Top Trending currencies

The Australian dollar (AUD) is the official currency of Australia and comprises banknotes and coins. It was introduced in 14 February 1966 when it replaced the Australian pound.

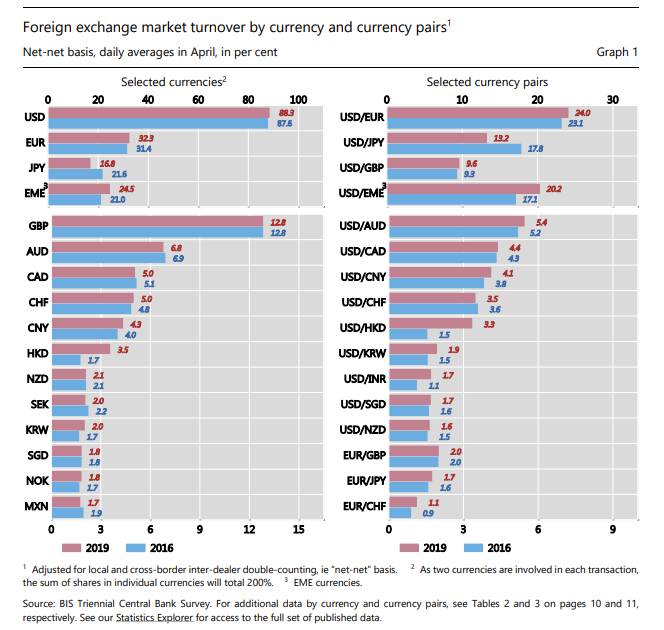

Interestingly, the Australian dollar is also the fifth-most commonly traded currency around the world. Besides, the AUD/USD remains the fourth-most traded currency pair.

It is important to note that the Australian foreign exchange market now ranks as the tenth largest in the world, versus the eighth largest in April 2016.

The foreign exchange (or forex) market is a globally decentralized or over the counter (OTC) market where banks, forex dealers, commercial companies, central banks, retail forex dealers, investors trade currencies. The market is highly liquid and one of the largest in the world where trillions of dollars are traded every day.

The most popularly traded currency in the global forex market is the US dollar (USD) owing to the strength of the US economy, followed by the Euro (EUR), the Japanese yen (JPY), and the pound sterling (GBP).

Nearly every Central Bank in the world holds the US dollar, which is used in pair with other currencies and has been deemed as the unofficial global reserve currency.

Currency?s underlying value and price movements relative to other currencies in the forex market is dependent upon several characteristics, including:

- Understanding what makes a currency successful in the foreign exchange market requires a thorough look at what moves the currency, the state of the economy of the respective country and other associated factors.

- An ideal currency performs three main functions including acting as a store of value, medium of exchange and a unit of account.

- Moreover, a currency is considered stable, thus frequently used, when the general level of prices, measured by its respective economy?s Consumer Price Index (CPI), does not flicker too much.

Let us understand why the Australian Dollar is considered attractive by the market participants in the forex market worldwide. This may be largely attributed to the prevalence of decent interest rates in Australia with little government intervention in controlling the foreign exchange rate. Moreover, Australia is also characterised by stable economic and political systems.

The case of the Australian Dollar

Australia followed the fixed exchange rate until 1971 when the Bretton Woods system broke down, following which the country switched to a fluctuating exchange rate regime against the US dollar. As a floating currency, the Australian dollar progressively became popular as one of the five most traded currencies in the world and is often referred to as the commodities currency due to the huge amount of natural resources exported by the bountiful Australia.

-

High Interest Rates with No Government intervention

In a floating exchange rate system, the economy automatically adjusts itself to stabilisation with change in external economic events. This regime is followed by most of the world?s advanced economies and contributes to macroeconomic stability by cushioning the economy from sudden shocks and allowing the central bank to largely focus on the monetary policy targeting domestic economic conditions.

Australian government?s no intervention policy has contributed in maintaining a stable economy and state of governance along with fairly decent interest rates. Moreover, the Reserve Bank of Australia (RBA), is a conservative institution, that takes the mandate to control inflation rather seriously, while Australia still has some of the highest interest rates when compared to other developed economies, despite two consecutive rate cuts this year.

-

Economic Stability

As mentioned earlier, the Australian dollar is backed by a stable economy and a generally pro-business environment. Moreover, the Australian economy has a heavy reliance on agriculture and commodities with Resources industry accounting for nearly 5% of the GDP, while farming and related sectors accounting for 12% of the GDP with a huge proportion of output going out of the borders.

Another interesting fact to note about Australia is that the country has a small manufacturing sector, while the majority of the manufactured products are shipped to the growing economies of Asia. Thus, the AUD strength is also closely linked to commodity cycle and Asia, and turns out to be counter-cyclical compared to currencies of other economics.

As a result, the Australia economy enjoys certain independence from the shocks in the other major world economies.

-

Geology & Geography

Australia is also characterised by a great geology with a wealth of natural resources that are high in demand worldwide, including gold, oil, diamonds, iron ore, agricultural products, uranium, nickel and coal. With the resource demand ever increasing across the Asian countries, Australia is able to maximally leverage its geographical position and is one of the choice trading partners for many developing and fast-growing Asian economies.

According to the Resources and Energy June 2019 Quarterly Report disclosed by Australian Government?s Department of Industry, Innovation and Science (DIIS), the export earnings from this sector are estimated to break fresh records and expected to touch $ 285 billion in 2019?20, before falling back in 2020?21.

Specifically, the outlook for iron ore and gold exports is quite bright for Australia. As per DIIS, Australia?s iron ore export earnings are forecasted to rise from $ 61 billion in 2017?18 to ~ $ 79 billion in 2019?20, driven primarily by higher prices. In addition, Australia?s gold export earnings are also expected to lift over $ 22 billion by 2020-21.

BIS? Foreign exchange turnover April 2019 Highlights

Australian dollar continues to be a significant currency in the global markets and the recent Triennial Central Bank Survey on Foreign exchange turnover in April 2019 released by the Bank of International Settlements (BIS) stated that OTC foreign exchange turnover (in terms of geographical distribution) for Australia stood at USD 119 billion (on a Net-gross basis).

Source: Triennial Central Bank Survey- Foreign exchange turnover April 2019 by Bank of International Settlements

Overall, trading in the global forex markets touched around $ 6.6 trillion per day in April 2019, which is higher than $ 5.1 trillion three years earlier. Moreover, the FX derivatives trading growth, majorly in FX swaps, exceeded that of spot trading.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.?

?