Highlights

- Coveo Solutions Inc, a Canadian software company, is drawing quite a bit of attention in the stock markets.

- Headquartered in Montreal, Quebec, it is known to provide an artificial intelligence (AI)-powered platform that helps enterprises enhance the digital experience for customers and employees.

- The software company is set to release its financial results for the third quarter of fiscal 2022 after market close on Monday, February 7, for the first time as a publicly listed company,

Coveo Solutions Inc, a Canadian software company, is drawing quite a bit of attention in the stock markets.

Headquartered in Montreal, Quebec, it is known to provide an artificial intelligence (AI)-powered platform that helps enterprises enhance the digital experience for customers and employees.

The tech player went public in November 2021, having raised C$ 215 million in gross proceeds in its initial public offerings (IPO).

Let us learn more about this newcomer software technology company.

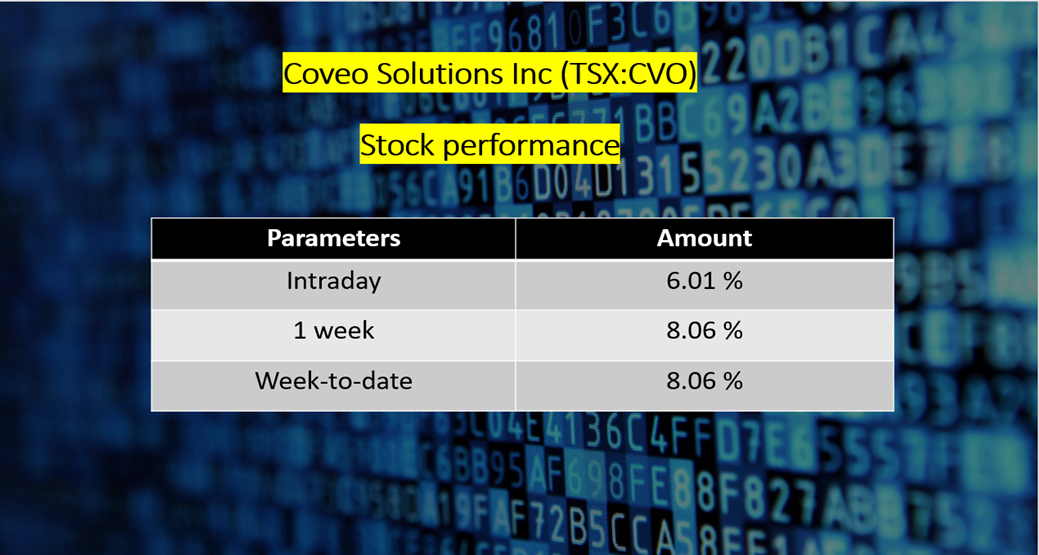

Coveo (TSX:CVO) stock performance

Coveo Solutions, as a Software-as-a-Service platform, offers personalized services, recommendations, and searches to boost businesses' overall productivity.

On December 8, the Canadian technology company integrated with SAP Commerce Cloud to improve the buying experience for SAP customers, thereby supporting e-commerce businesses.

Also read: BMO & RBC (RY): 2 TSX dividend stocks that can boost your passive income

Coveo stock shot up by about six per cent to close at a value of C$ 10.05 apiece on Friday, February 4, after clocking a day high of C$ 10.21.

Stocks of Coveo has increased by over 13 per cent from its 52-week low of C$ 8.88 (January 24).

The software tech stock swelled by approximately eight per cent week-to-date (WTD).

Image source: © 2022 Kalkine Media®

Why is Coveo (TSX:CVO) stock drawing investors' attention?

The software company is set to release its financial results for the third quarter of fiscal 2022 after market close on Monday, February 7.

This would be the first time it reports its earnings since becoming a public company, which could be a reason behind increasing investor interest.

Bottomline

Florida, US-based Retail Systems Research and Coveo Solutions, on January 26, said that 98 per cent of retail executives are using or planning to leverage AI and machine learnings in the next one and half years.

If these findings bear fruit in the future, it could bolster business performance for firms like Coveo.

Also read: Saputo (SAP) & Loblaw (L): 2 TSX stocks for you as milk prices rise