Summary

- Facedrive stocks saw an annual growth of more than 700 per cent.

- Stocks of Dye & Durham grew by over 230 per cent since they were listed on TSX in July last year.

- Both are growth stocks that investors would want to track.

With new technologies emerging at a breakneck speed, technology stocks can be a great value addition to your portfolio. But given the multitude of technology stocks in the market, it can also present the challenge of what to pick. The bottom line is companies that are embracing the emerging trends, are most likely to stay ahead of the pack, and they can be your multibaggers in the future.

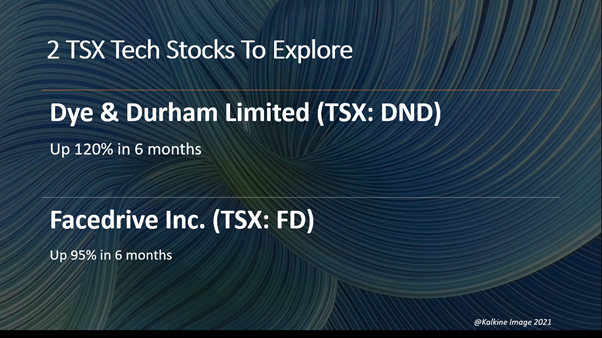

Two Canadian companies, Facedrive Inc. (TSX:FD) and Dye & Durham Limited (TSX:DND), appear to be on a roll after playing on the front foot despite the pandemic.

While the former made ground-breaking changes to their business to rapidly adapt to the pandemic situation, the latter carried out a series of acquisitions in other geographies to bolster their market lead.

Here are some key facts about these two stocks.

Facedrive Inc. (TSX:FD)

This Canadian ridesharing company has been a source of inspiration for others in the industry for their out-of-the-box ideas in the COVID times. Their innovation propelled them to achieve higher.

The company launched the TraceSCAN, an AI power solution that can track COVID exposure. The technology enabled them to continue with their activities without endangering their health.

Its subsidiary, Facedrive Health, is also working on a technology project called Herald that enables Bluetooth communications for sending digital exposure notification.

These technological breakthroughs have raised the bar for others in the industry.

On Thursday, February 11, Facedrive stocks closed at C$39.26 a share.

The stock has outperformed its peers. Its value rose by 120 per cent in the last 30 days and over 250 percent in the last three months.

The annual growth is more than 700 per cent.

The average 10-day and 30-day share volumes were 380,913 and 277,639, respectively.

Facedrive has a market cap of C$3.6 billion.

The company plans to launch Steer, a fast-growing electric vehicle subscription service, in Canada in March. It can prove to be a gamechanger for the company, given that the EV subscription business is expected to grow by US$9.15 billion in 2024.

Dye & Durham Limited (TSX:DND)

This Canadian software company is one of the top price performers in the market, and has been outperforming its peers.

The company provides cloud-based solutions to its various clients. Its systems enhance work processes and company services. It has operations in Canada, the UK, Ireland, and Australia, where it has both private and government clients.

Dye & Durham has recently acquired the Australian company GlobalX for C$166 million to expand its footprint in the country. The acquisition will complement its operations in other geographies such as the UK and Ireland. Before that, it had acquired another Australian firm for C$89 million in cash.

The purchase is expected to help boost its income from the cloud business.

DND shares were priced at C$49.30 during Thursday’s market close. The share value saw a 127 per cent increase in six months and a 237 per cent jump since the stock was listed on TSX in July last year.

The average 10-day and 30-day volumes were 240.016 and 235,895, respectively.

Dye & Durham has a market cap of C$3.1 billion.

The company is expected to release its second-quarter results on February 16, 2021.