Highlights

- BB stock shot up by over four per cent to C$ 7.67 at 10:53 AM EST on July 6

- BlackBerry’s IoT revenue surged by 19 per cent year-over-year in Q1 FY2023

- BB scrip zoomed by about eight per cent quarter-to-date

Stocks of BlackBerry Limited (TSX: BB) shot up by over four per cent to C$ 7.67 at 10:53 AM EST on Wednesday, July 6, after the Canadian software company announced that CARIAD selected BlackBerry® QNX® technology as a component of its software platform.

BlackBerry said it would license its QNX tech, including QNX® OS, to CARIAD.

CARIAD is a Volkswagen Group company engaged in developing a unified software platform comprising VW.OS, VW.AC (cloud) and end-to-end architecture under the Group’s NEW AUTO strategy.

With this development, let us look at BlackBerry’s detail.

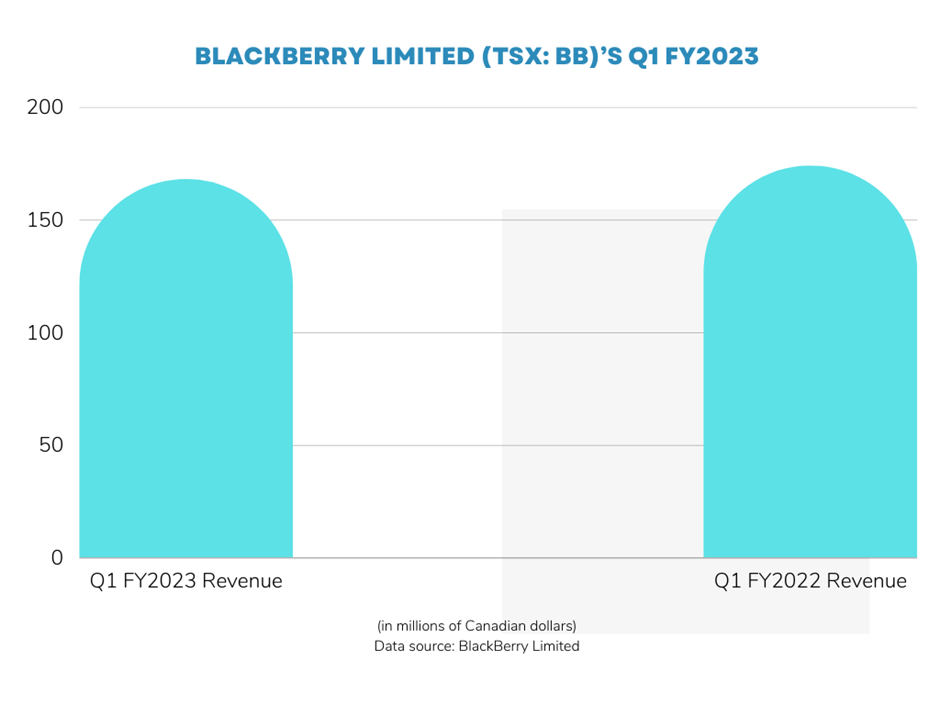

BlackBerry Limited (TSX:BB)’s Q1 FY2022

BlackBerry said that IoT (Internet of Things) revenue surged by 19 per cent year-over-year (YoY) to US$ 51 million in Q1 FY2023. The mid-cap company reported a nine per cent growth in software and services revenue in the latest quarter compared to Q1 2022. Cybersecurity revenue also swelled by six per cent in Q1 2023 compared to Q1 2022.

BlackBerry posted consolidated revenue of US$ 168 million in the first quarter of fiscal 2023 compared to US$ 174 million a year ago, mainly due to lower licensing and other revenue, which amounted to US$ 4 million in the latest quarter compared to C$ 24 million in Q1 FY2022.

©Kalkine Media®; ©Garis Studio via Canva.com

BlackBerry’s stock performance

BB scrip zoomed by about eight per cent quarter-to-date (QTD). However, this technology scrip was still down by over 51 per cent from a 52-week high of C$ 15.45 (July 6, 2021).

According to Refinitiv, BlackBerry’s Moving Average Convergence/ Divergence (MACD) indicator was nearing but below the zero line, with a Relative Strength Index (RSI) of 55.27 as of writing on July 6, with volume in green.

Bottomline

This agreement with CARIAD marks another step BlackBerry took in expanding its advanced driver assistance system (ADAS) footprints in the automobile industry. Also, the TSX information technology index was up by almost four per cent QTD. Hence, investors could consider this TSX tech stock for the long term.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.