Highlights

- Amid increased volatility in the market, stocks with the potential to provide stable returns could be considered for an investment portfolio.

- Recently, the International Monetary Fund slashed the world economic growth outlook.

- Since the start of this year, equities markets have remained volatile, and it is becoming difficult for investors to get higher yields on investments.

The world economy is in crisis, and the International Monetary Fund (IMF) recently slashed the world economic growth outlook.

Due to the ongoing war between Russia and Ukraine, the world economy has been impacted negatively, and the war is expected to have long-term impacts on economic growth.

Since the start of this year, equities markets have remained volatile, and it is becoming difficult for investors to get higher yields on investments.

Also Read: 8 reasons why you can save your retirement income in TFSA

Amid increased volatility in the market, stocks with the potential to provide stable returns could be considered for an investment portfolio.

That said, let's look at five blue-chip TSX stocks that could provide stable returns to investors:

Canadian National Railway Company (TSX:CNR)

Canadian National Railway has a massive rail network across Canada and the United States. It is one of the largest companies in Canada and has a market capitalization of approximately C$ 109.8 billion.

In Q4 2021, Canadian National delivered strong financial results and recorded revenues of C$ 3,753 million by surging three per cent year-over-year (YoY).

Also Read: 3 TSX smart penny stocks to buy in May

The operating income increased 11 per cent YoY to C$ 1,566 million in Q4 2021. Meanwhile, the diluted earnings per share jumped to C$ 1.69, up 18 per cent YoY.

At market close on April 25, the CNR stock was priced at C$ 158.09 per share.

Canadian Pacific Railway Limited (TSX:CP)

Canadian Pacific achieved a milestone in the fourth quarter of 2021 by creating the first single-line rail network connecting Canada, the United States, and Mexico by acquiring Kansas City Southern.

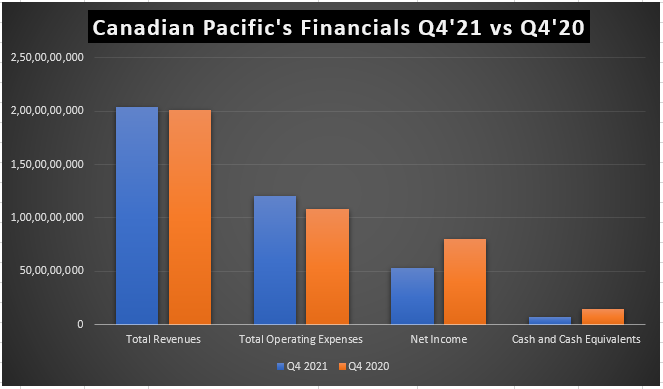

In Q4 2021, Canadian Pacific's revenue increased one per cent from Q4 2020 to C$ 2.04 billion. Meanwhile, it registered a growth of four per cent YoY for the full year.

Also Read: American Lithium (LI) and Frontier (FL): 2 TSXV lithium stocks to buy

The CP stock distributes dividends regularly and has a dividend yield of 0.8 per cent. It closed at C$ 94.88 per share on Monday, April 25.

©2022 Kalkine Media®

©2022 Kalkine Media®

Alimentation Couche-Tard Inc. (TSX:ATD)

Recently, Alimentation Couche-Tard announced its share repurchase program renewal and said it looks to repurchase up to 79.7 million Class A Multiple Voting Shares.

The ATD stock is among the top consumer stocks in Canada, and keeping consumer stocks in an investment portfolio could be a smart choice.

In Q3 2022, Alimentation's net earnings were US$ 746.4 million compared to US$ 607.5 million in Q3 2021. Meanwhile, the total merchandise and service revenues increased 5.8 per cent YoY to US$ 4.8 billion.

Alimentation paid a quarterly dividend of C$ 0.11 per unit to the shareholders and registered a dividend growth of 18.4 per cent in the last three years.

Great-West Lifeco Inc. (TSX:GWO)

During times of rising inflation and higher interest rates, some analysts believe that the stocks of financial services could be an option worth considering.

Great-West Lifeco is one of Canada's largest insurance service providers, and in Q4 2021, the total earnings increased to C$ 825 million from C$ 741 million in Q4 2020.

The insurance company's earnings per share increased to C$ 0.89 in Q4 2021 compared to C$ 0.8 in Q4 2020. The GWO stock's dividend yield is 5.4 per cent.

Loblaw Companies Limited (TSX:L)

Loblaw is one of the largest grocery, general merchandise, and pharmacy retailer in Canada and its stock was priced at C$ 117.15 per share on April 25 at market close.

Loblaw is expanding, and last month it announced to acquire Lifemark Health Group to expand its healthcare services. As the COVID-19 pandemic continues, expanding healthcare services could benefit the retailer in the future.

In Q4 2021, Loblaw's revenue increased by C$ 349 million to C$ 12,757 million. Meanwhile, the retail segment sales amounted to C$ 12,486 million, up 2.6% YoY.

Also Read: EMO, ODV, and DSV: 3 TSXV precious metals stocks to buy?

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.