Highlights

- The TSX energy index gained by nearly 49 per cent year-to-date (YTD)

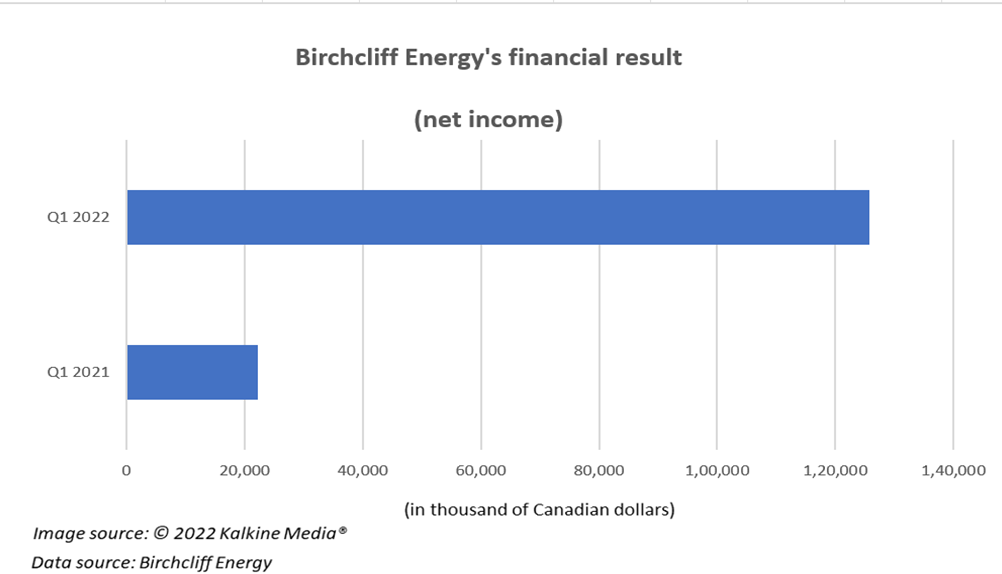

- A TSX energy stock reported a net profit surge of 467 per cent year-over-year (YoY) in Q12022

- This stock also delivered a return of about 128 per cent in 12 months

The rate hike imposed by the US Federal Reserve on June 15 seems to have recently affected the S&P/TSX Energy Index as it fell by over five per cent each day for two days starting from June 16. However, the Canadian oil and gas sector has largely been on fire this year with energy prices surging to record highs in 2022.

As the embargo on Russia's oil supply and increased fuel demand worldwide due to easing pandemic restrictions helped energy prices gallop, the TSX energy index gained by nearly 49 per cent year-to-date (YTD).

Energy prices have seen some decline recently due to the fear of rising inflation and ‘aggressive’ rate hike policy rates. But oil prices are still mostly elevated, and oil stocks could continue improving with the price surge. Crude oil was trading at US$ 104.42 per barrel at 5:08 AM EST on Wednesday, June 22, while Brent was surfing around US$ 109.94 a barrel while writing.

Amid such developments, some Canadian energy players have come to the spotlight due to their performance. One TSX energy stock, in particular, delivered a return of about 128 per cent in 12 months. Beside stock performance, this oil and gas company was quite a performer on the financial front with a net profit surge of 467 per cent year-over-year (YoY) in the first three months of fiscal 2022.

We are talking about Birchcliff Energy. Let us look at its financial and performance details.

Birchcliff Energy's (TSX:BIR) AFF zoomed 109% YoY in Q1 2022

Birchcliff raised its quarterly average production by one per cent YoY to 76,024 barrels of oil equivalent a day in the latest quarter. The Canadian oil and gas company posted an adjusted funds flow (AFF) of C$ 183.7 million in Q1 2022, up by 109 per cent YoY.

The energy producer delivered free funds flow (FFF) of C$ 95.4 million in the first three months of 2022. The Calgary-based company notably narrowed down its total debt to C$ 409 million at the end of Q1 2022, down by 47 per cent compared to March 31, 2021.

Also read: 2 TSX summer stocks to buy for July: Transat (TRZ) and Cineplex (CGX)

Birchcliff Energy increased its operating netback by 67 per cent to C$ 28.47 per barrel of oil equivalent in Q1 2022 compared to Q1 2021. The company’s Board also declared a 100 per cent increase in its quarterly dividend to C$ 0.02 per share, payable on June 30, compared to the previous year.

Birchcliff also said it would consider additional dividend hikes this year based on commodity prices and its FFF level, among other things.

Birchcliff stock performance

Stocks of Birchcliff Energy have swelled by over 48 per cent so far this year. From its 52-week low of C$ 4.06 (June 21, 2021), BIR stocks were up by almost 136 per cent.

BIR stock also rose by roughly three per cent to close at C$ 9.58 per share on June 22. According to Refinitiv data, BIR stock’s Relative Strength Index (RSI) value was 36.48 on June 21, marginally up from the 30-level, which signifies a bearish situation.

Also read: 2 TSX income stocks to buy for long term: Fortis (FTS) and BMO

What's in store for Birchcliff Energy?

Recession worries and concerns about slowed economic growth appear to be impacting investor sentiments, which in turn is affecting the global markets. However, it is believed that an increase in oil and gas prices in future could further boost the performance of oil stocks like Birchcliff Energy.

Income investors could also consider this stock as it offers exposure to the global oil and gas prices and pays dividends, thereby enhancing their portfolio income.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.

This TSX energy stock's net profit surged 467% YoY in Q1! Buy alert?