Highlights

- Amid inflation fear, many investors are on the lookout for stocks that are likely to grow and bring in regular dividend income.

- A metal distribution company mentioned here posted a return on equity (ROE) of 31.67 per cent.

- A stock listed below has swelled by almost 84 per cent over the past year.

Amid inflation fear, many investors are on the lookout for stocks that are likely to grow and bring in regular dividend income. These stocks could help investors in earning significant returns in the future.

Here are the two TSX-listed dividend paying stocks that might fetch notable returns in the long term.

Also read: 3 TSX financial stocks that sweetened their dividends after OSFI ruling

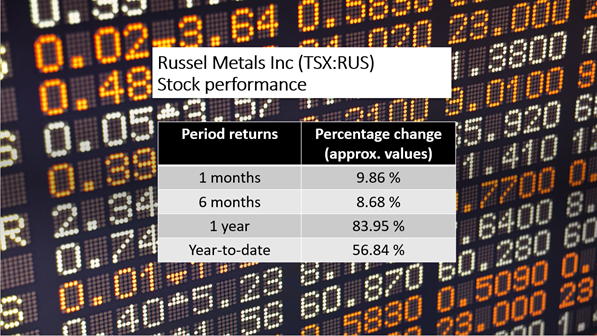

1. Russel Metals Inc (TSX: RUS)

Said to be one of the largest metal distributors in Canada, Russel Metals Inc saw its stock close at C$ 35.65 apiece on Friday, November 12, after clocking a day high of C$ 36.15.

The metal scrip increased by more than 17 per cent quarter-to-date (QTD) and surged by nearly 57 per cent this year. It also swelled by almost 84 per cent over the past 12 months.

Image source: © 2021 Kalkine Media Inc

Apart from its metal service centre, Russel provides energy products and distributes steel to the industrial markets in North America.

The Toronto-based metal company reported a top line of C$ 1.108 billion in the third quarter of fiscal 2021, up from that of C$ 615 million in the same quarter a year ago. Its net income was C$ 132 million in the latest quarter.

With a market capitalization of C$ 2.2 million, Russel held a price-to-book (P/B) ratio of 1.926 and a return on equity (ROE) of 31.67 per cent on Monday, November 15.

The company is expected to dole out a quarterly dividend of C$ 0.38 per share a month later, on December 15.

Earlier in November, the company signed an agreement to acquire Boyd Metals, which operates five service centres in southern US, for a purchase price of US$ 110 million. With this deal, Russel Metals is expected to expand its US service centre footprint.

2. AltaGas Ltd (TSX: ALA)

AltaGas Ltd is a diversified energy infrastructure firm that operates utilities, midstream, and corporate businesses across North America.

The Calgary, Alberta-headquartered firm saw its stock close at C$ 25.04 apiece on November 12, noting a growth of more than five per cent in the last six months.

Also read: 5 dirt cheap dividend stocks to buy under $5

ALA stock also soared by almost 34 per cent year-to-date (YTD) and climbed by more than 41 per cent in the past year.

The Canadian energy player recorded normalized funds from operations (FFO) of C$ 0.61 per share in the third quarter of 2021, recording a rise of 53 per cent year-over-year (YoY).

AltaGas noted a market capitalization of C$ 7.0 billion, a price-to-earnings (P/E) ratio of 15.9 and an ROE of 7.12 per cent November 15.

It is scheduled to pay a monthly dividend of C$ 0.083 per share on December 15 to shareholders to invest in its stocks on or before November 24.

Bottom line

Dividends can be a good way to earn some extra cash, but before making any investment-related decisions, especially in the tricky world of stock markets, investors should research a company thoroughly.