Summary

- Canada’s real estate market is staring at a bubble risk.

- Home prices touched C$975,980 in September, an 11 per cent increase from the same period last year.

- Altus Group Limited (TSX:AIF) stocks have gained by 45.54 percent this year.

- Madison Pacific Properties Inc reports net income of C$25.1 million for nine months ending May 31, 2020.

Defying the Covid-19 gloom across the world, the real estate market in Canada seems to be on the fast track to recovery. Numbers show the housing market is gaining strength with 97 per cent regions witnessing increase in home prices in the last three months.

Analysts fear, the Canadian real estate market is in a bubble.

A new UBS report says Toronto is facing the greatest housing bubble risk with prices touching C$975,980 by the end of September in 2020, an 11 per cent increase from the same period last year.

Another projection by brokerage firm Royal LePage says the median home pricing in Canada is expected to touch C$ 693,000 by the end of 2020, indicating a seven per cent increase from last year.

This rise in housing prices can partially be attributed to the Bank of Canada’s near-zero interest rates.

Buyers are now able to borrow at low rates, and those unemployed are making most of the federal dole outs such as the Employment Insurance (EI) program, the Canada Recovery Benefit (CRB) and Canada Recovery Sickness Benefit (CRSB) benefits. Also, shutdowns and layoffs have made people curtail discretionary expenses, resulting in 28.2 per cent spike in household savings in Q2 2020, the highest recorded since the 1960s, according to Statistics Canada. These factors together are driving growth of the real estate market in Canada.

Increasing consumer debt levels, decrease in new immigrants and rising rental prices has made Canada’s real estate market vulnerable to price increase.

In this pandemic-triggered homebody economy, people are moving towards suburbs and smaller cities, looking for more space. Investors are looking at buying out condos and affordable apartments in growing suburbs and renting them out.

Here are two real estate stocks gaining traction: Madison Pacific Properties Inc (TSX:MPC) and Altus Group Limited (TSX:AIF). Let us explore their stock performance and financials in detail.

Altus Group Limited (TSX:AIF)

Current Stock Price: C$55.25

The C$2.24-billion company provides advisory services, software, and data solutions for the commercial real estate industry in Canada. The company operations are divided into three business segments namely Geomatics, commercial real estate consulting and Altus Analytics. The commercial real estate wing generates the maximum revenue for the company. A part of the company revenues also comes from business operations in the United States, Europe, and the Asia-Pacific.

Altus Group Limited recently joined forces with WSP Global Inc (TSX:WSP) to form a new geomatics entity called GeoVerra Inc with offices in 29 cities and towns across Western Canada and Ontario.

AIF STOCK PERFORMANCE

Altus’s current earnings per share (EPS) is C$0.32. The scrips have advanced by 45.54 per cent year-to-date. Over the last six-month period, Altus stocks gained 32.43 per cent.

As per data on the TMX portal, the stocks offer a profit-to-equity ratio (P/E) of 173.50, profit-to-book (P/B) ratio of 5.95 and profit-to-cash flow (P/CF) ratio of 39.60. The return on equity (RoE) and return on assets (RoA) is 3.60 per cent and 1.76 per cent, respectively. Quarterly dividend payout is C$0.15. The dividend yield stands at 1.086 per cent.

AIF FINANCIAL HIGHLIGHTS

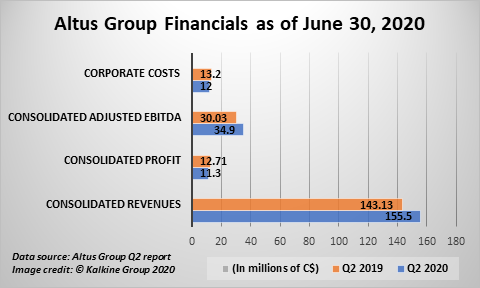

The company’s revenue was up by 8.6 per cent year-over-year (YoY) to C$155.5 million in the second quarter ended June 30, 2020. The profit from operations decreased by 10.9 per cent YoY to C$11.3 million due to the global restructuring program. The adjusted EBITDA was up by 16.2 per cent YoY to touch C$34.9 million in Q2 2020, as compared to C$30.03 million in Q2 2019.

The adjusted earnings per share for the second quarter was C$0.62, as compared to C$0.51 in the same quarter last year. The Q2 2020 revenue of Altus Analytics increased by 2.3 per cent to C$51.3 million, as compared to C$50.16 million in the same quarter last year.

The corporate costs stood at C$12 million in Q2 2020, down from C$13.2 million in the same period last year. The corporate costs declined because of reduced travelling and low office expenditures amid the pandemic.

Madison Pacific Properties Inc (TSX:MPC)

Current Stock Price: C$3.62

Madison Pacific Properties Inc is one of Canada’s largest commercial real estate developer owning industrial, retail and office assets in British Columbia, Alberta, and Ontario. Rental operations and property management contribute to majority of the company’s revenues. The Vancouver-based company owns a 50 per cent interest in Silverdale Hills Limited Partnership, which owns over 1300 acres of undeveloped residential designated lands in British Columbia.

The company holds approximate 81 per cent of its investment properties in British Columbia wherein the government has taken a phased approach to reopening.

Madison has agreed to offer rent relief and short-term rent deferrals through government assistance programs for those significantly affected by the Covid-19 pandemic.

MPC STOCK PERFORMANCE

The company has a current market capitalization of C$26.26 million. The year-to-date performance of the stock shows a marginal increase of 1.11 per cent.

As per data on TMX, the P/E ratio of the company is 5.80, the P/B ratio is 0.584 and the P/CF ratio is 18.40. The stock holds positive RoE at 10.49 per cent and RoA at 5.64 per cent.

The company offers a semi-annual dividend payout of C$0.052. The current dividend yield stands at 2.90 per cent.

MPC FINANCIAL HIGHLIGHTS

For the nine months ended May 31, 2020, Madison Pacific Properties reported net income of C$25.1 million, an increase from C$24.4 million in the same period last year. The cash flow from operating activities stood at C$10.2 million as compared to C$9.5 million in 2019. The net income after-tax net gain from the fair value adjustment on investment properties stood at C$19.3 million, as compared to C$16.5 million in the same period in 2019.