Highlights

- The HBTC crypto is a standard ERC-20 token, and the Huobi Blockchain Team founded it.

- As per the whitepaper, the HBTC crypto can bridge the Decentralized Finance (DeFi) market and centralized market.

- The trading volume of the HBTC crypto was over 200 per cent to about US$ 1.8 million, and its market cap stood at US$ 1.6 billion.

The price of Huobi BTC (HBTC) crypto recorded a massive surge on April 21 and soared massively to a record high of US$ 166,135 per token, according to CoinGecko data.

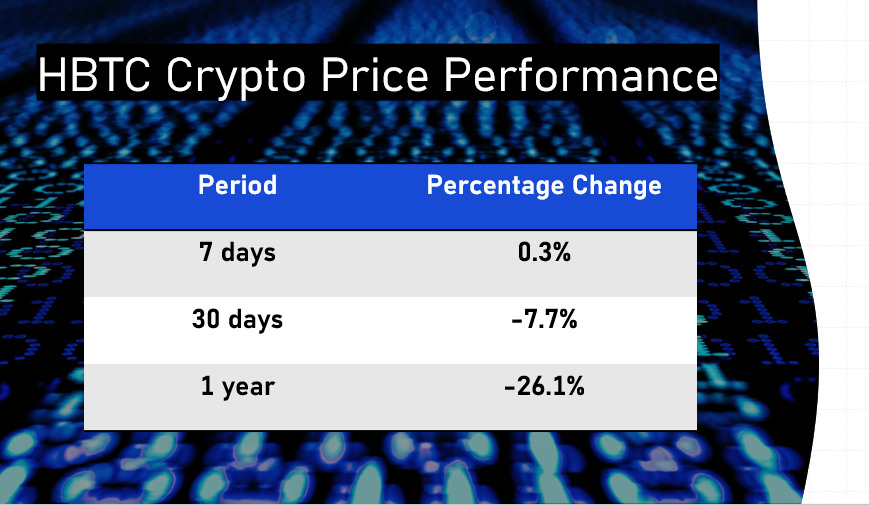

However, after the massive surge, the price of the HBTC crypto started declining rapidly, and at the time of writing this article, it was trading for US$ 40,663.07 per token.

Also Read: Zilliqa (ZIL) crypto soars amid rising market. Here's why

Meanwhile, the trading volume of the HBTC crypto was over 200 per cent to about US$ 1.8 million, and its market cap stood at US$ 1.6 billion.

What is HBTC crypto?

The HBTC crypto is a standard ERC-20 token, and the Huobi Blockchain Team founded it. Notably, this virtual currency maintains equivalent value to Bitcoin and has the flexibility of Ethereum.

As per the whitepaper, the HBTC crypto can bridge the Decentralized Finance (DeFi) market and centralized market by allowing users to participate in the DeFi space through Bitcoin.

In addition, the HBTC crypto claims to enable users to access decentralized protocols like Curve, Nest, BoringDAO, Uniswap, C.R.E.A.M, and Harvest.

According to the official website of the HBTC crypto, users can get it through its cryptocurrency exchange called Huobi Global.

Why did the HBTC crypto price soar massively?

There is no apparent reason behind the surge in the HBTC crypto price. It could be due to increased volatility in the market, and prices of almost all the virtual currencies keep fluctuating significantly.

After recovering for a few days, the crypto market crashed on April 22, and the global crypto market cap had declined to US$ 1.88 trillion at 3:30 AM EST.

The dominance of Bitcoin had declined by 0.13 per cent over the previous day to 41.06 per cent.

©2022 Kalkine Media®

©2022 Kalkine Media®

Bottom line

Investing in cryptocurrencies is a risky business because the market remains volatile, and one should exercise due diligence before buying a virtual currency.

Also Read: What is Dallas Cowboys crypto? All you need to know

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.