Highlights

- On April 21, Magna said that its new facility in Slovakia would support the growing advanced driver-assistance systems (ADAS).

- George Weston distributed a quarterly dividend of C$ 0.6 per unit, and its dividend grew 5.3 per cent in the last three years.

- On April 20, Metro announced a quarterly dividend of C$ 0.275 per unit, and its dividend yield is about 1.6 per cent.

Amid rising inflation, many individuals could be looking for an extra source of income to meet their expenses and save some money for the future.

A stock market often attracts people looking to generate some extra income on their investments. In Canada, the Toronto Stock Exchange is the primary exchange, and we have curated a list of five stocks that could generate a lifetime of passive income.

Let's look at them:

Magna International Inc. (TSX:MG)

This consumer cyclical Canadian company is involved in developing mobile technology for automakers. Apart from Canada, Magna International has business operations in the United States and Europe.

Magna's products are used in electric vehicles (EVs), and as the EV industry is expected to boom, the company could capitalize on that and expand rapidly in future.

Also Read: 8 reasons why you can save your retirement income in TFSA

On April 21, Magna said that its new facility in Slovakia would support the growing advanced driver-assistance systems (ADAS) and electrification market.

In 2021, Magna's sales increased to US$ 36.2 billion from US$ 32.6 billion in 2020. Meanwhile, the income from operations jumped to US$ 1.9 billion from US$ 1 billion in the same period.

Magna paid a quarterly dividend of US$ 0.45 per unit to the shareholders, and its dividend yield is three per cent. The MG stock's price was C$ 76.12 apiece at market close on April 26.

George Weston Limited (TSX:WN)

George Weston is one of the leading companies in Canada and operates in the retail and real estate industry. It holds a market capitalization of around C$ 23.1 billion, and the return on equity is 11.2 per cent.

Last month, George Weston announced full-year financial results for 2021 and said its revenue increased to C$ 53,748 million from C$ 53,270 million in the previous year.

Also Read: 3 TSX smart penny stocks to buy in May

The company's operating income surged 40 per cent year-over-year (YoY) to C$ 2,875 million in 2021. Meanwhile, the adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) increased to C$ 5,356 million.

George Weston distributed a quarterly dividend of C$ 0.6 per unit, and its dividend grew 5.3 per cent in the last three years.

Molson Coors Canada Inc. (TPX.B)

Molson Coors is one of the largest producers and distributors of malt beverages. It runs brands like Coors Light, Coors Banquet, Creemore, and Miller Lite.

In Q4 2021, the company raised its quarterly dividend by 12 per cent to C$ 0.38 per share. Meanwhile, the reported net sales increased by 14.2 per cent YoY.

Compared to a net loss of C$ 1,369.8 million in the fourth quarter of 2020, Molson Coors reported a net income of C$ 80 million in Q4 2021. Molson Coors stock closed at C$ 69 apiece on Tuesday.

Metro Inc. (TSX:MRU)

One of the largest grocery retailers in Canada, Metro has expanded its presence in the healthcare sector by acquiring Jean Coutu, a popular chain of drugstores.

Also Read: American Lithium (LI) and Frontier (FL): 2 TSXV lithium stocks to buy

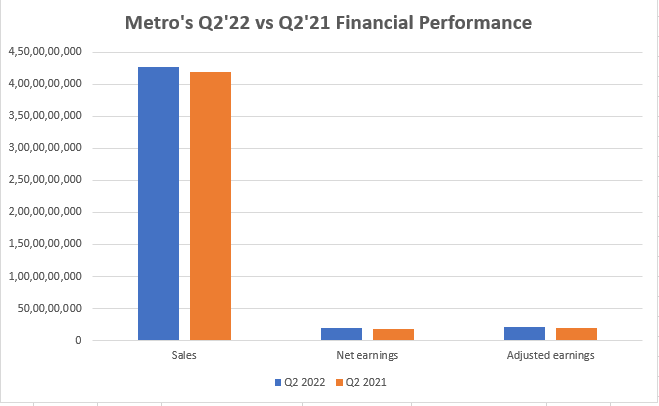

Recently, Metro announced results for the second quarter of this year and said its sales were up 1.9 per cent YoY to C$ 4,274.2 million. Also, the net earnings were C$ 198.1 million, reflecting an increase of 5.3 per cent from the same quarter of the previous year.

©2022 Kalkine Media®

On April 20, Metro announced a quarterly dividend of C$ 0.275 per unit, and its dividend yield is about 1.6 per cent. The MRU stock was priced at C$ 69.83 apiece at the end of the trading session on April 26.

Canadian Tire Corporation (TSX:CTC.A)

The Toronto-based company is a seller of apparel, home goods, automotive parts, footwear, vehicle fuel, and sporting equipment. Canadian Tire is one of the country's largest retailers, and its market cap is C$ 10.02 billion.

Canadian Tire reported record financial results in 2021 and said its diluted earnings per share jumped to a record level by surging 49.2 per cent YoY to C$ 18.38.

In Q4 2021, the consolidated retail sales increased by C$ 343.8 million, and consolidated revenue increased by C$ 263.1 million. At market close, the CTC.A stock was priced at C$ 178.56 per share.

Also Read: EMO, ODV, and DSV: 3 TSXV precious metals stocks to buy?

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.