Highlights

- Uranium, a radioactive element, is known to be used in nuclear power plants to produce clean energy.

- A uranium stock mentioned here delivered a return of roughly 165 per cent year-over-year (YoY).

- A Canadian uranium firm noted a return on equity (ROE) of 21.79 per cent.

Uranium, a radioactive element, is known to be used in nuclear power plants to produce clean energy.

The COVID-19 pandemic led to a near-complete shutdown worldwide, which drastically impacted the supply chain and resulted in increased demand for materials like uranium in the global market.

Uranium prices are expected to hit an upward trajectory as the global supply chain continues to suffer. Moreover, the effects of climate change have shifted the world’s focus towards clean and renewable energy sources, which is likely to further push the demand for uranium.

Keeping this in mind, let us quickly glance at two TSX-listed uranium stocks.

Also read: 2 Canadian stocks to buy in an age of floods, fire & climate change

1. Cameco Corporation (TSX: CCO)

One of the largest uranium producer in the world, Cameco Corporation is headquartered in Saskatoon, Saskatchewan.

The company claims that its flagship McArthur River mine, when operated at normal production level, accounts for around 50 per cent of output in normal market situations.

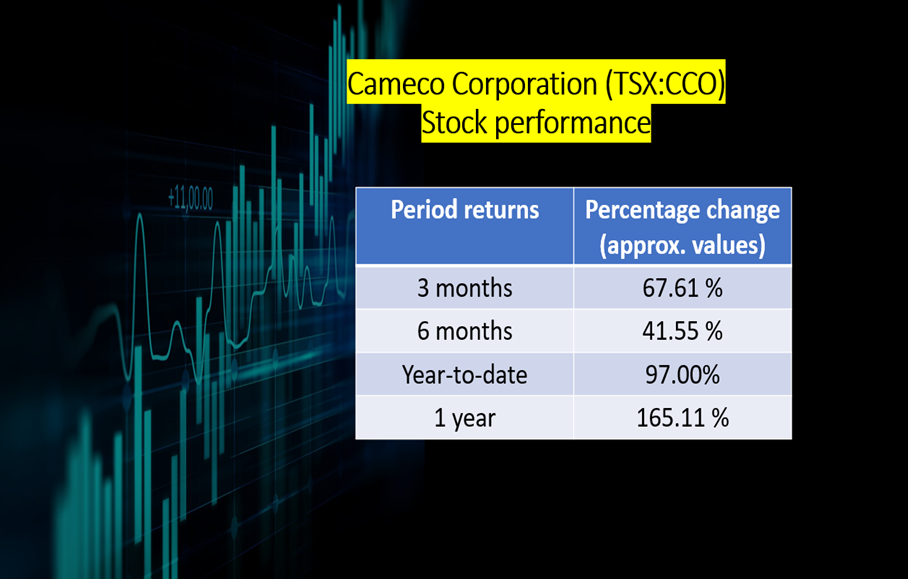

The uranium company saw its stock jump by roughly two per cent to close at a price of C$ 33.59 apiece on Thursday, November 18, having climbed by nearly 68 per cent in the last three months.

It also swelled by about 97 per cent on a year-to-date (YTD) basis and soared by more than 165 per cent over the past 12 months.

Image source: © 2021 Kalkine Media Inc

Cameco Corporation is expected to pay C$ 0.08 per share as an annual dividend on December 15 this year.

Also read: 2 Canadian small-cap stocks to buy under $10

2. Mega Uranium Ltd (TSX:MGA)

Mega Uranium Ltd is a pure play uranium exploration firm with operations in Australia and Canada.

The Toronto-headquartered company saw its stock close at a value of C$ 0.32 apiece on November 18, having surged by almost 78 per cent in the last three months.

The uranium stock also delivered a return of roughly 167 per cent on a year-over-year (YoY) basis.

On the valuation side, Mega Uranium held a return on equity (ROE) of 21.79 per cent and a return on assets (ROA) of 21.48 per cent as of Friday morning, November 19.

Bottom line

At the 2021 United Nations Climate Change Conference recently held in Glasgow, Scotland, the leaders of many countries promised to work at becoming carbon neutral economy in the next decade or so.

In order to achieve that goal, most nations in general are expected to switch to the usage of clean energy sources and reduce their carbon emissions.

As uranium can help fulfil that purpose, companies focused in that area could pay a crucial part in future technologies and, in turn, note a surge in demand.