Summary

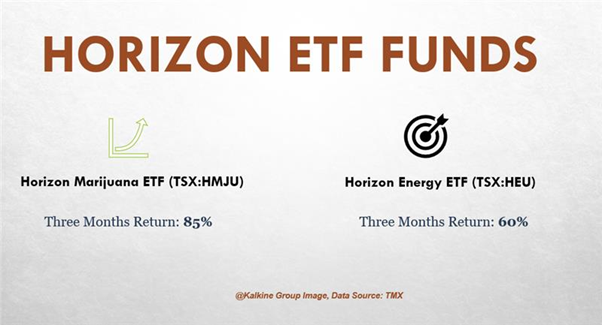

- Horizon’s BetaPro Marijuana ETF has outperformed the S&P/TSX Cannabis Index in the last three months.

- BetaPro Energy ETF units have also managed to surpass the S&P/TSX Capped Energy Index with 2x returns in the last three months.

- BetaPro Energy Fund is among TMX’s top price performers, and its present price-to-cashflow ratio stands at 5.20.

Horizons ETFs Management (Canada) Inc. is a financial services firm that provides one of the largest portfolios of exchange-traded funds (ETFs) in Canada. The Horizons ETFs group offers a diversified range of options for investors to meet their investment goals in a volatile market condition. Horizons ETFs firm holds more than US$ 15.8 billion of assets under its supervision and 93 ETFs listed on Canadian stock exchanges.

We take a closer look at its two Toronto Stock Exchange (TSX)-listed ETFs currently trending in Canadian markets: BetaPro Marijuana Companies 2x Daily Bull and BetaPro S&P/TSX Capped Energy 2x Daily Bull.

BetaPro Marijuana Companies 2x Daily Bull ETF (TSX:HMJU)

Current Unit Price: C$ 23.38

Cannabis stocks have been gaining on the back of 2020 US presidential election results in November. US president-elect Joe Biden has promised federal legalization of recreational marijuana. This hope of gaining access to the US recreational cannabis industry has generated enthusiasm among Canadian cannabis cultivators.

This fund actively tracks the Canadian cannabis stocks and has outperformed the S&P/TSX Cannabis Index performance.

The ETF added over 32 per cent in the last one month. In contrast, the S&P/TSX Cannabis Index has yielded nearly 19 per cent in the last one month.

In the last three months, the units have soared over 85.55 per cent. The Canadian marijuana index has delivered over 45 per cent growth in the same period.

BetaPro S&P/TSX Capped Energy 2x Daily Bull ETF (TSX:HEU)

Current Unit Price: C$ 25.80

This fund pursues daily investment outcomes (before fees, costs, dividends, brokerage charges and other expenses) and attempts to deliver twice the daily gains of the S&P/TSX Capped Energy Index.

With the recent promising developments around COVID-19 vaccines, investors are anticipating a recovery for the pandemic-hit energy sector. The International Energy Agency (IEA) announced its crude-oil outlook that projects a recovery of the crude-oil industry by the end of next year.

S&P/TSX Capped Energy Index has returned a 16 per cent growth in the last month. The Horizon energy fund has offered nearly 34 per cent gains in the last one month.

The Canadian energy index is up nearly 30 per cent in the last three months. In contrast, the fund units yielded almost 60 per cent returns in the same time frame.

The ETF units also made it to TMX’s top price performers that have the largest price gains across the TSX and TSXV in the last 30 days. It has a present price-to-book (P/B) ratio of 0.77 and a price-to-cashflow ratio of 5.20, as per TMX data.