Highlights

Canadian retirees looking for a steady stream of dividend income could consider defensive stocks like Fortis (TSX: FTS), Capital Power (TSX: CPX) and AltaGas (TSX: ALA).

Many Canadians are becoming increasingly concerned about recession risk as they continue to face higher interest rates. Retirement investors could explore dividend-paying utility stocks that could offer stable returns in such market environment as these stocks could help in resisting recessionary pressure.

Let's see three TSX dividend stocks that retirees could consider adding to their portfolios.

1. Fortis Inc (TSX:FTS)

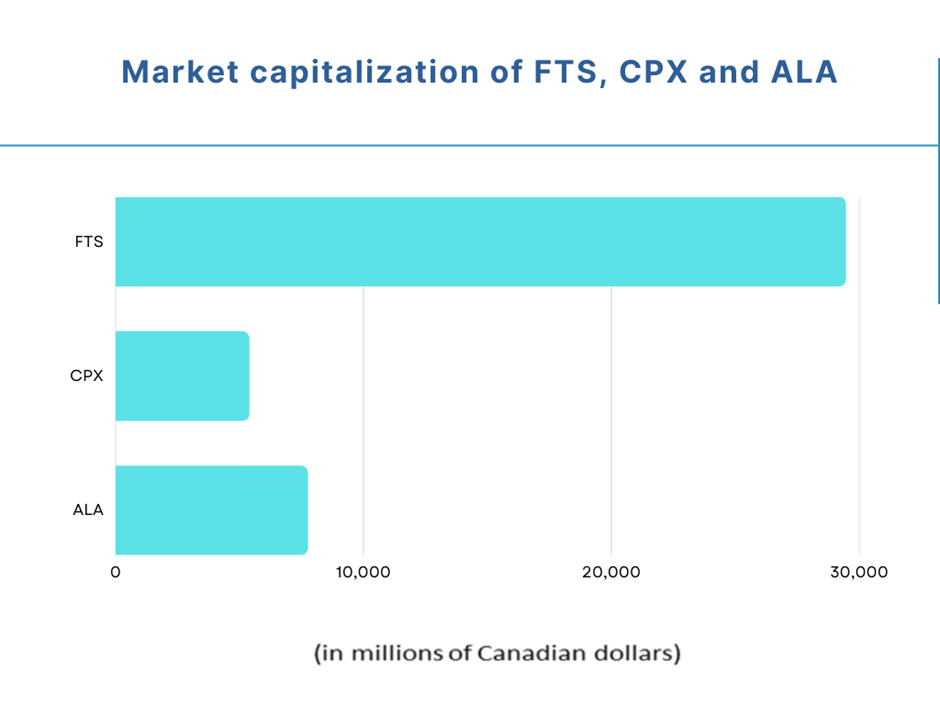

Fortis is among Canada’s top utility companies, which currently holds a market capitalization of about C$ 29.46 billion and delivers quarterly dividends (C$ 0.535).

The Canadian utility company increased its capital expenditures to C$ 964 million for the quarter ending March 31, 2022, which was higher than that of C$ 880 million a year ago. In addition, the large-cap company stated that its annual capital plan of C$ 4 billion is on track while reporting its Q1 2022 results.

FTS stock climbed nearly 11 per cent in 12 months. As per Refinitiv, this utility stock seems to be on a mixed trend with an increasing Relative Strength Index (RSI) of 58.27, supported by volume in green on July 14.

©Kalkine Media®; ©Garis Studio via Canva.com

2. Capital Power Corporation (TSX:CPX)

Capital Power recently announced that it has partnered with Manulife Investment Management to buy a 100 per cent stake in MCV Holding Company to acquire Midland Cogen facility in the US.

Capital had a dividend yield of almost five per cent (an annual dividend paid by the company denoted as a percentage of its stock price). The midcap utility company will disburse a quarterly dividend of C$ 0.547 on July 29. CPX scrip swelled by over 17 per cent year-to-date (YTD). According to Refinitiv data, CPX held an RSI of 62.23m with a rising trading volume on July 14.

3. AltaGas Limited (TSX:ALA)

AltaGas is also a diversified utility provider with a market capitalization of C$ 7.75 billion. The utility service company doles out a quarterly dividend of C$ 0.265. On July 5, the Canadian midcap company acquired the remaining 25.97 per cent equity stake in Petrogas Energy Corp for a consideration of C$ 285 million to become a 100 per cent owner and advance its global export strategy.

ALA stock spiked by almost six per cent in nine months. According to Refinitiv information, ALA stock held a moderate RSI value of 50.57 on July 14.

Bottomline

When thinking about retirement, quality dividend stocks like these utility stocks could bring a flow of dividend income and could also generate steady returns as they are backed by business operations of defensive nature.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.