Summary

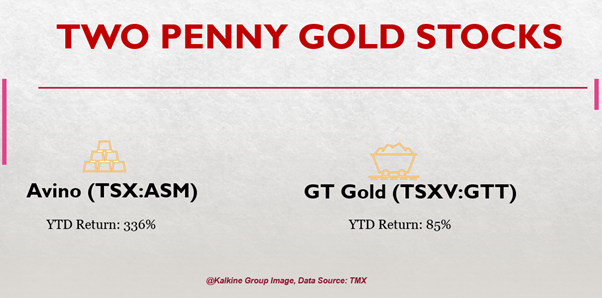

- GT Gold stocks have jumped almost 85 per cent year-to-date (YTD). The company made it to TMX’s top metal stocks.

- Avion stocks have swelled nearly 79 per cent YTD. The stock holds a present price-to-cashflow (P/CF) ratio of 23.20.

- Both stocks have rebounded from the pandemic-led gold price crash.

Gold is seen as a safe haven at times of economic crisis such as the pandemic-led market crash. The yellow metal is also viewed as a hedge against currency depreciation and inflation.

The precious metal has traded well despite the recent shift in the markets as investors seek riskier stocks in the wake of positive COVID-19 vaccine developments. These events are raising hopes of a revival from the pandemic-induced economic slump.

We take a look at the 2 penny gold stocks that are priced under C$ 5 per unit and have a market cap below C$ 300 million:

GT Gold Corp. (TSXV:GTT)

Current Stock Price: C$ 1.88

GT Gold Corp explores and produces gold in the territory of British Columbia's Golden Triangle.

The gold stock has soared nearly 30 per cent in the last three months. The stock has surged almost 85 per cent year-to-date (YTD). The penny scrips have returned over 128 per cent since its March meltdown. Its current market cap is C$ 244 million and price-to-book (P/B) ratio is 24.

The gold firm has 127.5 million outstanding shares, as per the TMX portal.

The company is placed among TMX’s top metal stocks that have surpassed their peers across the TSX and the TSXV with the largest price gains in the last 30 days. The company also ranks highly among junior basic material companies.

In the third quarter of 2020, the precious metal producer held cash of C$ 9.4 million as of September 30, 2020. The company expects that its cash in hand will be sufficient to fund all expenditures.

Avino Silver & Gold Mines Ltd. (TSX:ASM)

Current Stock Price: C$ 1.34

The mineral resource company operates in the exploration, mining, and production of silver, gold, and copper.

The metal stock has increased by almost 67.5 per cent in the last six months and swelled nearly 79 per cent YTD. The scrips have jumped over 239 per cent since the pandemic-led market meltdown in March.

Its current market capitalization stands at C$ 119 million. Its price-to-book (P/B) ratio is 1.576, and the present price-to-cashflow (P/CF) ratio is 23.20. The stock’s debt-to-equity ratio is 0.07, according to the TMX portal data.

In the third quarter of 2020, the company reported a cash balance of C$ 12.5 million along with a working capital of C$ 16.9 million. The company generated revenues from mining operations of C$ 2.7 million in Q3 2020.