Highlights

- Statistics Canada, on Friday, February 18, said that the retail sales in Canada decreased by 1.8 per cent in December 2021.

- The Omicron surge and severe floods in British Columbia disrupted retail business across the country, added the national data agency.

- However, the agency also stated an advance estimate for retail sales in January 2022, which suggested sales growth of 2.4 per cent based on the constantly evolving economic situations.

Statistics Canada, on Friday, February 18, said that retail sales in the country decreased by 1.8 per cent in December 2021. The disruption, it said, was led by the omicron surge and the severe floods in British Columbia.

For the fourth quarter of 2021, however, Canada’s retail sales were up 1.7 per cent, added the national data agency.

StatCan also noted that an advance estimate for retail sales in January 2022 projects a sales growth of 2.4 per cent, based on the constantly evolving economic situations.

Keeping this in mind, let’s explore two major TSX retail stocks.

1. Dollarama Inc (TSX: DOL)

Discount retail stores company Dollarama posted third-quarter sales of C$ 1.12 billion in the fiscal year 2022, representing a year-over-year (YoY) surge of 5.5 per cent.

Stock-wise, Dollarama scrips closed at C$ 64.29 apiece on Friday, up by over six per cent from its 52-week high of C$ 68.65 (February 9). The retail scrip also spiked by over 36 per cent in 12 months.

Also read: Air Canada (AC) triples operating revenues in Q4. A cheap stock to buy?

2. Aritzia Inc (TSX: ATZ)

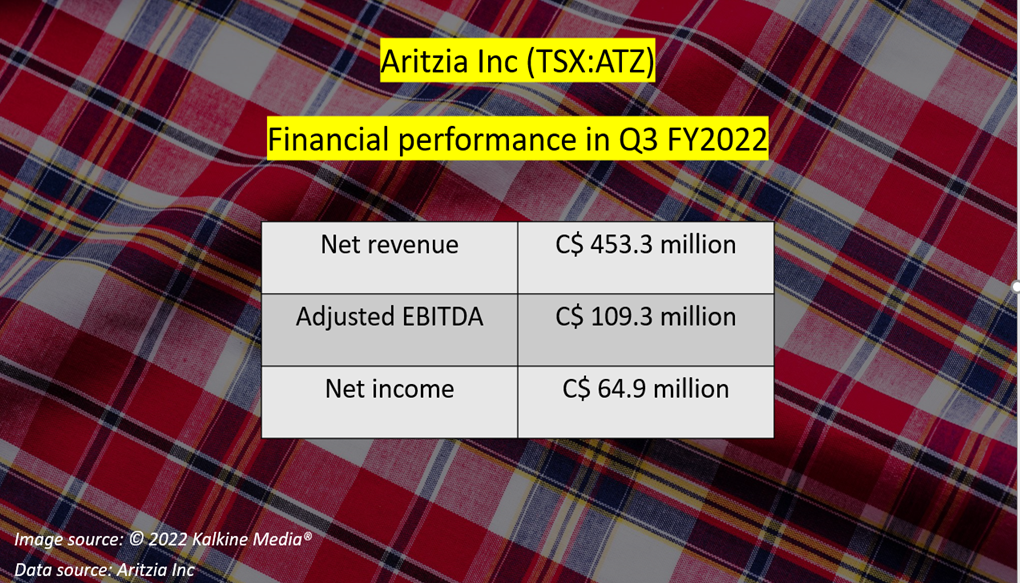

Aritzia Inc saw its net revenue catapult by 62.9 per cent YoY to C$ 453.3 million in Q3 FY2022. The vertically integrated design company has said that it expects its 2022 net revenue to increase by about 65-70 per cent from its 2021 net revenue, which would bring it to about C$ 1.425 billion to C$ 1.45 billion.

Aritzia shares galloped by over 85 per cent in 12 months. The apparel stock closed at C$ 54.16 apiece on Friday.

Bottomline

While posting the latest retail sales figures for, Statistics Canada reported that December 2021 saw retail sales decline in every Canadian province for the first time since the lockdown-inflicted December 2020.

The data agency, however, noted that the country’s retail sales grew for the second straight quarter in Q4 2021. Also, its sales growth projection for January 2022 could also be indicative of retail companies rebounding.

Also read: Barrick Gold (ABX) & Franco (FNV): 2 top TSX gold stocks to watch

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.