Highlights

- Penny stocks have the potential to provide higher returns and people with high-risk capacity could invest in them.

- Canadian penny stocks are worth exploring if investors want to get hold of some good cheap stocks.

- Investments in penny stocks is a risky business so one should research before investing.

Over the years, penny stocks have become popular among investors who want to turn their small investments into significant gains. These stocks were earlier not considered highly, however, a few success stories have increased the number of investors showing interest in them.

As penny stocks are highly volatile, the risk level is substantial when investing in them. However, they also can generate stronger and higher returns in comparison to the midcap and smallcap stocks.

As penny stocks are priced under five dollars, youngsters often take the chance to invest in them with hopes of higher returns. Generally, young people have a high-risk potential as they have time to recover from the losses. On that note, we have shortlisted five penny stocks that could feature in investment portfolios of people aged under 35.

Also read: Top 5 Canadian penny tech stocks to buy

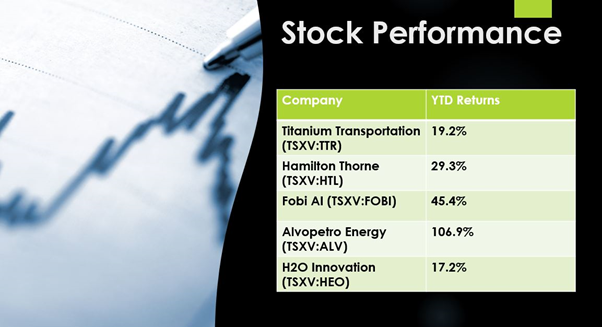

1. Titanium Transportation Group Inc. (TSXV:TTR)

The transportation and the logistic firm provide truckload, cross-border trucking, warehousing, and distribution services among others. As vaccinations are increasing, transport activity is expected to pick up and logistical operations may return to normal soon.

Titanium Transportation has a business presence in the United States and Canada. With a market cap of C$ 130.9 million, the TTR stock pays a quarterly dividend of C$ 0.02 per unit to the shareholders.

In the second quarter of this year, Titanium delivered record revenue for the fourth consecutive quarter. The revenues were C$ 100.8 million, up by 165.6 per cent year-over-year (YoY).

2. Hamilton Thorne Ltd. (TSXV:HTL)

The healthcare company provides instruments, software, consumables, and services that reduce the cost of Assisted Reproductive Technologies (ART). Hamilton Thorne is growing rapidly and in May 2021, it announced the acquisition of Australia-based Tek-Event Pty Ltd.

In Q2 2021, the company announced that its sales increased by 71 per cent YoY to US$ 12.5 million and the net income was US$ 482,000 in comparison to a net loss of US$ 594,000 in Q2 2020.

At market close on Thursday, September 30, the HTL stock was priced at C$ 1.81 apiece.

3. Fobi AI Inc. (TSXV:FOBI)

The Vancouver-based company's business operations are based on the rapidly involving technology of artificial intelligence. Fobi's platform uses AI to deliver retail insights to brands and brick and mortar businesses.

Also read: Top 3 dividend-paying penny stocks to buy in Canada

On September 29, Fobi signed a consulting agreement worth C$ 240,000 with national cannabis retailer Kiaro Holdings. The company is also looking to acquire the Qples online coupon and advertising program for C$ 3.2 million.

At market close on September 30, FOBI stock was priced at C$ 2.98 per share.

4. Alvopetro Energy Ltd. (TSXV:ALV)

The energy company is engaged in the development, production, exploration, and acquisition of hydrocarbons in Brazil. Alvopetro has interests in Gomo and Cabure natural gas assets and seven exploration assets in the Reconcavo basin.

On September 21, the company announced a quarterly dividend of US$ 0.06 per unit to the shareholders and it will be payable on October 15. In Q2 2021, Alvopetro's net income was US$ 3.6 million in comparison to a net loss of US$ 1.1 million in Q2 2020.

The ALV stock was priced at C$ 4.47 apiece at market close on Thursday, September 30.

5. H2O Innovation Inc. (TSXV:HEO)

The company provides water treatment solutions through its innovative technologies. The company has three major operating business segments, such as specialty products, operation and maintenance services, and water technologies and services.

H2O Innovation reported record fiscal 2021 results in which its revenues were C$ 144.3 million, reflecting growth of eight per cent YoY. Meanwhile, the adjusted EBITDA increased to C$ 14.6 million.

HEO stock closed at C$ 2.39 apiece at the end of the trading session on September 30.

© 2021 Kalkine Media Inc.

Bottom line

Before making an investment in a stock, it is important to research about the company and study the financial reports. As penny stocks are volatile, a person with low-risk capacity should avoid such investments.