Summary

- Charlotte's Web stocks shot up over six per cent on Wednesday, December 2.

- HEXO stocks shot up by nearly 72 per cent in the last six months and by almost 66 per cent in the last three months.

- In November, Sundial Growers stocks ballooned by about 410 per cent.

Cannabis stocks were boosted by the recent news of the UN Commission on Narcotic Drugs (CND) removing medical marijuana from the list of Schedule IV narcotic drugs. Along with larger cap cannabis producers, small cap Canadian companies such as Charlotte's Web Holdings (TSX:CWEB), HEXO Corp (TSX:HEXO) and Sundial Growers (NASDAQ: SNDL, SNDL:US) have also been trending heavily following the announcement.

Let’s analyze the performance of these small cap pot stocks:

Charlotte's Web Holdings Inc (TSX:CWEB)

Current stock price: C$ 6.7

Market cap: C$ 702 million

Rallying among top trending health care stocks on the Toronto Stock Exchange (TSX), stocks of Charlotte's Web Holdings Inc currently have a 52-week high of 12.31 and a 52-week low of 3.08.

The small cap pot stocks shot up over six per cent on Wednesday, December 2.

Charlotte’s Web shares are down nearly 33 per cent this year. Since taking a tumble during the coronavirus pandemic-led market crash in March, the scrips fell almost 12 per cent in the last six months. But over the last three months, stocks of this cannabis firm grew nearly 59 per cent.

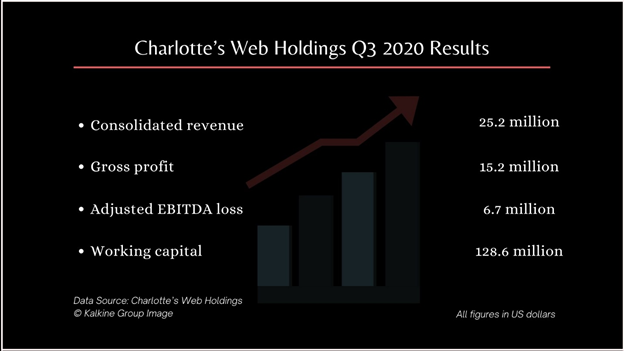

Charlotte’s web q3 2020 report

Charlotte’s Web Holdings Inc reported a consolidated revenue increase of four per cent year-over-year (YoY) to US$ 25.2 million in the third quarter of 2020, a 17 per cent quarter-over-quarter increase from Q2 2020 as well.

The cannabidiol (CBD) product manufacturer said that its Direct-to-Consumer (DTC) eCommerce sales had jumped 27.5 per cent YoY in Q3 2020 and contributed 66.3 per cent of the quarter’s revenue.

The company’s gross profit stood at US$ 15.2 million in the quarter, comprising 60.3 per cent of Q3 2020’s consolidated revenue.

Its adjusted EBITDA loss amounted to US$ 6.7 million in the third quarter ending 30 September 2020.

Charlotte’s Web reported cash in hand of US$ 65.9 million and a working capital of US$ 128.6 million at the end of September 2020.

Hexo corp (TSX:HEXO)

Current stock price: C$ 1.51

Market cap: C$ 730 million

Stocks of Canadian cannabis firm HEXO Corp are among the most active stocks on the TSX due to heavy trading movement. The stocks collected an average trading volume of 6.4 million in the last 10 days and that of 5.1 million in the past month.

HEXO Corp saw tough times amid the pandemic. It had to resort to selling assets, downsize workforce and reduce production. The company also conducted an at-the-market (ATM) equity program back in August to raise proceeds. HEXO also faced a delisting warning from the New York Stock Exchange (NYSE) in April this year.

The US stock exchange had given the company a deadline of December 2020 to pull up its stock price over US$ 1 to evade getting delisted. On the NYSE, HEXO stocks are currently priced at US$ 1.17.

Hexo corp stock performance

HEXO stocks are down 27 per cent year-to-date (YTD). Since plummeting sharply during the March lows, the scrips shot up by nearly 72 per cent in the last six months and by almost 66 per cent in the last three months.

The stocks jumped over nine per cent on December 2.

Fueled by the US elections, wherein political campaigns revolved arounf the legalization of marijuana, HEXO scrips registered a growth of close to 76 per cent in the month of November.

Hexo corp q4 2020 report

HEXO Corp’s gross revenue increased by 76 per cent YoY to C$ 36.1 million in the fourth quarter ending 31 July 2020, driven majorly by its new Cannabis 2.0 products. The pot company’s newly launched cannabis vapes contributed C$ 1.3 million to gross sales in Q4 2020.

Its gross margin before fair value adjustments stood at 30 per cent in Q4 2020, down from 40 per cent QoQ.

HEXO also reported operating expenses of C$ 71.5 million in the latest quarter, including impairments charges worth about C$ 46.4 million, an onerous contract loss amounting to C$ 1.8 million and restructuring costs of about C$ 0.1 million.

Sundial growers inc (NASDAQ: SNDL, sndl:US)

Current stock price: US$ 0.08

Market cap: C$ 354 million

Stocks of Calgary-based pot company Sundial Growers surged by about 24 per cent on Thursday, December 2.

In November alone, the stock ballooned by about 410 per cent.

However, Sundial shares are down nearly 76 per cent this year. After collapsing amid the March market meltdown, the scrips swooped almost three per cent in the last six months.

Sundial growers inc q3 2020 report

Sundial Growers’ net cannabis revenue dropped 36 per cent QoQ to C$ 23 million in the third quarter ending 30 September 2020. Its cash used from operations slumped 63 per cent in Q3 2020, amounting to C$ 5.3 million.

The pot firm reported that it received about C$ 4.1 million under the Canada Emergency Wage Subsidy (CEWS) in the latest quarter.