Source: ESB Professional, Shutterstock

Multinational tech giant Microsoft Corp (MSFT:US or NASDAQ: MSFT) is in talks to acquire artificial intelligence (AI) specialized company Nuance Communications Inc. (NUAN:US or NASDAQ: NUAN) in a US$ 16-billion deal.

The expected share price for Nuance could be around US$ 56 apiece, against its current price of US$ 45.58, representing an acquisition premium of around 23 per cent. Media reports suggest that the full-fledged deal could be announced on April 12.

If successful, this acquisition will be the second-biggest purchase of Microsoft, after the US$ 26.2-billion LinkedIn deal in 2016.

The US-based conversational AI solutions provider Nuance is known for its collaboration with Apple Inc to launch voice support assistant ‘Siri’. The company also develops software for multiple sectors such as automotive and healthcare enterprises. It earns its maximum revenue from the healthcare division.

Let us check out both software stocks’ performances:

Nuance Communications Inc. (NUAN:US or NASDAQ: NUAN)

The company offers its services to approximately ten thousand healthcare organizations globally and 80 per cent of radiologists in the US. Its current market cap is US$ 13 billion.

The AI stock has grown over 168 per cent in the past one year due to growing demand of healthcare-related solutions. It achieved a record price of US$ 51.62 per share on February 08, 2021. Currently, it is trading approximately 12 per cent down from its all-time high.

However, it has slightly increased by 3.40 per cent this year.

Nuance Communications' One-Year Stock Performance Chart. (Source: Refinitiv)

In the first fiscal quarter of 2021, its healthcare cloud revenue surged by 28 per cent year-over-year (YoY). Its top line was US$ 345.8 million, and earnings per share stood at US$ 0.02 in Q1 FY21.

It held US$ 374 million in cash balance as of December 31, 2021. Its operating cash flow also rose to US$ 54.6 million in Q1 FY21 against US$ 44.7 million in Q1 FY20.

Image Source: Pixabay.com

Microsoft Corp (MSFT:US or NASDAQ: MSFT)

The Windows operating systems manufacturer’s current stock price is US$ 255.85. Its market cap is inches away from the US$ 2-trillion mark.

The company’s shares are trading at an all-time high and could be sweetened further if it cracks Nuance deal. The stock is up by 55 per cent in one year and has delivered 15 per cent returns year-to-date (YTD).

The large-cap tech firm is distributing a quarterly dividend of US$ 0.56 per share for the current quarter.

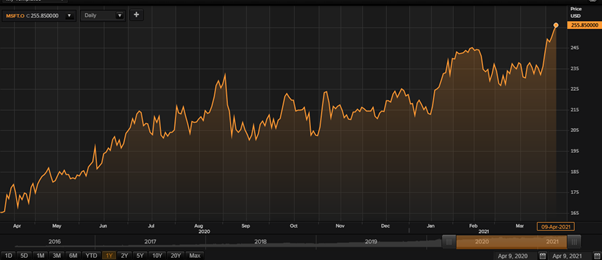

Microsoft's One-Year Stock Performance Chart. (Source: Refinitiv)

The company’s revenue amounted to US$ 43.1 billion in Q2 FY21, a rise of 17 per cent YoY. Its quarterly profit was US$ 15.5 billion, a surge of 33 per cent YoY. It delivered diluted earnings per share of US$ 2.03 in Q2 FY21, an increase of 34 per cent YoY.

.jpg)