Highlights

- Passive income-focused investors can consider dividend stocks with high yields for their portfolios

- While assessing different investment options, dividend yield can be a crucial factor to consider.

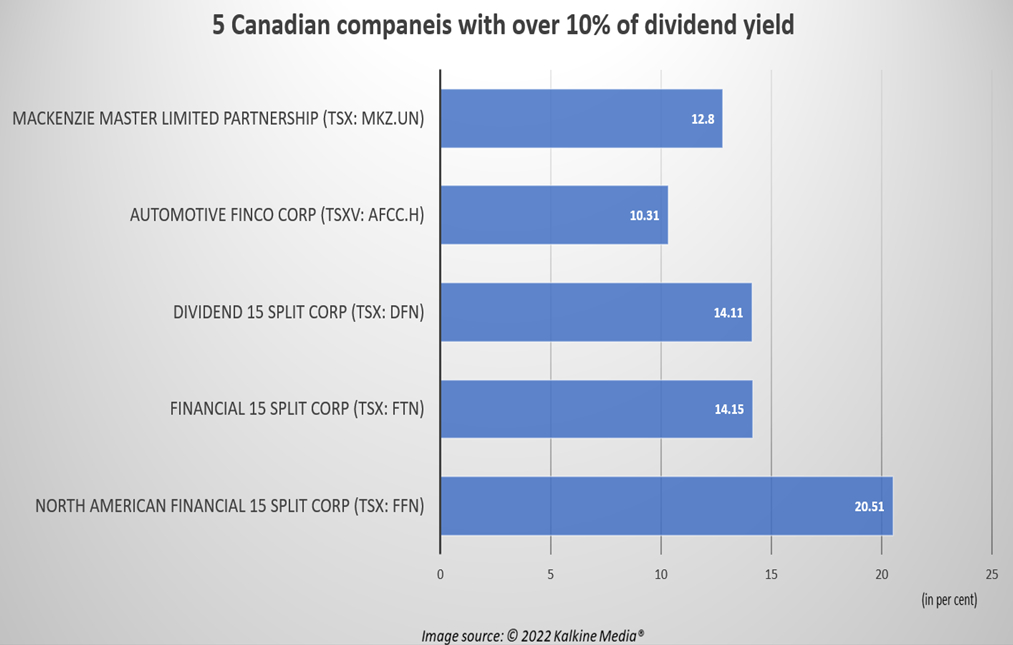

- A company listed below held a dividend yield of roughly 21 per cent.

Passive income-focused investors can consider dividend stocks with high yields for their portfolios. Dividend stocks offer surplus income besides returns, which can help investors stabilize their cash positions. And while assessing different investment options, dividend yield can be a crucial factor to consider.

Following are some TSX options that currently hold a dividend yield of over 10 per cent.

1. North American Financial 15 Split Corp (TSX:FFN)

North American Financial 15 Split Corp is a Quadravest (a Canadian investment management company) product that actively manages a portfolio of 15 core large-cap companies in the financial service sector across Canada and the United States.

North American Financial’s portfolio companies are likely to gain from favourable economic and capital market situations, growing earnings momentum etc. The C$ 279 million market cap company held a dividend yield of roughly 21 per cent.

The Toronto-based investment company pays a monthly dividend of C$ 0.113 per share to its shareholders. The next dividend pay-out by North American Financial is scheduled for May 10. FFN stock was down by over eight per cent in the last one year.

Also read: CGI (GIB.A) and DSG: 2 TSX tech stocks to buy instead of Amazon (AMZN)?

2. Financial 15 Split Corp (TSX:FTN)

Financial 15 Split Corp is also a Quadravest company investing in a high-quality portfolio of financial service companies in Canada and the U.S. This company focuses on yield products for retail investors.

Financial 15 Split posted a dividend yield of over 14 per cent. It is supposed to pay a dividend of C$ 0.126 per share every month. Its next dividend payment is due on May 10.

Stocks of Financial 15 declined by nearly five per cent in the past 12 months.

3. Dividend 15 Split Corp (TSX:DFN)

Dividend 15 Split Corp is a Canadian investment company, a Quadravest product, that mainly invests in 15 high-quality dividend yield companies like Royal Bank of Canada (TSX: RY), TC Energy (TSX: TRP) etc. based in Canada in order to provide cash dividend to its shareholders every month. It recorded a dividend yield of over 14 per cent.

DFN will pay a monthly dividend of C$ 0.10 apiece on May 11. DFN scrip swelled by almost six per cent year-over-year (YoY).

4. Automotive Finco Corp (TSXV: AFCC.H)

Automotive Finco Corp is a Toronto-headquartered firm that provides financial solutions exclusively to the auto retail sector. The firm also explores direct investment and finance opportunities throughout the auto dealership and retail sector. It had a dividend yield of over 10 per cent.

Stocks of Automotive Finco expanded by over 14 per cent in the past 52 weeks.

Also read: 10 under-$10 TSX stocks to add to your TFSA for retirement

5. Mackenzie Master Limited Partnership (TSX: MKZ.UN)

Mackenzie Master LP offers a wide array of financial solutions, including exchange-traded funds (ETF), mutual funds etc. The Canadian partnership firm is also engaged in the provisions of investment advisory services.

Mackenzie Master held a dividend yield of almost 13 per cent. It pays an annual dividend (C$ 0.096 per share paid on January 21) to shareholders. Units of Mackenzie Master plummeted by nearly 10 per cent over the last 12 months.

Bottomline

Before taking any investment actions based on dividend yield, investors should properly analyze any stock and its fundamental strength to ensure stable dividend income. Besides this, a detailed analysis of its financial statements can also help investors estimate dividend growth prospects and make informed investment decisions.

Also read: IFC, FFH, CIX, GSY and IGM: 5 TSX financial stocks to buy in May 2022

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.