Highlights

- Bank of Montreal (TSX:BMO) ended the earnings season for the Big Six banks on Friday, December 3.

- BMO’s net income surged by 36 per cent year-over-year (YoY) in Q4 FY21.

- It has announced a 25 per cent boost to its quarterly dividend.

That’s a wrap for the Big Six banks’ earnings season for fiscal 2021!

Bank of Montreal (TSX:BMO) ended the season on Friday, December 3, joining its peers in the Big Six group to post increased profit as well as dividend payout.

Let’s a look at how the Montreal-based lender fared in fiscal 2021 and its fourth quarter.

Also read: Which Canadian bank stocks to buy as dividends go up?

Bank of Montreal Q4 & FY2021 Financials – Key Highlights

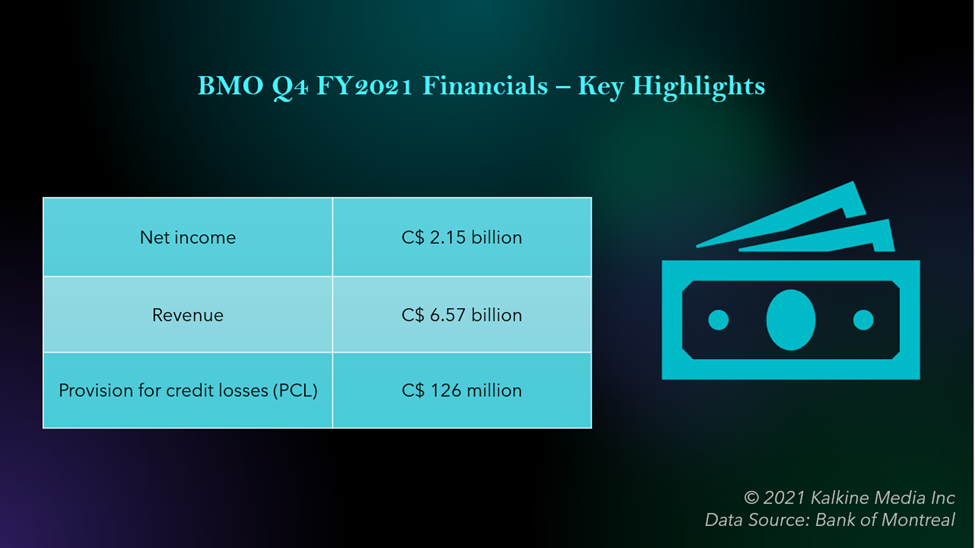

Bank of Montreal’s net income surged to C$ 2.15 billion in Q4 FY21, which was up by 36 per cent year-over-year (YoY).

On an annual basis, the Canadian lender saw a growth of 52 per cent YoY in its profit of C$ 7.75 billion in fiscal 2021.

Its revenue fell to C$ 6.57 billion in Q4 FY21, down from that of C$ 7.56 billion in the previous quarter.

For the whole fiscal year ending in October 2021, however, BMO’s topline expanded to C$ 27.18 billion, up from that of C$ 25.18 billion in fiscal 2020.

The Big Six bank continued its recovery from the pandemic lows as its provision for credit losses (PCL) amounted to C$ 126 million in the latest quarter, as against a PCL of C$ 70 million Q3 FY21.

BMO’s latest earnings report reflected a return on equity (ROE) of 16 per cent in Q4 FY21, as against that of 12.4 per cent in Q4 FY21.

Also read: How the omicron variant can impact Canadian stock markets

BMO’s dividend hike

Now free to buy back shares and hike dividends, Bank of Montreal has announced a 25 per cent boost to its quarterly dividend.

The bank is set to pay a dividend of C$ 1.33 per share, as against a payout of C$ 1.06 apiece, on February 28 next year.

The Canadian lender added that it plans to buy back up to 22.5 million of its shares.

Bank of Montreal (TSX:BMO) stock performance

A day before the release of its latest earnings report, BMO stocks shot up by about two per cent to close at a value of C$ 134.81 apiece on Thursday, December 2.

Although the bank stock has fallen by about two per cent this week amid the string of earnings releases from top Canadian banks, it has galloped by over 39 per cent year-to-date (YTD).

The bluechip scrip holds a market cap of about C$ 87 billion, while its price-to-earnings (P/E) ratio stands at 12.4.

Bottomline

Market experts had predicted an interesting earnings season for the Big Six Canadian banks after the Office of the Superintendent of Financial Institutions (OSFI) greenlit share buybacks and dividend expansions for banks in November.

However, investors fear that the emergence and spread of the omicron variant could hamper the performance of the Canadian economy and its banks in the coming months.