Summary

- Online media outlet BuzzFeed is set to acquire HuffPost publication, a part of Verizon Media, in a recently hashed-out stock deal.

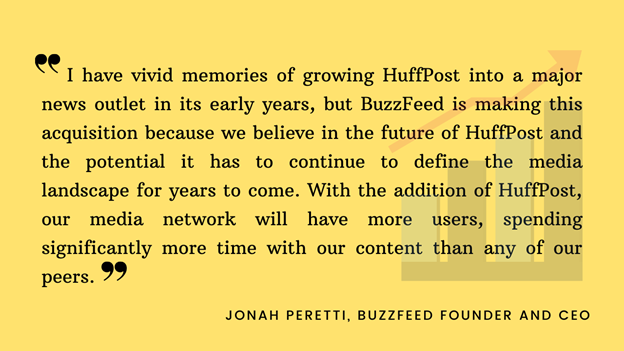

- BuzzFeed founder and chief executive officer (CEO) Jonah Peretti, who was one of the original Huffington Post’s founders, will be running the combined company.

- Verizon media is a unit of Verizon Communications Inc (NYSE: VZ, VZ:US).

- HuffPost came to Verizon in 2015 after it acquired AOL, which had bought the Huffington Post in 2011.

New York-based digital media house BuzzFeed Inc has agreed to buy Verizon Media’s HuffPost publication in a stock deal, the two companies announced on Thursday, November 19. Verizon Media, which is a unit of Verizon Communications Inc (NYSE: VZ, VZ:US), is said to be making an investment in BuzzFeed along with the stock deal, as per some media reports.

The deal will see the two companies work on advertising opportunities in a collaboration. They will reportedly be syndicating content on each other’s websites and share the advertisement revenue.

Along with content syndication, the deal is expected to bring the two companies fresh consumer shopping experiences, ad products, and new revenue opportunities.

Rise Of Media House Acquisitions

Digital media houses such as BuzzFeed and HuffPost enjoyed an impressive growth earlier around the beginning of the millennium as readers shifted towards the new media platforms for content and fast-paced news delivery. However, the eventual rise of social media-based content delivery, via tech giants such as Facebook Inc (NASDAQ:FB), Twitter Inc (NASDAQ:TWTR) and Alphabet Inc’s Google (NASDAQ:GOOGL), stole away online media houses’ thunder.

As the crowd of competitors grew, so did the fight of the limited audience’s attention. Digital media outlets suffered as social media giants burrowed into the ad revenue system and tweaked algorithms consistently that drove readers’ attention to their content. Many traditional print and electronic media houses also expanded to the digital platform and learned new tricks of business to generate payment for content online, pushing new media-only outlets further towards the periphery.

To top all that, the COVID-19 pandemic this year brought on a fresh wave of trauma for the industry, triggering operational disruptions, financial crisis and mass layoffs.

In an attempt to trigger a jump-start growth in the increasingly competitive field of online content, digital media companies have been experimenting with different methods, including mergers and acquisitions.

The BuzzFeed and HuffPost acquisition deal comes in the heels of a slew of digital media mergers in the recent times. CEO Jim Bankoff’s Vox Media acquired New York Magazine in September 2019, while US-Canadian company Vice Media bought entertainment website Refinery29 around October 2019. Group Nine Media, which also owns NowThis News, purchased pop culture-oriented site PopSugar around the same time.

Let’s take a closer look at BuzzFeed and HuffPost owner Verizon Media to analyze the recent acquisition deal better.

What Is BuzzFeed’s Role In The Acquisition Deal?

BuzzFeed founder and chief executive officer (CEO) Jonah Peretti will be running the combined company, while a new editor-in-chief will be appointed for HuffPost.

Jonah Peretti, who was one of the original Huffington Post’s founders, said BuzzFeed will be reviewing HuffPost’s business before it makes any call regarding reduction of its workforce or making additional hiring. The company expects to generate an operating profit this year for the first time in years, Mr Peretti said.

BuzzFeed said that its acquisition of HuffPost will combine the four prominent media brands to “create a massive media network”.

BuzzFeed was founded in 2006 and initially indulged in entertainment-oriented quizzes, listicles, etc. Since 2012, with the appointment of political journalist Ben Smith, BuzzFeed steered towards news-related content and went to get nominated for the Pulitzer Prize.

What Is Verizon Media’s Role In The Acquisition Deal?

Verizon Media will get a minority stake in BuzzFeed as a part of the deal. However, it will not be entitled to a role in BuzzFeed’s board.

Verizon Media CEO Guru Gowrappan said that the company has “a powerhouse ecosystem” and its partnership with BuzzFeed will help speed up their “transformation and growth”.

Verizon Media Immersive, which the company claims is the largest online Extended Reality (XR) platform for ad and content, will also be available for access to BuzzFeed, along with Verizon Media’s ad platform.

HuffPost came to Verizon in 2015 after it acquired AOL, which had bought the Huffington Post in 2011.

Stocks of Verizon Communications Inc are currently valued at US$ 60.21, with a 10-day average share movement volume of 14.4 million. Verizon shares are down about two per cent this, though they gained almost 11 per cent in the last six months.

While BuzzFeed has plans to expand its business via Huffpost’s reach, the two media outlets will continue to operate separately, the official news release has stated.