Highlights

- The PHAC reported that monkeypox cases in Canada hit 1,008 in numbers on Wednesday, August 10

- Stocks of Dialogue Health were up by nearly 59 per cent so far in this quarter

- Medical Facilities reported a net income of US$ 22.24 million in Q2 2022.

Monkeypox cases in Canada are rising, which can fuel some interest in healthcare stocks like Well Health (TSX: WELL), CloudMD (TSXV: DOC), and HLS Therapeutics (TSX: HLS) etc. The Public Health Agency of Canada (PHAC) reported that monkeypox cases hit 1,008 in numbers on Wednesday, August 10. The outbreak was highest in Ontario and Quebec, which recorded 478 and 425, respectively.

Monkeypox outbreak was declared as a public health emergency of international concern by the World Health Organization (WHO) on July 23 as monkeypox cases continue to increase worldwide. Hence, Kalkine Media® have selected eight Canadian health stocks that investors can explore amid growing health concerns.

1. Well Health Technologies Corp (TSX:WELL)

WELL Health Technologies anticipated its revenue to surpass C$ 130 million and shareholder free cash flow (FCF) of about C$ 15 million in the second quarter of 2022. The company claimed that there was a significant surge in patient visits. WELL revealed that its omnichannel patient visits reached 839,698 in the latest quarter, representing a year-over-year (YoY) surge of 50 per cent.

The WELL Health scrip zoomed by about 24 per cent quarter-to-date (QTD). As per Refinitiv, WELL scrips had a Relative Strength Index (RSI) value of 63.66 on August 10, which points to medium-to-high momentum.

2. CloudMD Software & Services Inc (TSXV:DOC)

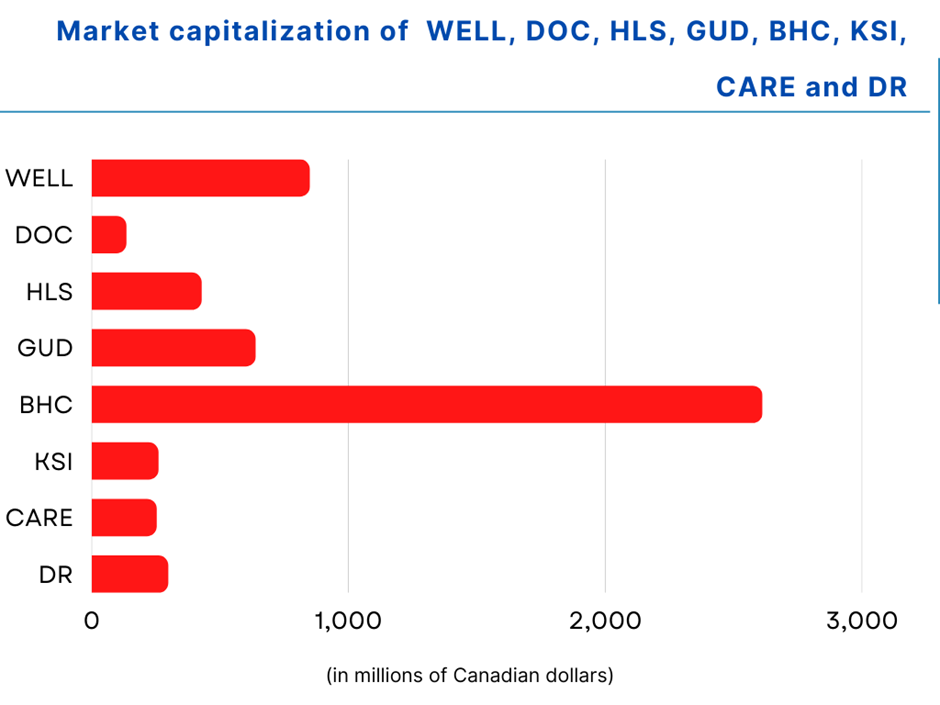

CloudMD is a junior healthcare technology company with a market capitalization of C$ 134 million. The health service provider recently finalized the review and announced a settlement agreement regarding the VisionPros acquisition. The Canadian health company stated on June 15 that it had welcomed over 300 customers onboard since starting of 2022. CloudMD also partnered with Sanofi Canada to improve access to critical mental health support for patients with diabetes. Shares of CloudMD Software zoomed by almost 17 per cent in the last month.

