Highlights

- Air Canada (TSX:AC) is trending again on the stock markets in the light of some new developments helped by the pandemic recovery.

- Stocks of Air Canada clocked a day high of C$ 25.64 per share on February 22, Tuesday, after the airline announced the plans for summer 2022.

- The air carrier said to launch new services on four transborder and three national routes this summer.

Air Canada (TSX:AC) is back on the trending charts in the light of some new developments helped by the pandemic recovery.

Stocks of the airline enterprise clocked a day high of C$ 25.64 per share on Tuesday, February 22, after it announced the plans for summer 2022.

What is on the cards for Air Canada (TSX:AC) this summer?

On Tuesday, the Montreal-headquartered airline announced the expansion of its air routes network for Summer 2022 as its business recovery from the pandemic continues.

The air carrier said to launch new services on four transborder and three national routes this summer. In addition, the company will also relaunch 41 North American routes, which were previously suspended, mainly due to eased COVID restrictions.

Also read: HIVE & Hut 8 (HUT): 2 Canadian crypto stocks to bag in 2022

With this, Air Canada will operate 46 U.S. airports and 51 Canadian airports, offering customers the “largest” network.

The air travel company stated that it will resume non-stop services from Toronto, Montreal, and Vancouver next month, signalling the carrier’s recovery is “well underway”.

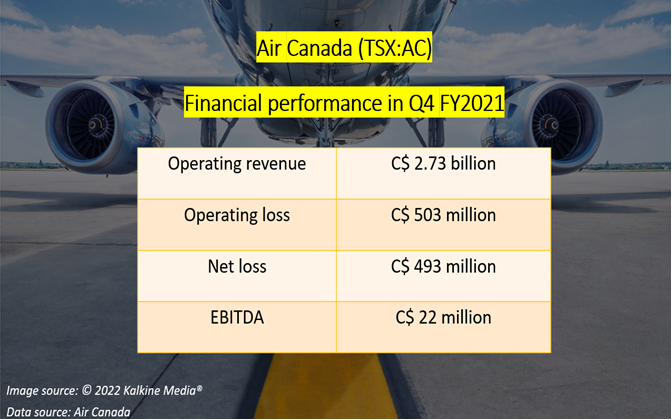

Air Canada’s Q4 FY2021 financial results

The C$ 9-billion market cap flier increased its operating revenues by 30 per cent year-over-year (YoY) to C$ 2.73 billion in Q4 FY2021. Its fourth-quarter net loss was C$ 493 million in fiscal 2021 compared to C$ 1.16 billion a year ago.

Air Canada stock performance

Air Canada stock soared by over 20 per cent year-to-date (YTD).

The airline stock closed higher at C$ 25.45 apiece on Tuesday, with 5 million shares exchanging hands during the trading session.

Bottomline

As countries around the world are slowly reopening their borders and relaxing pandemic restrictions for fully vaccinated travellers, Air Canada could see notable growth in its air travel business this summer.

Also read: How is Bombardier (TSX: BBD.B) stock doing?