Core retail sales in Canada grew by nearly three times at 1.1 per cent in September against 0.4 per cent in August 2020, Statistics Canada reported. The retail figures amounted to C$ 53.9 billion due to higher sales at general merchandise and eatery stores, an increase of 1.8 per cent in three months.

As per the StatCan’s September Retail Trade Survey, released on November 20, there was a 0.9 per cent increase in sales at food and beverage stores for the second consecutive month, led by higher rates for meat, fish, and dairy products.

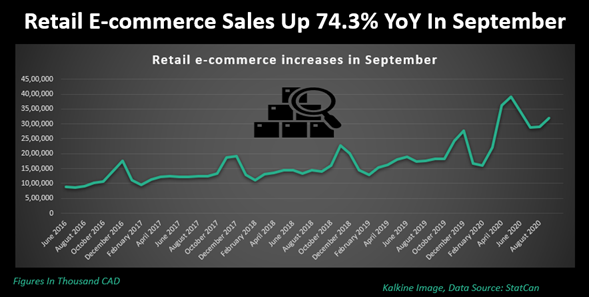

Retail e-commerce sales in the country soared three-quarter high on a year-over-year basis. The statistics agency recorded retail e-commerce sales up 74.3 per cent year over year in September, whereas total unadjusted retail sales rose 9.3 per cent. On an unadjusted basis, retail e-commerce sales achieved C$ 3.2 billion in September, amounting to 5.6 per cent of total retail business.

As Canadian retail sales sustained to improve in September, pacing up to 1.1 per cent month-on-month, let us look at the following large-cap retail stock from the Toronto Stock Exchange (TSX): Dollarama Inc. (TSX:DOL) and Metro Inc (TSX:MRU). We will do a detailed analysis of these stocks and look at their financial performance.

Dollarama Inc. (TSX:DOL)

Current Stock Price: C$ 50.70

Montreal-based Dollarama Inc company mainly engages in operating discount retail stores. The retailer offers a diverse range of everyday consumer goods and seasonal products at low price points. General merchandise and consumer goods together account for most of the company's product contributions. The grocer operates throughout Canada, generally stationed in metropolitan areas, mid-size cities, and small towns.

Dollarama Stock Performance

The discount retail store is currently valued at C$ 15.77 billion. Its stocks surged by 1.42 per cent in a day on the back of Statistics Canada’s Monthly Retail Survey Report. The stocks are up over 15 per cent in the last six months. The grocery stock has soared by nearly 13 per cent year-to-date (YTD). Dollarama stocks have rebounded over 43 per cent since the coronavirus pandemic led market crash on March 24.

The company approved a quarterly cash dividend of C$ 0.044 per share for its stockholders. The retail company holds a current dividend yield of 0.347 per cent. Its three-year dividend growth is 7.09 per cent and the five-year dividend growth stands at 8.83 per cent.

It has a current price-to-earnings (P/E) ratio of 28.60, and its price-to-book (P/B) ratio is 137.027. The price-to-cashflow ratio is 17 and its debt to equity ratio is 28.61. The stock delivers a positive return on assets (ROA) of 14.17 per cent, as per the TMX portal.

Dollarama Financial Highlights

In the second quarter of fiscal 2021, its sales soared by 7.1 per cent to C$ 1,013.6 million. The company commenced 13 new stores in Q2 FY21, as compared to 14 new store openings in Q2 FY20.

Dollarama is expected to release its third-quarter earnings of fiscal 2021 on December 9.

The company continued to carefully resume its operations with all required precautions against the ongoing COVID-19 pandemic. Dollarama has introduced more initiatives for both online and in-store shopping.

Metro Inc (TSX:MRU)

Current Stock Price: C$ 60.68

Metro Inc is one of the leading grocery retailers in Canada. Following its acquisition of the Jean Coutu Group in 2018, it expanded into the pharmacy sector. It operates an array of businesses, but most frequently works as either a retailer, managing individual stores, or a franchisor, licensing its patents and delivering merchandise to franchisees.

Metro Stock Performance

The retail franchisor is currently valued at C$ 15.19 billion. Its stocks traded in the green on the back of Statistics Canada’s Monthly Retail Survey Report. The stock has increased by over 7 per cent in the last six months. The retail stock has surged by nearly 12.5 per cent year-to-date (YTD). Metro stocks have recovered over 20 per cent since March lows.

The company pays a quarterly cash dividend of C$ 0.225 per share to its stockholders. The retailer holds a current dividend yield of 1.483 per cent. Its three-year dividend growth is 10.11 per cent, and the five-year dividend growth stands at 13.36 per cent.

The stock has a current price-to-earnings (P/E) ratio of 19.60 and its price-to-book (P/B) ratio is 2.527. The price-to-cashflow ratio is 12.90, and its debt to equity ratio is 0.78. The stock delivers a positive return on equity (ROE) of 12.80 per cent and a positive return on assets (ROA) of 6.34 per cent, as per TMX data.

Metro Financial Highlights

Metro Inc recorded sales of C$ 4,143.6 million in the fourth quarter of 2020. The company posted net earnings of C$186.5 million in Q4 2020, an increase of 11.4 per cent YoY. Metro’s expenditures related to COVID-19 made to C$ 137 million in fiscal 2020.