Highlights

- TECSYS said that its total revenue amounted to C$ 34.2 million in Q1 FY2023, higher than C$ 33.23 million in Q1 FY022

- Dye & Durham saw a double-digit surge of 78 per cent in its top line to C$ 122.9 million in Q3 FY2022 compared to Q3 2021

- Descartes reported revenues of US$ 123 million in Q2 FY2023, denoting a year-over-year increase of 18 per cent

Canadians with a growth-oriented investment approach can consider quality TSX-listed technology stocks like TECSYS (TSX: TCS), Enghouse Systems (TSX: ENGH), Dye & Durham (TSX: DND), etc.

Technology stocks have been under pressure over economic concerns like the Ukraine crisis, mounting inflationary pressure, and interest rate hikes. However, investors looking beyond the near-term environment might still find tech stocks interesting as these companies grow faster than the overall market. The reason behind this growth could be a disruptive technology, competitive edge, unique business model, and many such factors.

Hence, despite the current economic headwinds, long-term investors can explore solid technology stocks that could offer substantial capital gains in the future. Kalkine Media® has picked some TSX tech stocks that growth investors can assess and evaluate right now for future gains:

1. TECSYS Inc (TSX:TCS)

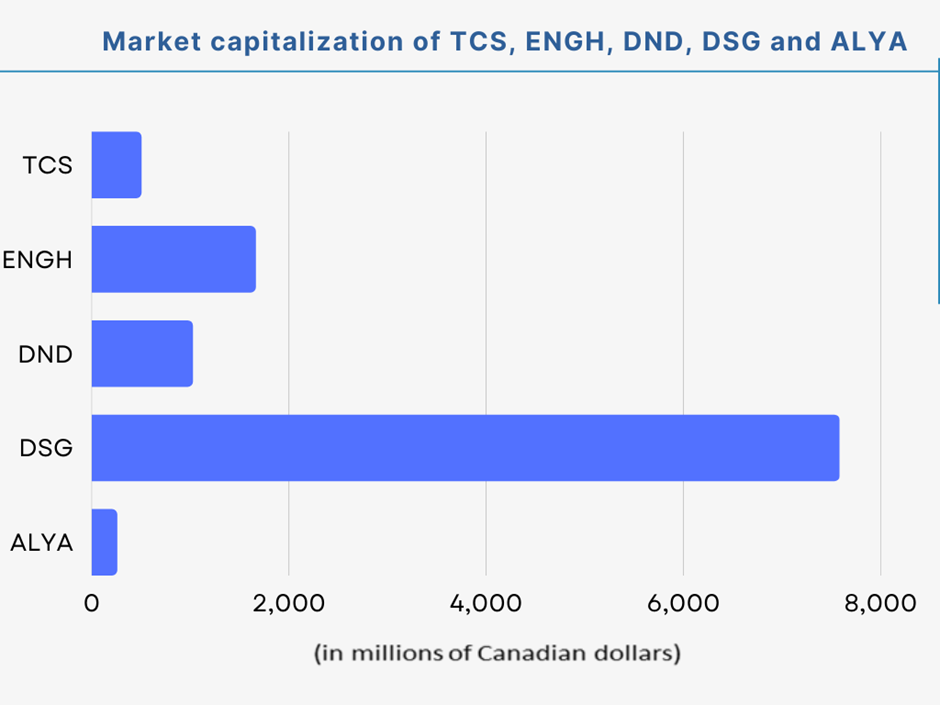

TECSYS is a C$ 498.77 million market capitalization company developing and selling supply chain management solutions for business enterprises to streamline distribution, storage, transport, logistics, and other tech-driven support services. The small-cap tech firm reported a year-over-year (YoY) rise of 42 per cent in its Software-as-a-Service (SaaS) revenue to C$ 8 million in the first quarter of FY2023. TECSYS highlighted that its SaaS subscription booking grew by 256 per cent to C$ 3.9 million in the first quarter of this fiscal year.

TECSYS said its total revenue amounted to C$ 34.2 million in the latest quarter, higher than C$ 33.23 million in the first quarter of the past fiscal year. TECSYS also saw its gross profit jump to C$ 14.75 million in Q1 FY2023 relative to C$ 14.42 million posted in Q1 FY2022.

