Highlights

- The SNT crypto is the native utility token of the Status network.

- Amid the crashing market, the Status (SNT) crypto climbed around 12% in the last 24 hours.

- Status is classified as a decentralized program that incorporates an informing framework.

The crypto market doesn't seem to be recovering anytime soon, and despite showing little growth over the last few days, it crashed massively on Thursday morning.

The valuation of the global cryptocurrencies dipped by 5.12% to US$ 1.23 trillion. The value of the world's oldest cryptocurrency continues to tumble, and Bitcoin was down by 5.6 per cent over the previous day at 2 AM EST.

Also Read: Why is NuCypher (NU) crypto skyrocketing with 20,000% volume gains?

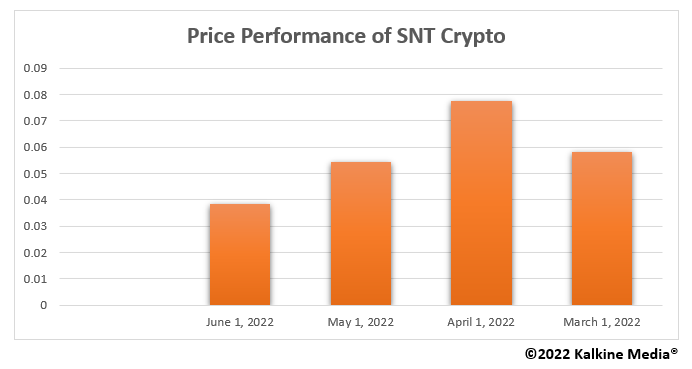

Amid the crashing market, the Status (SNT) crypto climbed around 12% in the last 24 hours, and it was trading at US$ 0.04444 at the time of writing. Also, the trading volume of the SNT crypto was up over 120% to US$ 81.3 million.

The surge in the price of Status crypto has left investors wondering why this crypto is rising despite the market crash. Let's find out more:

What is SNT crypto?

Status is classified as a decentralized program that incorporates an informing framework. Status permits you to connect with an organization from any place in that capacity.

The network is a light client Ethereum hub and can give you admittance to all Ethereum decentralized applications (also called DApps) from an application introduced on your cell phone or tablet. This implies that clients can send encoded messages and access decentralized applications, including a crypto wallet.

The SNT crypto is the native utility token of the Status network, and it utilizes these tokens for transactions. The objective of Status is to make the adoption of Ethereum-based decentralized applications speedier and more efficient.

Major cryptocurrency exchanges like Binance, KuCoin, and CoinTiger have listed the SNT crypto to allow users to buy and sell the token.

Bottom line

There is no apparent reason behind the price and volume surge of the SNT crypto, and it could be gaining traction as it is a Web3 token. On May 31, the network tweeted that if users are worried about data privacy, then Status is the right place for them.

The Status network aims to build the next generation of the web without compromising its users' data privacy. As big tech corporations are accused of abusing data, users have become more aware of data privacy.

Also Read: Canada's Newton crypto exchange hacked? Find out more here

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.