Highlights

- Home sales dropped by 16.8 per cent year-on-year (YoY) across the Greater Toronto Area in February, the Toronto Regional Real Estate Board (TRREB) has reported.

- The average selling price jumped by 27.7 per cent last month, TRREB added.

- The TRREB’s latest home sales data for the month of February month, which it released on Thursday, March 3, at the heels of Bank of Canada (BoC)’s move to increase interest rates to 0.5 per cent on March 2.

Home sales dropped by 16.8 per cent year-on-year (YoY) across the Greater Toronto Area in February, while the average selling price jumped by 27.7 per cent, the Toronto Regional Real Estate Board (TRREB) has reported.

The TRREB’s latest home sales data for the month of February month, which it released on Thursday, March 3, at the heels of Bank of Canada (BoC)’s move to increase interest rates to 0.5 per cent on March 2.

With these new numbers on Canada’s home sales activity out, let us discuss two TSX real estate stocks.

DREAM Unlimited Corp (TSX: DRM)

Toronto-based DREAM Unlimited saw its top line reach C$ 150.12 million in Q4 FY2021 compared to C$ 48.63 million a year ago. Its net margin multiplied to C$ 34.68 million in the latest quarter, notably up from C$ 5.24 million in Q4 2020.

Also read: RY & Scotiabank (BNS) raise prime rate after BoC's move: Buy alert?

The C$ 2-billion market cap company significantly improved its fourth-quarter earnings to C$ 80.31 million in FY2021 compared to a loss of C$ 32.31 million in 2020. The real estate firm will dole out a quarterly dividend of C$ 0.10 apiece on March 31.

Stocks of DREAM galloped by over 113 per cent in the past 12 months. DRM stock closed at C$ 47.54 apiece on Thursday, March 3.

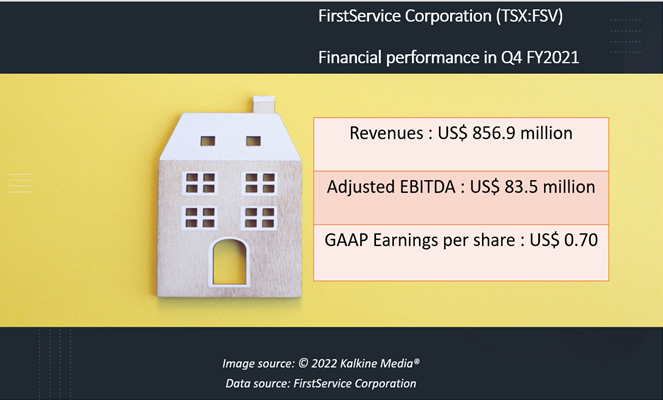

FirstService Corporation (TSX: FSV)

FirstService Corporation saw its Q4 revenue climb 11 per cent YoY to US$ 856.9 million in 2021 compared to US$ 775.1 million a year ago. Its adjusted earnings per share (EPS) were US$ 1.21 apiece in the latest quarter, up from US$ 1.02 in Q4 2020.

FSV stock closed at US$ 179.81 apiece on Thursday. FirstService will pay a quarterly dividend of US$ 0.203 apiece on April 7.

Also read: Is TD Bank (TSX:TD) worth a buy as its profit surges 14% YoY in Q1?

Bottomline

The TRREB said that it expects housing prices to rise moderately in the second half of 2022 as some homebuyers are likely to hold their purchases due to increased borrowing costs. Accelerated immigration level and supply deficit in the housing market, however, can have a countering effect to higher borrowing costs, it added.