Highlights

- Retirement planning is all about finding the right balance between risk and return.

- Dividend-yielding stocks can act as a supplement to retirement income.

- The individual should think long-term and invest in high-quality securities that can grow and payback.

The impact of COVID-19 has raised an obvious question on the entire retirement planning scenario, focusing on who is planning to retire shortly.

Retirement planning is all about finding the right balance between risk and return, and dividend-yielding stocks can act as a supplement to retirement income.

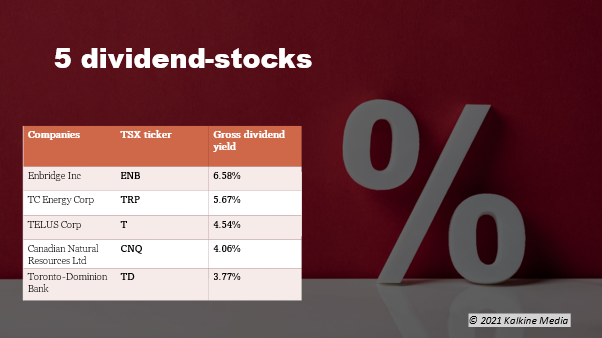

Here are five dividend-yielding stocks listed on the Toronto Stock Exchange (TSX) that people above the age of 60 can look at.

- TC Energy Corporation (TSX:TRP)

TC Energy pays its investors a dividend of C$ 0.87 on a quarterly basis and holds a price-to-earnings (P/E) ratio of 29.9.

It posted a net income of US $ 982 million in the second quarter of fiscal 2021.

The energy infrastructure firm’s stocks closed trading at C$ 60.96 on September 30.

TC Energy recently announced its plans to build a carbon sequestration facility in partnership with another energy infrastructure player.

Also Read: Exscientia IPO: When can you buy AI pharmatech stock EXAI?

- Canadian Natural Resources Limited (TSX:CNQ)

Canadian Natural Resources, an energy giant, owns diversified oil and natural gas assets.

With an increasing focus on sustainable energy solutions, the market strength for natural gas is likely to continue as companies worldwide are switching from fossil fuel-based energy to renewable resources like wind, solar, etc.

The company had nearly C$ 5.596 billion in liquidity as of June 30, 2021.

CNQ stock settled at a price of C$ 46.31 on September 30, having surged by as much as approximately 117 per cent in the last one year and by about 51.4 per cent year-to-date (YTD).

It is set to pay a dividend per share of C$ 0.47 on October 5.

- Toronto-Dominion Bank (TSX:TD)

TD Bank posted a net income of C$ 3.58 billion in Q2 2021, noting a 58 per cent jump on a year-over-year (YoY) basis.

The Canadian bank, which operates under the segments of Canada retail, US retail and wholesale banking, pays a quarter-based dividend of C$ 0.79 that noted a dividend yield of 3.7 per cent as of October 1.

TD stocks, after closing at C$ 83.85 apiece on September 30, posted a 36 per cent climb on a one-year basis.

Also Read: Smart financial planning tips for parents: Include RRSP & stocks

- TELUS Corporation(TSX:T)

TELUS, through its various subsidiaries, provides telecom and wireless services in Canada.

TELUS stocks closed at a value of C$ 27.84 on September 30, posting a surge of 18 per cent for the past one year.

The telecom giant pays a dividend of C$ 0.316 apiece, which noted a dividend yield of 4.5 per cent at the time of writing this.

In the second quarter of fiscal 2021, TELUS reported a spike of 5.9 per cent YoY in the TELUS technology solutions customer base, representing 16.3 million customers.

TELUS could be a long-run dividend-yielding stock to buy and hold, given the boom in the digital revolution across the globe.

- Enbridge Inc(TSX:ENB)

Enbridge Inc, an oil and gas distribution firm located in Alberta’s Calgary region, pays a quarterly dividend of C$ 0.835, which posted a dividend yield of 6.6 per cent as of October 1.

The recent upward trend in the international energy markets has helped buoy this stock up. Enbridge, which recorded a closing share price of C$ 50.46 apiece on September 30, was among the top stocks in terms of volume on the Toronto Stock Exchange (TSX).

Enbridge Inc also earned a distributable cash flow of C$ 2.5 billion in the second quarter of fiscal 2021.

Bottom line

For a comfortable post-retirement life, one must start planning early on in life. Individuals should ideally think long-term and invest in high-quality securities that can grow and pay back.

However, one should bear in mind that the stock markets can be a volatile space in terms of investment. Even the strongest of enterprises can face hard times for various reasons, and that can impact their stock performances.