Summary

- The S&P/TSX Venture Information Technology Index is up 47+ per cent year-to-date.

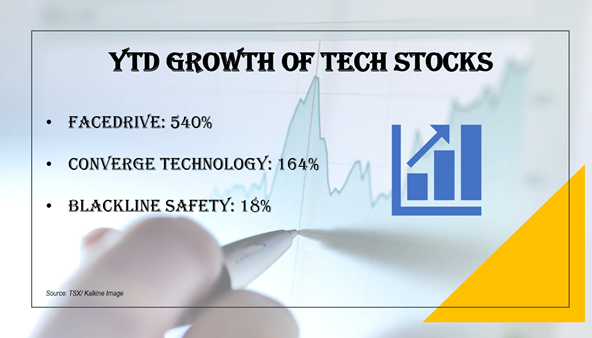

- Facedrive, Converge Technology Solutions and Blackline Safety Corp are three tech stocks that have fared well this year.

- Facedrive and Converge Technology stocks have surged by over 540 per cent and 164 per cent, respectively, this year.

- Blackline stocks are up almost 27 per cent in the last six months.

The Toronto Stock Exchange Venture (TSXV), the ground zero for small and micro-cap organizations trying to prove their mettle in the equity world, has been on an upswing this year. The benchmark index of the junior Canadian market has gained 33 per cent this year. Tech companies constitute 7.3 per cent of the 33.20 of this broad market indicator. The S&P/TSX Venture Information Technology Index is up 47.60 per cent year-to-date, indicating positive momentum in small and micro tech firms.

In this article, we look at three rising tech stars on the TSXV: Facedrive Inc, Converge Technology Solutions and Blackline Safety Corp.

Facedrive Inc (TSXV:FD)

Stocks of ridesharing company Facedrive have skyrocketed by over 540 per cent this year and remained pretty much unscratched by the worldwide pandemic disaster. The C$ 1.3-billion company has various segments such as Facedrive Rideshare that offers “green transportation solutions”, e-commerce platform Facedrive Marketplace, food delivering Facedrive Foods and Facedrive Health.

Facedrive’s revenue in the third quarter of 2020 (ending September 30, 2020) was C$ 0.26 million, up from C$ 0.19 million a year ago. However, the net loss marginally reduced to C$ 3.524 million in Q3 from C$ 3.527 million in the same quarter a year ago. The company had C$ 7.36 million cash and cash equivalents in hand at the end of September 30, 2020.

The stock holds a current price-to-book (P/B) ratio of 79 and is among the top tech companies across the TSX and the TSXV that are outperforming their peers.

Converge Technology Solutions (TSXV:CTS)

Stocks of the IT infrastructure firm shot up by 3.6 per cent in a day after it announced the acquisition of Workgroup Connections, a cloud-based technology solutions company, on December 2.

Converge Technology scrips are up by 164 per cent this year. Its current market cap is C$ 471 million.

The small cap stock holds a P/B ratio of 10.57, price-to-cash flow ratio of 3.6 and debt-to-equity of 2.39, as per data on the TMX portal.

In November, the company received the conditional approval to graduate to the Toronto Stock Exchange. Following the final approval, which is subject to terms and conditions, Converge Technology will start trading on the TSX from February 2021.

The company is primarily a North American IT solution and services provider of analytics, cloud products, cybersecurity, etc.

The tech firm’s third-quarter (ending September 30, 2020) revenue increased by 31 per cent year-over-year (YoY) to C$ 189.9 million, while gross profit surged 50 per cent YoY to C$ 52.4 million.

Blackline Safety Corp. (TSXV:HIVE)

Canada-based Blackline Safety Corp is a safety technology company. It deals in products and services that protect people and property through its connectivity tech such as wireless and GPS. Some of its products include safety monitoring software, surveillance and asset security, vehicle tracking and so on.

Blackline stocks are up nearly 18 per cent year-to-date. In the last six months, the scrips have advanced by almost 27 per cent. Its current P/B ratio is 11.4.

The C$ 352-million safety tech company’s operations exist across Canada, the US, Europe and Australia, and New Zealand.

The company’s revenue was C$ 9.4 million for the quarter ended July 31, 2020, up from C$ 8.1 million the same quarter a year ago. Net loss narrowed down to C$ 1.7 million in its latest quarter, from C$ 2.2 million a year ago.