Highlights

- In Q1 2022, Alvopetro posted record financial results and said its funds flow from operations was the highest since its inception.

- In Q1 2022, PetroTal achieved a record quarterly production of 11,746 barrels of oil per day.

- As of writing, the Crude Oil WTI Futures was up by 0.8 per cent to US$ 116.22 per barrel.

Oil prices were little altered after OPEC+ reportedly agreed to increase crude output to compensate for a decline in Russian supply. The Organization of the Petroleum Exporting Countries (OPEC) reportedly agreed to increase the output by 648,000 barrels per day in July and August.

Also Read: 5 top TSXV clean tech and life sciences stocks to buy in June

After the European Union announced a ban on Russian oil imports, the crude oil prices increased, and it could later gain momentum due to the latest development.

As of writing, the Crude Oil WTI Futures was up by 0.8 per cent to US$ 116.22 per barrel. Meanwhile, the Brent Oil Futures rose 0.6 per cent to US$ 116.98 per barrel.

Alvopetro Energy Ltd. (TSXV:ALV)

Alvopetro is a resource business established in Canada that explores, acquires, develops, and produces hydrocarbons in Brazil. It makes money by selling oil, condensate, and natural gas.

In Q1 2022, Alvopetro posted record financial results and said its funds flow from operations was the highest since its inception. The company's funds flow from operations was US$ 10.9 million.

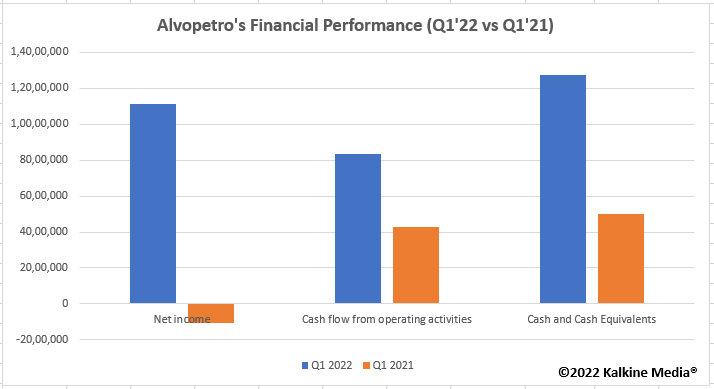

Alvopetro raised its dividend by 33 per cent to US$ 0.08 per share. The company reported a net income of US$ 11.1 million in Q1 2022 compared to a net loss of US$ 1.1 million.

At the time of writing, the ALV stock was up by around one per cent to US$ 7.5 per share.

PetroTal Corp. (TSXV:TAL)

The oil and natural gas corporation have business operations in South America. In February, the company announced a 2022 capital budget of US$ 120 million and targeted a 100 per cent growth rate in average oil production.

In Q1 2022, PetroTal achieved a record quarterly production of 11,746 barrels of oil per day and generated a record net operating income of US$ 64.2 million.

Before modifications in non-cash working capital and debt repayment, PetroTal achieved a record free cash flow of US$ 41.2 million. The TAL stock jumped 1.2% during the trading session to C$ 0.83 apiece.

Also Read: Can Cenovus (TSX:CVE) be next Suncor as it restarts West White Rose?

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.