3. HLS Therapeutics Inc (TSX:HLS)

HLS Therapeutics is a small-cap firm with a market capitalization of C$ 422.08 million. The Toronto-headquartered speciality pharmaceutical products firm is focused on central nervous system (CNS) and cardiovascular treatments.

The stock of HLS Therapeutics spiked by about 11 per cent in one month. As per Refinitiv findings, HLS stock's RSI value was 58.57, which indicates that the stock is in neutral territory.

©Kalkine Media®; ©Garis Studio via Canva.com

©Kalkine Media®; ©Garis Studio via Canva.com

4. Knight Therapeutics Inc (TSX: GUD)

Knight Therapeutics is a drug manufacturing company dealing in pharmaceutical solutions, consumer health products, and medical devices. Knight’s debt-to-equity (D/E) ratio of 0.06 could mean less financial risk (as it is below one). Knight reported a top line surge of 15 per cent to C$ 75.82 million in Q2 2022 compared to Q2 2021. The drug manufacturer also increased its net profit notably by 91 per cent to C$ 2.51 million in the latest quarter compared to a year ago.

The GUD stock spiked by nearly five per cent year-to-date (YTD). Refinitiv information shows Knight stock's RSI value was 50.76 on August 10, signalling a normal trend.

5. Bausch Health Companies Inc (TSX: BHC)

Stocks of Bausch Health galloped by over 22 per cent month-to-date (MTD). According to Refinitiv data, BHC stocks held an RSI value of 37.52, marginally up from the oversold level of 30, with 1.64 million shares switching hands.

Bausch Health reported total revenues of US$ 1.96 billion in Q2 2022, comparatively low from US$ 2.1 billion in the previous year's second quarter. The mid-cap healthcare company also reduced its revenue expectations for fiscal 2022 between US$ 8.05 billion to US$ 8.22 billion, lower than the previously announced guidance range of US$ 8.25 billion to US$ 8.4 billion.

6. Kneat.com Inc (TSX: KSI)

Kneat is a healthcare technology company engaged in digital and automated validation processes. The C$ 259-million market cap company said its total revenues jumped by 76 per cent YoY to reach C$ 5.5 million in Q1 2022. The health tech firm improved its gross profit margin by 59 per cent in Q2 2022 compared to 56 per cent posted in Q2 2021, reflecting a notable rise in Software-as-a-Service (SaaS) revenue. Stocks of Kneat.com climbed almost 29 per cent QTD.

7. Dialogue Health Technologies Inc (TSX:CARE)

Dialogue Health Technologies is a healthcare service company operating a virtual healthcare and wellness platform. The Canadian health firm posted a revenue of C$ 23 million in the second quarter of fiscal 2022, up by 38.3 per cent YoY. Stocks of Dialogue Health were up by nearly 59 per cent in this quarter.

According to Refinitiv information, Dialogue Health stocks held an RSI value of 63.11 on August 10.

8. Medical Facilities Corporation (TSX:DR)

Medical Facilities owns and operates surgical facilities, including hospitals and surgical centres, via its subsidiaries in the US. Medical Facilities said that its facility service revenue increased by 4.7 per cent YoY to US$ 102.16 million in the second quarter of 2022.

The healthcare company stated that its net income was US$ 22.24 million in the latest quarter, reflecting a significant growth of 87.6 per cent. The DR stock soared by nearly 18 per cent in 52 weeks. On August 10, Medical Facilities stocks recorded an RSI value of 58.57, as per data gathered from Refinitiv.

Bottom line

Surging monkeypox cases worldwide could spur some interest in healthcare stocks. The TSX Capped Health Care Index notably grew by nearly nine per cent in August. Hence, investors can explore Canadian healthcare stocks discussed above. Also, some of these stocks saw their revenue increase in the latest quarter and can offer significant growth exposure.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.