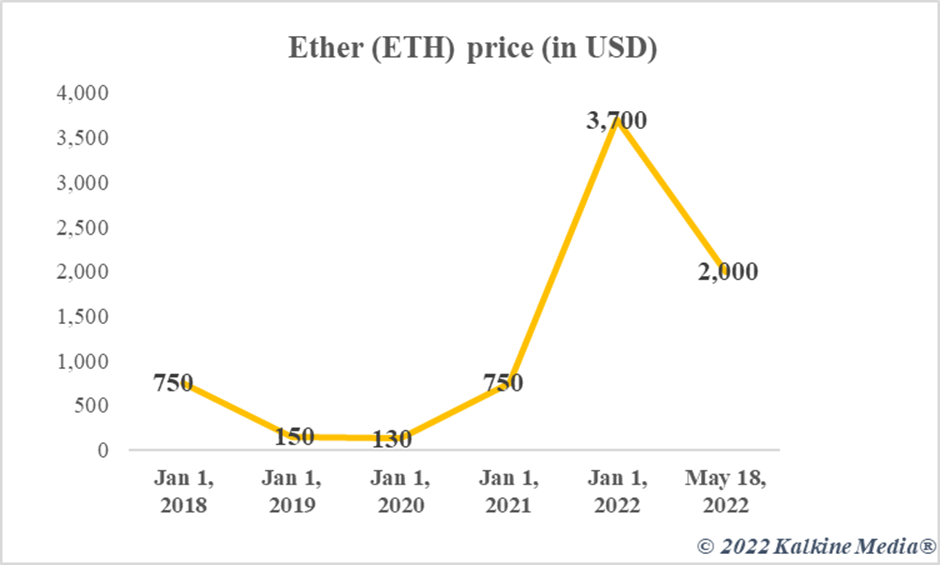

Data provided by CoinMarketCap.com

Is Bitcoin’s use comparable with Ether’s?

The answer is no. Bitcoin also has its blockchain network, but services like those provided by Ethereum’s blockchain are unavailable. Instead, Bitcoin, now legal tender in a few countries, wants to replace fiat currencies, although it is not looked upon favourably by most countries and their regulatory authorities. Bitcoin and Ether could be said to be comparable only because both are traded as speculative assets on dedicated crypto exchanges. But the utility of both these blockchain-based assets is not comparable.

Bottom line

Ether is used as ‘money’ within Ethereum, but it cannot be compared with legal tender like the US dollar. Ether tokens have a separate use case from Bitcoin. This also means that for Ether cryptocurrency to sustain, Ethereum’s ecosystem has to shine in the long run. From NFTs to ERC 20 tokens, things that Ethereum supports have had a subdued run in 2022.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.

.jpg)