Highlights

- According to reports, the Bank of Canada (BoC) might soon hike the interest rates by 0.5%.

- In recent months, both experts and Canadian consumers have feared that the world may undergo a financial crisis.

- Investors could be looking for recession-proof stocks.

In recent months, both experts and Canadian consumers have feared that the world may undergo a financial crisis. When discussing the economy, investors and general people often fear that a recession might come due to rising inflation and several other macroeconomic factors.

Also Read: Can Cenovus (TSX:CVE) be next Suncor as it restarts West White Rose?

According to reports, the Bank of Canada (BoC) might soon hike the interest rates by 0.5%. If this happens, the interest rate hike could burden the market that has thrived for over a decade due to easy monetary policy.

Furthermore, investors must deal with excessive inflation and a worsening geopolitical problem in the form of the Russia-Ukraine conflict. In this scenario, investing in recession-proof TSX equities may be advisable. Let's get started.

George Weston Limited (TSX:WN)

The company operates through two subsidiaries that specialise in retail and real estate. George Weston operates through Loblaw, Canada's largest grocery retailer, and Choice Properties, a real estate investment trust.

During the market correction, often grocery retail stocks prove to be a superb hold. Also, due to rising food prices, these businesses may grow.

On May 10, George Weston declared a dividend of C$ 0.66 per unit, and it would be payable on June 14. In Q1 2022, the company posted net earnings of C$ 373 million compared to a net loss of C$ 52 million in Q1 2021.

The WN stock ended the trading session on Tuesday at C$ 155.24 apiece after climbing 0.6 per cent.

Alimentation Couche-Tard Inc. (TSX:ATD)

It is primarily a convenience store chain in several countries, including Canada and the United States. Alimentation's operations are separated into three regions: the United States, Europe, and Canada.

ATD stock's return on equity is 23 per cent, and it last distributed a dividend of C$ 0.11 apiece. Meanwhile, the company's dividend registered a growth of 18.4 per cent in the last three years.

Recently, Alimentation announced that it has commenced deploying Circle K electric vehicle (EV) fast chargers in the United States. As EVs are expected to become mainstream, the company could benefit from them.

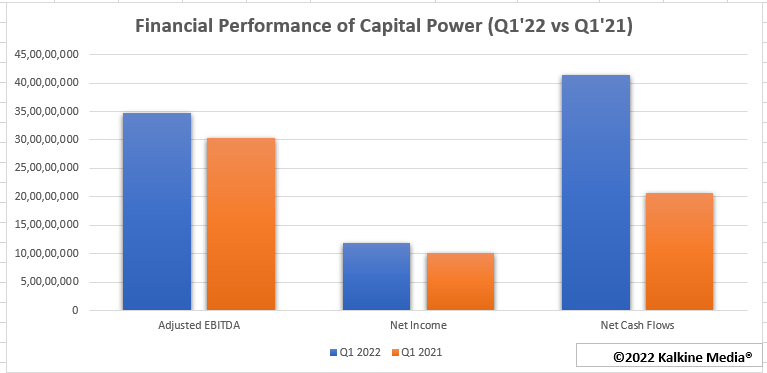

Capital Power Corporation (TSX:CPX)

Utility stocks could come in handy during a recession, and Capital Power Corporation could be a good choice for diversifying your investment portfolio.

The utility company has business operations in North America and generates most of its revenue from electricity and natural gas sales. Notably, Capital Power has a dividend yield of 4.8 per cent, which could mean that it provides a good passive income to shareholders.

In the first quarter of 2022, the company generated $415 million in net cash flows from operating activities and $200 million in adjusted funds from operations (AFFO).

The CPX stock closed around one per cent higher at C$ 45.46 per share on May 31.

Fortis Inc. (TSX:FTS)

In Canada and the United States, Fortis serve more than 3.4 million electricity and gas consumers. Electricity generating and various Caribbean utilities are among the company's minor investments.

In the first quarter of this year, Fortis achieved C$ 350 million in net income or C$ 0.74 per share. Also, Fortis has set a goal of achieving net-zero direct GHG emissions by 2050, demonstrating its commitment to a clean energy future.

When the Toronto Stock Exchange closed for trading on May 31, the FTS stock was priced at C$ 63.79.

Corby Spirit and Wine Limited (TSX:CSW.A)

Liquor has a reputation for resiliency during prior periods of economic distress, and the Toronto-based Corby Spirit is an importer and marketer of spirits and wines.

The company recently announced its results for the third quarter of 2022. It said that the Board of Directors decided to pay a dividend of C$ 0.24 per unit to the stockholders per its dividend policy.

The Corby Spirit stock declined 0.5% during the trading session on Tuesday and closed at C$ 18.41 apiece.

Also Read: 5 top TSXV clean tech and life sciences stocks to buy in June

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.