Highlights

- Cargojet Inc (TSX:CJT) stocks surged by almost 10 per cent in the last one week following some corporate announcements.

- The freight airline is set to release its fourth quarter and year-end results for fiscal 2021 on March 7, said an announcement on January 12.

- On January 10, the Mississauga, Ontario-based aviation company also renewed and extended its air cargo service agreements with two key customers in the country.

Cargojet Inc (TSX:CJT) stocks surged by almost 10 per cent in the last one week following some corporate announcements.

The C$ 3-billion company, which operates an air cargo network across 14 major cities in Canada, is set to release its fourth quarter and year-end results for fiscal 2021 on March 7, said an announcement on January 12.

As floods in British Columbia left railway lines, roads and ports inundated, dependence on air cargo shipments increased massively near the end of 2021. Due to this, many market analysts have set their expectations high for Cargojet, which they believe is implementing a long-term growth strategy by investing in infrastructure and aircraft.

On January 10, the Mississauga, Ontario-based aviation company also renewed and extended its air cargo service agreements with two key customers in the country. These agreements are timed for three years and include two renewal options of one year each.

Also read: 5 Canadian growth stocks to hold for the long haul

Let us have a closer look at the stock and financial performance of Cargojet.

Cargojet Inc (TSX: CJT) stock performance

Stocks of Cargojet Inc closed at a value of C$ 178.79 apiece on Tuesday, January 18, noting a rise of over two per cent from the previous close.

The air cargo scrip has plunged by nearly 15 per cent year-over-year (YoY). However, it appears to be slowly recovering now, having gaining over seven per cent year-to-date (YTD).

Image source: © 2022 Kalkine Media®

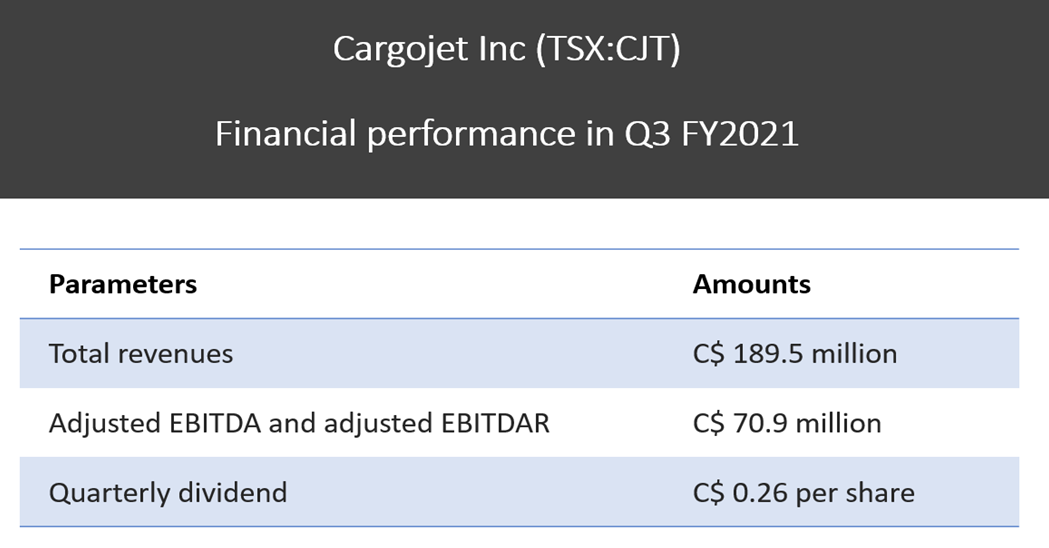

Cargojet Inc’s financial performance in Q3 FY2021

The air cargo company has reported that it earned a total revenue of C$ 189.5 million in the third quarter of fiscal 2021, which was up from that of C$ 162.3 million a year ago.

Cargojet posted an adjusted EBITDA and adjusted EBITDAR of C$ 70.9 million in Q3 FY2021, as against that of C$ 69.8 million in the same period of 2020.

The air transportation company also paid a quarterly dividend of C$ 0.26 apiece on January 5 this year.

Also read: Enbridge (TSX:ENB) & Vermilion (TSX:VET): 2 oil & gas stocks to watch

Bottomline

Cargojet has noted that it is focused on exploring market opportunities in the international air cargo space. Plus, the growing importance of e-commerce and supply chain networks are likely to bolster its air cargo operations across Canada in the near future.

.jpg)