However, the supply chain solution company incurred higher operating expenses of C$ 14.66 million in the latest quarter (compared to C$ 13.34 million in Q1 FY2022). This led to reduced profit from operations of C$ 0.09 million in Q1 FY2023, lower than C$ 1.08 million posted in the first quarter a year ago. On the other hand, TECSYS announced a quarterly dividend of C$ 0.07, which is said to be paid on October 7.

2. Enghouse Systems Limited (TSX:ENGH)

Enghouse Systems is a C$ 1.82 billion market size firm offering software solutions and services through two operating segments – Interactive Management Group (IMG) and Asset Management Group (AMG). Enghouse reported a top line of C$ 102.11 million in the third quarter of 2022, representing a reduction of 13.2 per cent from C$ 117.64 million posted in Q3 2021. The small-cap software firm saw its basic earnings per share (basic EPS) at C$ 0.33 in the third quarter this year, down from C$ 0.38 reported in the same period of 2021.

Enghouse, however, noted increased cash and cash equivalents (CCE) of C$ 225.94 million at the end of the third quarter of 2022, up from C$ 195.89 million posted on October 31 last year. Enghouse’s Board of Directors (BoD) also approved a quarterly dividend of C$ 0.185, scheduled to be paid on November 30.

3. Dye & Durham Limited (TSX:DND)

Dye & Durham is a Canadian provider of cloud-based solutions headquartered in Toronto. Dye & Durham recently announced that the Australian Competition and Consumer Commission (ACCC) sent a confirmation to Link (ASX:LNK), saying it would not oppose the previously announced acquisition deal between companies. In addition, the Australian company also obtained approval about the same from the Central Bank of Ireland.

The C$ 1.03 billion market cap company posted a double-digit surge of 78 per cent in its top line to C$ 122.9 million in the third quarter of FY2022 compared to Q3 2021. Moreover, Dye & Durham also distributes dividends every quarter.

©Kalkine Media®; ©Garis Studio via Canva.com

©Kalkine Media®; ©Garis Studio via Canva.com

4. Descartes Systems Group Inc (TSX: DSG)

Descartes Systems is a C$ 7.48 billion market capitalization company enabling interaction within the shipping industry through its software solutions. Descartes reported revenue of US$ 123 million in Q2 FY2023, denoting an increase of 18 per cent from US$ 104.6 million in the second quarter of the last fiscal year. Descartes added that quarterly revenue included services revenues of US$ 109.4 million, a 17 per cent jump from US$ 93.5 million in the same period a year ago. It also comprised professional services and other revenues, which amounted to US$ 10.3 million, and license revenues of US$ 3.3 million in Q2 FY2023.

Descartes Systems Group saw its gross margin increase to 77 per cent in the latest quarter, higher than 76 per cent in Q2 2022. However, the mid-cap tech company noted a net profit decrease of US$ 22.9 million in the second quarter of this fiscal year compared to US$ 23.1 million in the Q2 FY2022.

5. Alithya Group Inc (TSX:ALYA)

Alithya Group is a C$ 252.85 million market capitalization firm offering integrated strategy and digital transformation solutions. Alithya saw its revenue swell by 23.2 per cent to C$ 126.76 million in Q1 FY2023 compared to C$ 102.92 million in the same period a year ago. Alithya Group also noted a gross margin of 26.9 per cent in the latest quarter, down from 27.5 per cent in Q1 FY2022.

Geographically, the penny cap company saw revenue from Canada grow by 13.3 per cent to C$ 78.2 million in Q1 2023, compared to C$ 69 million in Q1 2022. Revenue from the US climbed 44.3 per cent to C$ 44.6 million in the latest quarter, compared to C$ 30.9 million in the same period a year earlier. International revenue also improved by 32.7 per cent YoY to C$ 3.9 million in the first quarter of this fiscal year.

Bottom line

Though the near-term environment may continue to be uncertain, quality technology stocks could still be an option to explore if one is looking for a significant return in the long term. Apart from growth exposure, income investors can also explore the TSX stocks discussed here, as some pay dividends.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.