Highlights:

- February was chosen as Black History Month as the birthdays of former US President Abraham Lincoln, and social reformer Frederick Douglass falls in this month.

- After the killing of George Perry Floyd Jr., an African-American man, in 2020, a movement called Black Lives Matter (BLM) was started across the world.

- Racial justice investing focuses on investments that support racial justice, diversity, and inclusion.

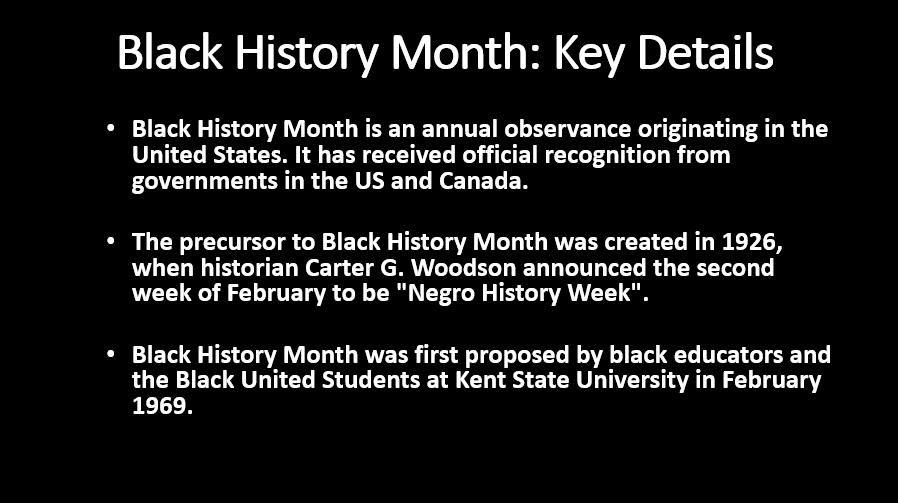

February marks the beginning of Black History Month in Canada and the United States. It is a month-long observance to celebrate the achievements of Black people and give a fresh reminder to assess where systemic racism persists.

Starting in February 1926, Black History Month began as the Negro History Week, and Carter G. Woodson created it. Mr Woodson is known as the father of Black History, and as a historian, he developed a field of African American studies.

February was chosen as Black History Month as the birthdays of former US President Abraham Lincoln, and social reformer Frederick Douglass falls in this month.

Also Read: 3 ETF trends that can rule in 2022

Mr Lincoln and Douglass are known to have played an essential role in helping to end slavery. Over the years, people have become sensitive and have often raised their voices against racism.

After the killing of George Perry Floyd Jr., an African-American man, in 2020, a movement called Black Lives Matter (BLM) was started across the world.

Some people take to the streets to voice their concerns over racism, gender inequality, and other social wrongs. Meanwhile, some support a cause through other methods, including racial justice investing.

This Black History Month, Take Time to Explore 2 Socially Driven ETFS

What is racial justice investing?

This strategy focuses on investments that support racial justice, diversity, and inclusion. Racial justice investing could include buying shares of Blacks' companies or investing in exchange-traded funds (ETFs) comprising companies supporting social justice movements. ©2022 Kalkine Media®

©2022 Kalkine Media®

This article will look at two ETFs available in the US markets. You can explore if you are looking to indulge in racial justice investing.

2 ETFs for racial justice

- IMPACT SHS TRUST I (ARCA:NACP)

This ETF tracks the performance of the Morningstar ®Minority Empowerment Index (an underlying index). The index is designed in such a manner that it measures the performance of companies that are empowering minorities.

At market close on January 31, the NACP ETF closed at US$ 33.6, two per cent higher than the previous trading session.

In the last 12 months, the ETF has returned about 17 per cent to the holders.

- ADASINA SOCIAL JUSTICE ALL CAP GLOBAL ETF (ARCA:JSTC)

This fund tracks and invests the fund assets in a portfolio of global companies whose practices are in sync with the social justice investment strategy.

The JSTC ETF closed 2.1 per cent higher at US$ 17.24, and since the past year, the ETF returned 13.4 per cent.

Bottom line

Investors often select ETFs to give exposure to the stock market at a lower cost. Some market analysts consider ETFs a low-risk option because it replicates a stock index and offers a diverse option to investors compared to investing in a few stocks of your choice.

Also Read: What do Canadians need to know about crypto ETFs?