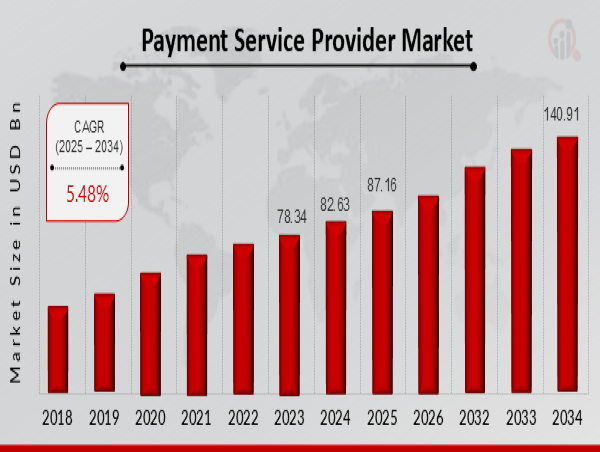

The Payment Service Provider (PSP) market has experienced significant growth in recent years as the demand for fast, secure, and convenient payment solutions continues to rise globally. With the increasing penetration of smartphones, digital wallets, and e-commerce platforms, payment service providers play a critical role in bridging the gap between merchants and consumers. Businesses across industries—from retail and hospitality to healthcare and education—are adopting PSPs to streamline their payment processes and enhance customer satisfaction. This market is driven by the surge in online transactions, the growing popularity of cashless payment systems, and the rapid evolution of financial technology (FinTech). As businesses aim to offer seamless checkout experiences and reduce operational costs, payment service providers are emerging as vital partners in their digital transformation journeys.

Get Exclusive Sample of the Research Report at -

https://www.marketresearchfuture.com/sample_request/36491

The market segmentation of the Payment Service Provider industry offers insight into its diverse landscape. By component, the market is divided into solutions and services. The solutions segment includes payment gateways, POS solutions, mobile payment applications, and recurring billing systems, while services encompass consulting, integration, and support. By payment method, the market is categorized into credit/debit cards, e-wallets, bank transfers, and cryptocurrencies. Each payment method appeals to different demographics and use cases, contributing to the market’s multifaceted nature. By enterprise size, the market is bifurcated into small & medium-sized enterprises (SMEs) and large enterprises. SMEs, in particular, are rapidly adopting PSPs to reduce barriers to market entry and to gain access to wider audiences. By end-user industry, key verticals include retail and e-commerce, BFSI (banking, financial services, and insurance), travel and hospitality, healthcare, and government. These segments reflect the broad applicability of PSPs in managing secure and efficient payment processing across various operational models.

The market dynamics of the Payment Service Provider industry are shaped by a blend of drivers, challenges, opportunities, and trends. One of the primary growth drivers is the global shift toward digital and contactless payments, accelerated by the COVID-19 pandemic. Consumers are increasingly expecting fast, convenient, and secure payment options, pushing businesses to upgrade their systems. Another driver is the surge in cross-border e-commerce, which necessitates multi-currency and real-time settlement capabilities. However, challenges remain, including concerns over data privacy, fraud, regulatory compliance, and the high cost of implementation for smaller businesses. Additionally, the complex and fragmented regulatory landscape across different regions can hinder seamless operations for global providers. On the flip side, emerging markets present significant opportunities for PSPs, especially in underbanked regions where mobile payments and digital wallets can leapfrog traditional banking. Also, advancements in blockchain, artificial intelligence, and biometric authentication are opening new frontiers for innovation and value-added services within the industry.

Buy this Premium Research Report at -

https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=36491

Recent developments in the Payment Service Provider market underscore its dynamic and fast-paced nature. Several leading companies have made strategic acquisitions to enhance their service offerings or enter new markets. For instance, Stripe expanded into the Middle East through partnerships and investment in local infrastructure. Similarly, PayPal introduced new features, such as cryptocurrency trading and “buy now, pay later” services, to broaden its user base. Many PSPs are also prioritizing ESG (Environmental, Social, and Governance) initiatives by developing green payment technologies and promoting financial inclusion. Technological advancements, particularly in machine learning and real-time fraud detection, are being rapidly integrated into PSP platforms to enhance security and reduce operational risks. Regulatory bodies across Europe, Asia-Pacific, and North America have also introduced updated compliance standards such as PSD2 (Revised Payment Services Directive) and open banking protocols, influencing how PSPs structure their services and partnerships.

In terms of regional analysis, the Payment Service Provider market is gaining momentum across all major regions, with some variations in growth drivers and adoption patterns. North America leads the market, driven by high digital literacy, advanced payment infrastructure, and a strong presence of global tech companies. The United States and Canada have seen widespread adoption of mobile wallets and contactless payments, with fintech innovations flourishing in urban centers. Europe follows closely, bolstered by regulatory frameworks like PSD2 that promote transparency and competition in the financial sector. The region’s preference for secure and compliant systems makes it a lucrative market for established PSPs. In the Asia-Pacific, countries such as China, India, and Southeast Asian nations are witnessing exponential growth due to the rising use of smartphones and government-backed initiatives to promote digital payments. China's Alipay and WeChat Pay, for example, dominate the local market, while new entrants in India like PhonePe and Razorpay are capturing significant market share. In Latin America and the Middle East & Africa, improving internet penetration, favorable demographics, and evolving regulatory environments are contributing to a surge in digital transactions and PSP adoption, particularly in metropolitan and urban areas.

Browse In-depth Market Research Report -

https://www.marketresearchfuture.com/reports/payment-service-provider-market-36491

Key Companies in the Payment Service Provider Market Include

• PayPal

• Payoneer

• Visa

• Braintree

• Stripe

• Venmo

• Adyen

• Skrill

• American Express

• Authorize.Net

• Revolut

• Worldpay

• Alipay

• Mastercard

• Square

The Payment Service Provider market is poised for substantial growth in the coming years, driven by digital transformation, evolving consumer expectations, and technological innovation. As businesses and consumers alike continue to embrace the convenience and efficiency of digital transactions, PSPs will remain central to the evolution of global commerce. With opportunities abounding in both developed and emerging economies, and continuous advancements in AI, security, and user experience, the future of payment service providers looks increasingly promising and transformative for the global financial ecosystem

Explore MRFR’s Related Ongoing Coverage In ICT Domain -

Field Effect General Purpose Transistor Market -

https://www.marketresearchfuture.com/reports/field-effect-general-purpose-transistor-market-35783

Gaas Photodiode Market -

https://www.marketresearchfuture.com/reports/gaas-photodiode-market-35795

Electronic Shift Operations Management Solution Market -

https://www.marketresearchfuture.com/reports/electronic-shift-operations-management-solution-market-35858

Email Hosting Service Market

Customer Revenue Optimization Software Market

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Contact US:

Market Research Future

(Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: [email protected]

Website: https://www.marketresearchfuture.com

Website: https://www.wiseguyreports.com/

Website: https://www.wantstats.com/

Sagar Kadam

Market Research Future

+ +1 628-258-0071

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()