Gold prices saw a remarkable rally in 2020. The precious metal attained its peak point of US$ 2000 in July and maintained it during the month of August. After the COVID-19 led market meltdown, investors treated gold as their last resort, guided to a 28 per cent price gain in 2020.

The year 2021 is also shaping up well for this yellow metal. Gold touched US$ 1,946 an ounce-mark on Monday, January 4, its highest point in about two months.

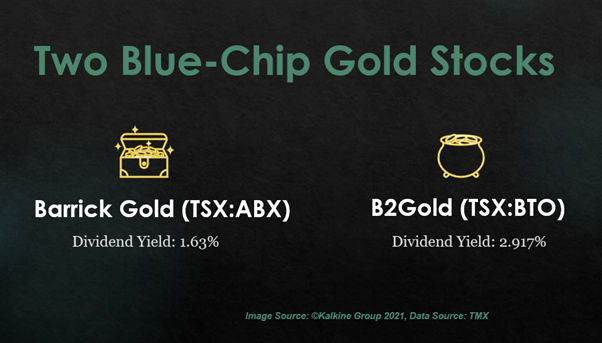

While it is difficult to predict how long will this rally last, investors have continued to explore dividend-paying gold stocks. With that in mind, let us take a look at two top performing dividend-paying gold stocks:

Barrick Gold Corporation (TSX:ABX)

The yellow metal company has a current dividend yield of 1.63 per cent. The company distributes a quarterly cash dividend of C$ 0.09 per common unit. Barrick holds a 3-year average dividend growth of 20.21 per cent and five-year dividend growth of 11.54 per cent.

Stocks of the precious metal firm yielded over 29 per cent returns in 2020. Its scrip price touched 52-week high of C$ 41.09 per unit in 2020.

The unit’s current price-to-earnings (P/E) ratio is 13.20. The gold stock delivers a positive return on equity (ROE) of 14.09 per cent and a return on assets (ROA) of 6.73 per cent. It has a price-to-book (P/B) ratio of 1.764 and a price-to-cashflow (P/CF) ratio of 8.60, as per the TMX data.

The gold share is offering earnings per share (EPS) of 2.24, and it has a debt-to-earnings (D/E) ratio of 0.23. The metal stock is trading actively across the TSX and the TSXV, and is a part of TMX’s top volume performers.

B2Gold Corp. (TSX:BTO)

The gold company delivers a current dividend yield of 2.917 per cent. It distributed a quarterly cash dividend of US$ 0.04 per common share for the fourth quarter of 2020.

Stocks of B2Gold grew over 50 per cent in the last one year. The stock flirted with the highest price of C$ 10 per share but missed the double-digit price mark in 2020.

Stocks of the gold mining company have an ROE of 30.02 per cent and a return on assets (ROA) is 21.88 per cent. Its P/B ratio is 2.401 and the P/CF ratio is 6.50. Its current P/E ratio is 8.80 and the D/E ratio is 0.02 as per the TMX website.

This yellow metal miner also made it to TMX’s top volume companies, led by its 10-day average trading volume across the market. Its current market cap is above C$7 billion.