Summary

- The scrips of HIVE Blockchain Technologies Ltd gained 450+ per cent YTD.

- The Westaim Corporation has stakes in investment firms Arena and HIIG group.

- Founders Advantage Capital Corp generated revenue of C$15 million in Q2 2020.

In times as these when industry majors are struggling to survive and revive, there is a growing community of innovators cashing on the winds of change. Three companies in their early formative years have been trending on the Toronto Stock Exchange Venture (TSXV) for volume and price activities. These three are financial stocks: Hive Blockchain Technologies Ltd. (TSXV:HIVE), The Westaim Corporation (TSXV:WED) and Founders Advantage Capital Corp. (TSXV:FCF). Let’s take a look at their financials and stock performance.

Hive Blockchain Technologies Ltd. (TSXV:HIVE)

HIVE Blockchain Technologies Ltd provides infrastructure solutions for the blockchain industry. The company is also engaged in the mining of digital currencies. It is the first publicly listed blockchain infrastructure firm that connects blockchain and cryptocurrencies to the capital markets. In the third quarter, the company reported record Ethereum production driven by decentralized finance (“DeFi”) applications on the blockchain network.

HIVE Blockchain stocks are up by a massive 450+ per cent year-to-date and 34.78 per cent month-to-date.

Current market capitalization of the company is C$182 million. The stock holds profit-to-book (P/B) ratio of 5.3 and profit-to-cash flow (P/CF) ratio of over 300.

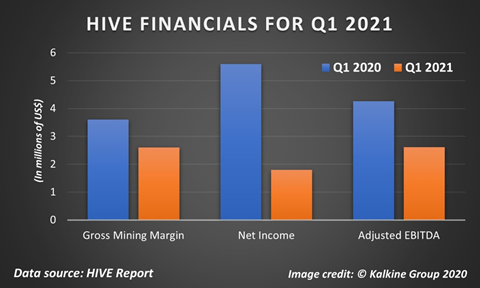

According to first quarter results for financial year 2021 (period ended June 30, 2020), the company generated income of US$6.6 million from digital currency mining, a 28 per cent decrease from US$9.12 million in the same period last year.

The gross mining margin for Q1 FY2021 was US$2.6 million or 39 per cent of the income from digital currency mining, as compared to US$3.6 million in Q1 FY2020. The net income was US$1.8 million in Q1 FY2021, as compared to US$5.6 million in Q1 FY 2020. The adjusted EBITDA for the period was US$2.61 million, as compared to US$4.26 million a year ago.

The stock is currently trading at C$0.53.

The Westaim Corporation (TSXV:WED)

Canada-based Westaim Corp is an investment firm that provides long-term capital to businesses operating in the global finances sector. The company invests both directly and indirectly or through acquisitions, joint ventures, and other arrangements to be able to provide its shareholders with capital appreciation.

The company generates revenue for investors from interest and dividend income. It seeks to acquire securities of all kinds (debt, equity, and derivatives) from both public and private enterprises. The company enjoys regional presence in Europe, the United States, Canada, Asia Pacific, and other countries. It has stake in investment firms Arena and HIIG Group.

After witnessing a drop at the onset of the pandemic outbreak during the period between March to June, this financial stock performance declined 12.45 per cent, but it has been improving steadily from June 2020. The stock is down over nine per cent this year.

The stock is trading at C$2.39 at the time of writing this story.

Current market capitalisation of the company is C$342 million. The stock holds profit-to-book (P/B) ratio of 0.766 and profit-to-cash flow (P/CF) ratio of 11.60.

Westaim reported total revenue of US$3.7 million in its second quarter (period ended June 30, 2020), as compared to US$11.3 million in Q2 2019. The company recorded a net loss of US$0.1 million for three months ended June 30, 2020, as compared to a net profit of US$7.8 million in the same period last year.

Net expenses for the three months ended June 30, 2020 of US$3.7 million as compared to US$3.5 million in Q2 2019. The fair value of the company’s investment in Q2 2020 in HIIG was US$191 million. The gross written premiums for Q2 2020 was US$253 million, as compared to US$258.7 million in Q2 2019, a decrease of 2.2 per cent. As of June 30, 2020, the company had cash of US$8.6 million in hand.

Founders Advantage Capital Corp. (TSXV:FCF)

Founders Advantage Capital Corp stocks are up 35 per cent YTD. This investment company has controlling interest acquisitions in middle-market entities with significant free cash flow. The company’s platform is designed to empower entrepreneurs who believe in business growth, along with operational control in the business as a long-term partner. The company recently entered into an agreement to acquire Dominion Lending centres.

The company’s subsidiaries are Dominion Lending Centres Limited Partnership (“DLC”), Club16 Trevor Linden Fitness (“Club16”), and Cape Communications International Inc. partnership operating as Impact Radio Accessories (“Impact”).

Current market capitalisation of the company is C$69.57 million. The stock holds P/B ratio of 0.979, P/CF ratio of 2.80 and Debt-to-Equity (D/E) ratio of 1.54.

As per the financial results for the second quarter period ended June 30, 2020, the corporation generated revenue of C$15.0 million, as compared to C$23.6 million in Q2 2019. The EBITDA for Q2 2020 of C$5.3 million, as compared to C$9.2 million in Q2 2019. This decrease is primarily due to Covid-19 pandemic and Club16 closing operations temporarily between March 17 to May 31, which impacted sales from concerts and professional sporting events being suspended.

The stock is currently trading at C$1.76.