Highlights

- Hycroft Mining Holding Corporation (NASDAQ: HYMC, HYMC: US) made headlines on the markets as its stock galloped by over 203 per cent during the trading session on Tuesday, March 8.

- Hycroft Mining, a small gold and silver mining firm operating in Winnemucca, Nevada, noted a massive surge in its stock prices on Tuesday as gold and silver prices continued to race higher amid the rising market volatility sparked by the Russia-Ukraine crisis.

- Hycroft, in its preliminary operating results for 2021, said that it produced 55,668 ounces of gold for the year, surpassing its high-end guidance range due to improved equipment, process control and costs.

Hycroft Mining Holding Corporation (NASDAQ: HYMC, HYMC: US) made headlines on the markets as its stock galloped by over 203 per cent during the trading session on Tuesday, March 8.

Let us find out why this mining company is drawing investors’ attention.

Also read: Rogers-Shaw deal sees new development: How are RCI.B & SJR.B stocks?

Why is Hycroft (NASDAQ: HYMC, HYMC: US) soaring?

Hycroft Mining, a small gold and silver mining firm operating in Winnemucca, Nevada, noted a massive surge in its stock prices on Tuesday as gold and silver prices continued to race higher amid the rising market volatility sparked by the Russia-Ukraine crisis.

This crisis has increased geopolitical stress and fuelled inflationary pressure, affecting the global economy.

Precious metals, along with other commodities like nickel, wheat, and oil, are seeing price surge as investors worldwide seem to take refuge in safe haven options to hedge against the ongoing market fluctuations.

Also read: Why is Kinross Gold (TSX:K) trending amid Russia-Ukraine war?

Hycroft’s preliminary results for 2021

The precious metal miner, on February 22, released its preliminary operating results for 2021 in addition to the initial assessment results for its project. Hycroft said that it produced 55,668 ounces of gold for the year ended on December 31, 2021, surpassing its high-end guidance range due to improved equipment, process control and costs.

The mining company stated that it had cash on hand worth US$ 12.3 million at the end of 2021.

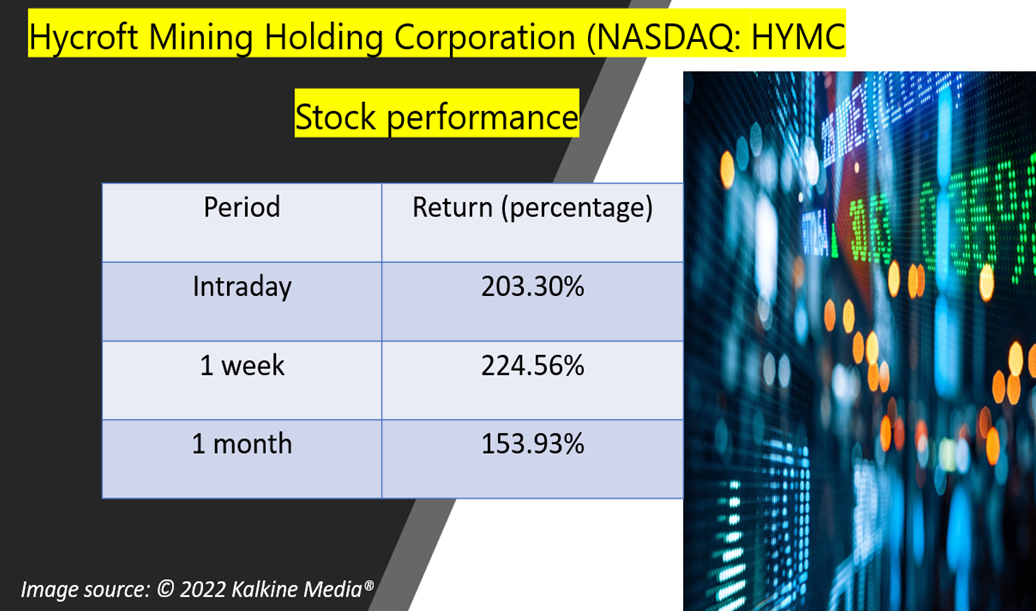

Hycroft’s stock performance

Stocks of Hycroft Mining surged by over 203 per cent to close at US$ 1 apiece on Tuesday, with 202 million shares exchanging hands. The mining scrip gained by approximately 225 per cent week-to-date.

At this price level, HYMC stock was trading nearly 87 per cent down from its 52-week high of US$ 7.47 (March 17, 2021).

Bottomline

Some analysts predict that mounting gold and silver prices could continue to influence mining stocks. However, investors should try and correctly time the market in order to make significant gains out of the market trends.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.