Highlights:

- BCE Inc. paid a dividend of C$ 95 per share

- TransAlta Renewables has a market cap of C$ 4.5 billion.

- Enbridge posted revenue of C$ 13,215 million in the June 2022 quarter.

Investors often consider stocks with high dividend yields. In Canada, stocks like BCE Inc. (TSX: BCE), TransAlta Renewables Inc (TSX:RNW), Enbridge Inc (TSX: ENB), and Manulife Financial Corporation (TSX:MFC) offer a high yield to shareholders.

The stock market has been volatile for several reasons, starting from the Russia-Ukraine crisis to rising inflation and subsequent interest rate hikes. This year saw the biggest tech rout followed by retail stocks’ steep plunge. Investors are wary of picking stocks and are undecided on what to pick and discard.

Here, we take a look at five high dividend yield stocks curated by Kalkine Media® and try to evaluate their performances in recent quarters:

BCE Inc. (TSX:BCE)

The erstwhile Bell Canada, BCE is a Canadian holding company that provides wireless and internet services, broadband, television, and landline phone services in Canada.

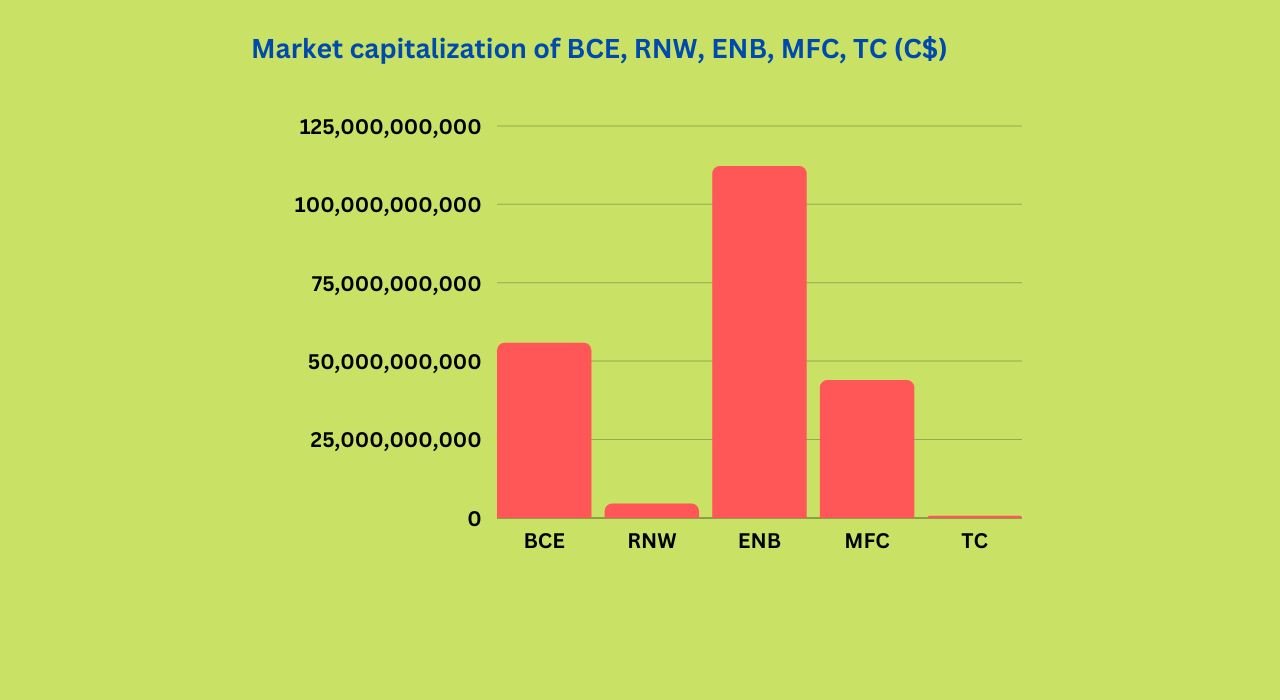

BCE is a C$ 55.8 billion company that paid a C$ 0.95 per share dividend. It is next payable on October 15, 2022.

The company said that in the second quarter of fiscal 2022, its net earnings plunged 10.9 per cent due to a net loss in non-cash equity derivatives.

However, it also posted a 3.8 per cent consolidated service revenue growth in the reported quarter along with a 4.6 per cent higher adjusted EBITDA.

The company’s subscriber revenue and advertising revenue moved on an upward trajectory in Q2 2022. While the subscriber revenue was up 3.5 per cent YoY, advertising revenue rose 4.7 per cent on a yearly basis.

The BCE stock had a Relative Strength Index of 61.09, as shown on Refinitiv for September 15, 2022. It shows that the stock is likely stable currently.

TransAlta Renewables Inc (TSX:RNW)

A subsidiary of TransAlta Corp, TransAlta Renewables Inc is a renewable energy enterprise involved in developing and operating hydropower, gas power, and wind power generation units.

The C$ 4.5 billion market cap company, TransAlta, has a dividend yield of 5.592 per cent. The dividend payout is on a monthly basis.

The RNW stock showed a surge of 2.18 per cent in the current quarter. TransAlta’s revenue for the second quarter of 2022 grew by US$ 47 million, whereas in the past six months, it increased by US$ 64 million relative to the same period a year ago.

The company's revenue for the three and six months ended June 30, 2022, increased by C$ 47 million and C$ 64 million. This growth was propelled by higher wind resources in Canada, higher environmental credit, and higher production from its wind facility.

Enbridge Inc (TSX:ENB)

Enbridge is a multinational pipeline company that owns and operates pipelines throughout Canada and the US. It mainly transports crude oil, natural gas liquids, and natural gas.

The C$ 112.6 billion market capitalization company has a dividend yield of 6.189 per cent. It distributed a quarterly dividend of C$ 0.86 per share.

In the quarter that ended June 30, 2022, Enbridge registered revenue of C$ 13,215 million, compared to C$ 10,948 million in the same period a year ago.

The company’s earnings per common share attributable to common shareholders for the second quarter of 2022 was C$ 0.22 relative to C$ 0.69 in the year-ago quarter.

The ENB stock increased by 12.48 per cent year-to-date (YTD) while it soared 2.24 per cent in the current quarter.

Source: ©Kalkine Media®; © Canva via

Source: ©Kalkine Media®; © Canva via

Manulife Financial Corporation (TSX: MFC)

The C$ 43.4 billion market capitalization company, Manulife Financial Corporation, is a global Canadian insurance firm headquartered in Toronto, Ontario.

The company said that its second-quarter 2022 net income attributed to shareholders of C$ 1.1 billion was down C$ 1.6 billion from the second quarter of 2021.

Manulife Financial’s Global Wealth and Asset Management net inflows were C$1.7 billion in the reported quarter. Its core earnings of C$ 1.6 billion in Q2 2022 were also a dip of nine per cent from the corresponding quarter of the previous year.

The company’s dividend yield is 5.774 per cent, and paid a quarterly dividend of C$ 0.33. The next payable date is September 19, 2022.

Bottom line

Although the dividend yield of stocks is a big draw for investors, it is not easy to just pick such stocks to invest. The unstable condition of the stock market has jeopardized the investment plans of traders. One simply cannot rely on the stock performance to put money in. Past performances are no longer a guarantee for future gains. Investors should do a lot of analysis to choose their stocks back by a long-term strategy to prevent the loss of money.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.